Zomato Ltd. – Long-Term Investment Analysis

(All figures in ₹ Crores unless specified)

FairValue:

https://docs.google.com/spreadsheets/d/e/2PACX-1vSrP_szSc_bqCYFSTpgHt82SGnHnEkQDWFtdLxuZit9u7QWx46Fcf7YYzzB9S6TrN2aIg7MpTz_cl_t/pubhtml?gid=749202956&single=true

1. Company Overview

Zomato Ltd. is one of India’s largest online food delivery, quick commerce, and restaurant discovery platforms. Founded in 2008, it has transformed from a restaurant listing site into a diversified digital consumer services company with operations across multiple verticals:

Food Ordering & Delivery

Hyperpure (B2B supplies to restaurants)

Quick Commerce (Blinkit)

Going Out (Events & Dining)

The company has achieved strong top-line growth, expanding into adjacent high-growth segments while targeting profitability and positive cash flows.

2. Industry & Growth Prospects

Sector Overview

Food Delivery: Expected to grow at 18–20% CAGR over the next 5 years, driven by urbanisation, digital penetration, and changing consumption habits.

Quick Commerce: One of the fastest-growing segments globally, projected at 35–40% CAGR in India till 2030.

B2B Supplies (Hyperpure): Opportunity for steady 15–20% CAGR, aligned with restaurant sector growth.

Growth Drivers for Zomato

Increasing smartphone penetration and digital payments adoption.

Expanding addressable market in Tier-2 & Tier-3 cities.

Cross-leveraging multiple verticals to improve customer stickiness.

3. Historical Financial Performance

CAGR (Last 5 Years):

Sales: 51%

Margins: Improved from -77% to positive territory in FY2024.

4. Latest Quarterly Analysis – Q1 FY26

Key Takeaways:

Revenue growth strong at 70%, driven by Quick Commerce (+155%) and Hyperpure (+89%).

Sharp profit drop due to higher cost base and competitive pricing in quick commerce.

Margins squeezed by heavy investments in growth verticals.

5. Segmental Revenue (Q1 FY26)

6. Cost Structure – Q1 FY26

7. Valuation Trends

PE Range: Post-profitability (FY2024 onwards), PE surged to 122–782 due to low earnings base.

PBV Range: 2–9 in recent years, currently 6–8.

8. Forward Estimates

FY2026E:

Sales: ₹33,401 Cr

Profit: ₹334 Cr

EPS: ₹0.38

Fair Value (PBV-based): ₹203

FY2030E:

Sales: ₹95,396 Cr

Profit: ₹3,816 Cr

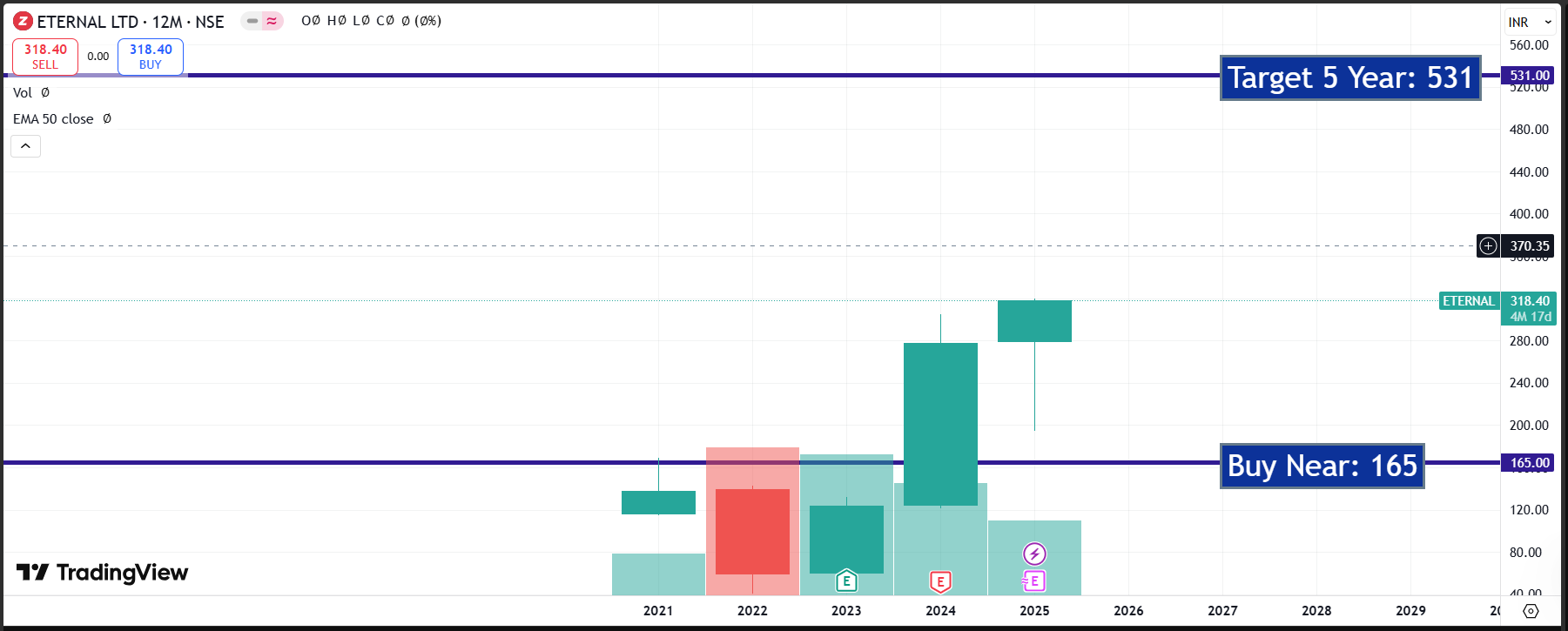

Price Potential: ₹579 – ₹869 (PBV-based)

9. Risk & Reward

Positives:

Multi-vertical growth model with cross-sell synergies.

Quick commerce leadership potential via Blinkit.

Path to higher margins with scale.

Risks:

Sustained cash burn in newer segments may delay margin expansion.

Intense competition from Swiggy, Amazon, and local players.

High valuations relative to current profitability.

10. Portfolio Weightage

Given volatility and execution risk, a tactical allocation of ~0.5% is suggested for aggressive portfolios out of 2% strategic weightage. For conservative investors, exposure only after consistent profitability is advisable.

Conclusion

Zomato is transitioning from growth-at-all-costs to a scale-plus-profitability phase. The company’s ability to monetise quick commerce and maintain leadership in food delivery will determine its long-term value. High growth potential comes with equally high execution risk.

Disclosure: This is an unbiased educational analysis, not a buy/sell recommendation.