📊 HDFC Asset Management Company (HDFC AMC) – Long-Term Investment Outlook

🏦 Company Overview

HDFC AMC, part of the HDFC Group, is one of India’s leading asset management companies, managing a wide range of mutual funds across equity, debt, and hybrid categories. Since receiving SEBI approval in 2000, the company has consistently grown its Assets Under Management (AUM) and maintained industry-leading profitability.

🌏 Industry Overview

The Indian asset management industry is poised for robust growth driven by:

Rising retail participation in equities & mutual funds 📈

Increased SIP inflows and financialisation of savings 💰

Strong regulatory framework and investor awareness campaigns

Penetration in Tier-2/3 cities and digital distribution channels 📲

India’s mutual fund industry AUM is expected to grow at ~15% CAGR over the next decade, with equity-oriented funds gaining higher share.

HDFCAMC: Fairvalue:

📈 Historical Growth – AUM, Sales, and Profits

🚀 AUM Growth: 165,619 Cr (FY16) → 8,28,600 Cr (FY26 Trailing)

💹 Profitability: Maintains one of the highest margins in the industry.

📊 Valuation History – PE & PBV Ranges

Price-to-Earnings (PE)

Price-to-Book Value (PBV)

📌 Insight: Valuations are currently near the upper historical band, reflecting premium market positioning.

📅 Q1 FY26 Performance Snapshot

💡 Revenue growth remains strong with minimal cost increases, maintaining superior margins.

🔍 Cost Structure – Q1 FY26

📈 FY26 and Long-Term Estimates

💰 Valuation Ranges (PE & PBV Based)

📌 Current Price: ₹5,586 – Near mid-range of FY26 valuations.

📦 Portfolio Allocation View

⚖️ Allocation reflects premium business with stable growth, but high valuations.

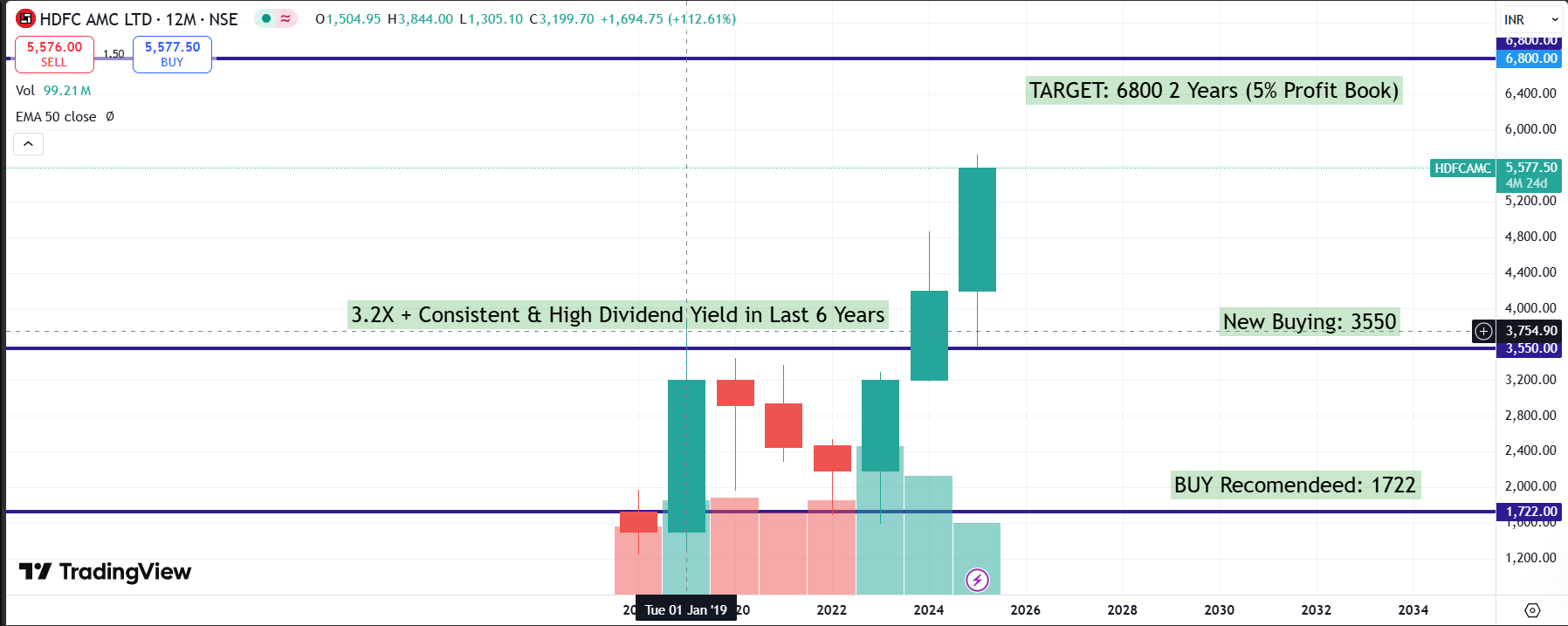

📉 Technical View (Based on Attached Chart)

Previous Buy Recommended: ₹1722 🟢

New Buying Zone: ₹3,550

Target (2 Years): ₹6,800 (Partial profit booking)

Dividend Track: 3.2x returns + consistent high yield in last 6 years.

✅ Conclusion – Long-Term Risk & Reward

Positives:

Industry leader with strong brand & distribution network

Sustained high margins & RoE

Large and growing retail investor base

Expanding AUM with market share stability

Risks:

Valuations near upper range historically

Market-linked revenue → sensitive to equity market cycles

Competition from new AMC entrants

🎯 Investor Approach: Accumulate in buying zones, hold for long-term compounding. SIP approach ideal for mitigating valuation risks.

📢 Disclosure

This report is for educational purposes only, based on publicly available information and reasonable assumptions. Not a recommendation. Investors should do their own due diligence.