AU Small Finance Bank – Long-Term Investor Report (FY2012–FY2026E)

📅 CMP: ₹727 | 📈 Market Cap: Mid-to-Large Cap Banking Play | Portfolio Weightage: ~1.8% from 2%

Fairvalue:

https://docs.google.com/spreadsheets/d/e/2PACX-1vRg1tSKFe-u3gKrsjyojpraa0BgCp8uc91CDC5EW5wLCHb_RJ8_6sbNVHNBNtQ6Ww/pubhtml?gid=69417233&single=true

1. Company Overview

AU Small Finance Bank (AUBANK), headquartered in Jaipur, is one of India’s fastest-growing private banks, transforming from a vehicle finance company to a full-fledged small finance bank in 2017. It has carved a niche in retail-focused lending, particularly in semi-urban and rural India, and is now expanding into digital-first offerings. The bank’s core strengths include a strong deposit franchise, diversified asset book, and focus on underserved markets.

2. Industry & Growth Drivers

The Indian banking sector is undergoing a structural growth phase driven by:

Credit Growth: 14–16% CAGR industry-wide, led by retail and SME lending.

Financial Inclusion: Government-backed schemes (Jan Dhan, PM SVANidhi) expanding formal credit access.

Digital Banking: Increasing adoption of UPI, mobile banking, and fintech partnerships.

Private Bank Advantage: Better asset quality, higher ROE, and capital efficiency compared to PSU peers.

Outlook: AUBANK, with its retail focus and strong Tier-2/3 city penetration, is well-positioned to ride the credit growth wave while expanding into new segments.

3. Historical Financial Performance (FY2012–FY2026E)

Key Observations:

✅ Advances grew at 35% CAGR (7-year) and 32% CAGR (3-year).

✅ Revenue outpaced profit growth in recent years, driven by high loan book expansion.

⚠️ NPM has compressed from 16–21% historically to ~11% recently due to their transition from MFI to SFB. .

⚠️ GNPA has risen slightly from 1.7% (FY2023) to 2.47% (FY2026E).

4. Valuation History – PE & PBV Trends

📌 Current Multiples: PE ~22x FY26E EPS, PBV ~2.8x FY26E BV — Valuation in mid-range historically.

5. Latest Q1 FY26 Snapshot

Revenue: ₹5,189 Cr (+21.3% YoY)

Net Profit: ₹581 Cr (+15.5% YoY)

GNPA: 2.28% (vs 1.67% YoY)

NIMs & Margins: NPM down to 11.2% (-56 bps YoY)

Cost Growth: +22.2% YoY, with provisions rising sharply (+88.3%).

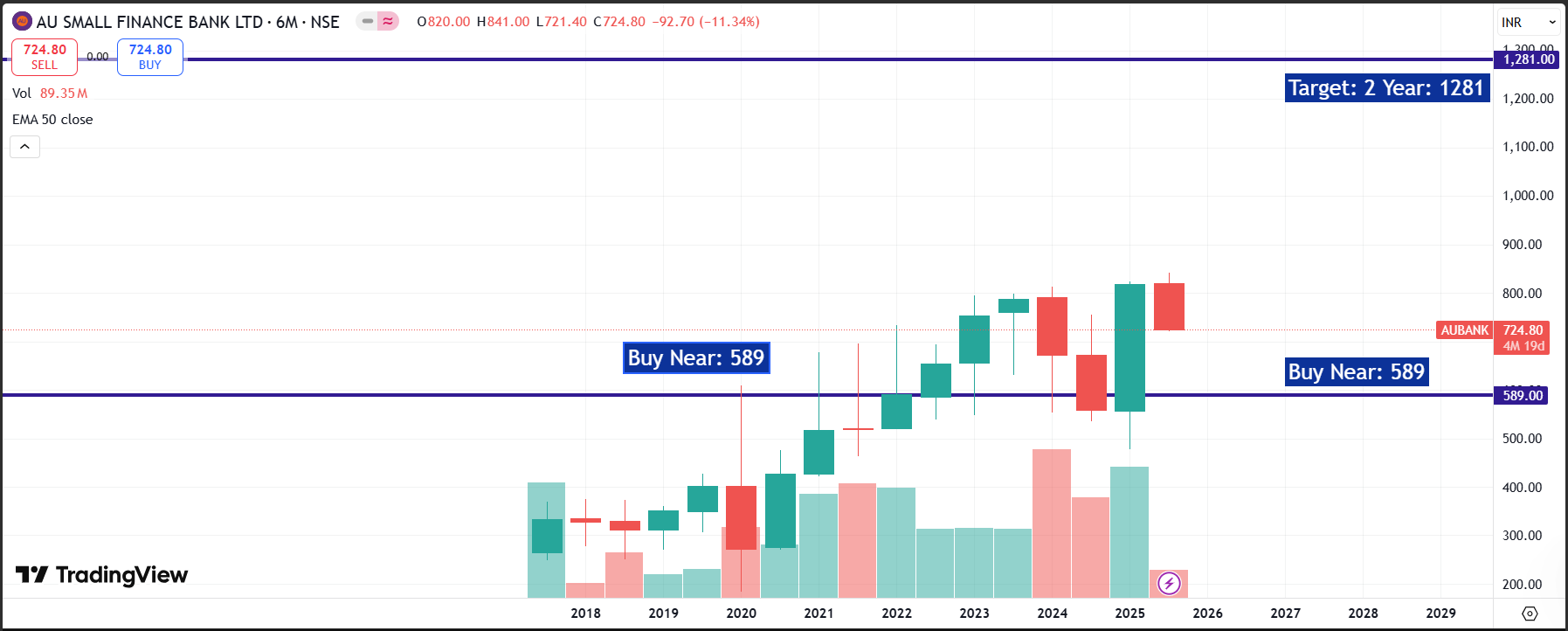

6. Growth Estimates & Price Projections

7. Risks & Rewards – Long Term View

Positives:

✔ Strong advances growth with retail dominance.

✔ Expanding deposit base and geographic footprint.

✔ Consistent PE re-rating potential as bank matures.

Risks:

⚠ NPM compression due to higher provisions and rising costs.

⚠ Slight uptick in GNPA needs close monitoring.

⚠ Valuation premium demands continued high growth to sustain.

Reward Potential:

If the bank sustains 20–25% credit growth with GNPA under 2.5%, EPS could triple by FY2035 — implying 3x–5x price appreciation potential in the next decade.

8. Conclusion for Investors

AU Small Finance Bank offers high-growth banking exposure with a proven track record in retail credit and financial inclusion. While near-term margins are under pressure, long-term potential remains strong if asset quality stabilizes. Suitable for aggressive long-term portfolios with a 10+ year view, ideally accumulated during valuation dips.

📢 Disclosure

This report is for educational purposes and not investment advice. Investors should perform independent research before making any investment decisions.