Dr. Lal PathLabs Ltd. – Long-Term Investor Analysis (FY26 Outlook)

1. Company Overview

Dr. Lal PathLabs Limited (founded 1949, listed 2015) is India’s leading diagnostic services provider, with 298 clinical laboratories (including 4 reference labs in Delhi, Kolkata, Bangalore & Mumbai), 6,607 Patient Service Centers (PSCs), and 12,365 Pick-up Points (PUPs) as of March 2025.

It offers 3,172 pathology tests, 1,455 radiology/cardiology tests, and 385 test panels, with growing specialization in genomics, reproductive health, autoimmune disorders, and allergy diagnostics.

The company has steadily expanded into Tier-II/III cities and strengthened its presence in the South and West through acquisitions (Suburban Diagnostics) and new reference labs.

2. Industry & Growth Prospects

India’s healthcare and diagnostics sector is growing structurally due to:

Healthcare infrastructure gaps: India faces a shortage of 2.4 million hospital beds, leading to demand for diagnostic support.

Chronic disease prevalence: 100M+ diabetes patients, rising hypertension and obesity rates expand long-term test demand.

Government push: Ayushman Bharat, Heal in India, and Ayushman Bharat Digital Mission (ABDM) are expanding diagnostic reach.

Technology adoption: AI-driven diagnostics, telemedicine, digital health records, and automation are improving efficiency and penetration.

Industry shift: From unorganized to organized players, accelerated by hospital chains and e-commerce entrants in diagnostics.

Growth Outlook: Industry expected to grow at ~12–15% CAGR this decade, with diagnostics gaining higher share in preventive and chronic care.

3. Historical Performance (FY12 – FY25)

9-Year CAGR (FY16–FY25):

Revenue: 14%

Profit: 15%

EPS: 15%

NPM: Stable at 16–19%

4. Latest Q1 FY26 Results (June 2025)

Revenue: ₹670 Cr (+11% YoY)

PAT: ₹134 Cr (+24% YoY)

EBITDA Margin: 28.7% (vs 28.2% LY)

PAT Margin: 20.0% (vs 17.9% LY)

EPS: ₹15.9 (+24% YoY)

Drivers:

Volume growth: +10.7% in samples, +5.3% in patients

Test mix improvement: 3.07 tests per patient vs 2.92 LY

Preventive “SwasthFit” program contributed 27% revenue (highest ever)

Regional strength: Delhi & NCR (31%), UP & Uttarakhand (19%), West India (14%), South India (6%)

5. Cost Structure (Q1 FY26)

Employee Costs: 26% of total

Materials: 25%

Fees to Collection Centers: 18%

Other Costs: 24%

Finance: 1%

Efficiencies via automation, cluster model, digital logistics, and SwasthFit bundles are boosting profitability.

6. Peer Comparison (FY25 Data)

Insights:

Dr Lal enjoys highest scale and margins among listed peers.

Valuations (PE 42–62, PBV 9–13x) are premium, justified by brand and leadership.

7. Long-Term Estimates & Valuations

Stock Price (Aug 2025): ₹3,315

Near-term valuation: Fair (close to FY26 blended fair value).

Long-term CAGR potential (FY25–35): ~9–10% CAGR assuming steady margins.

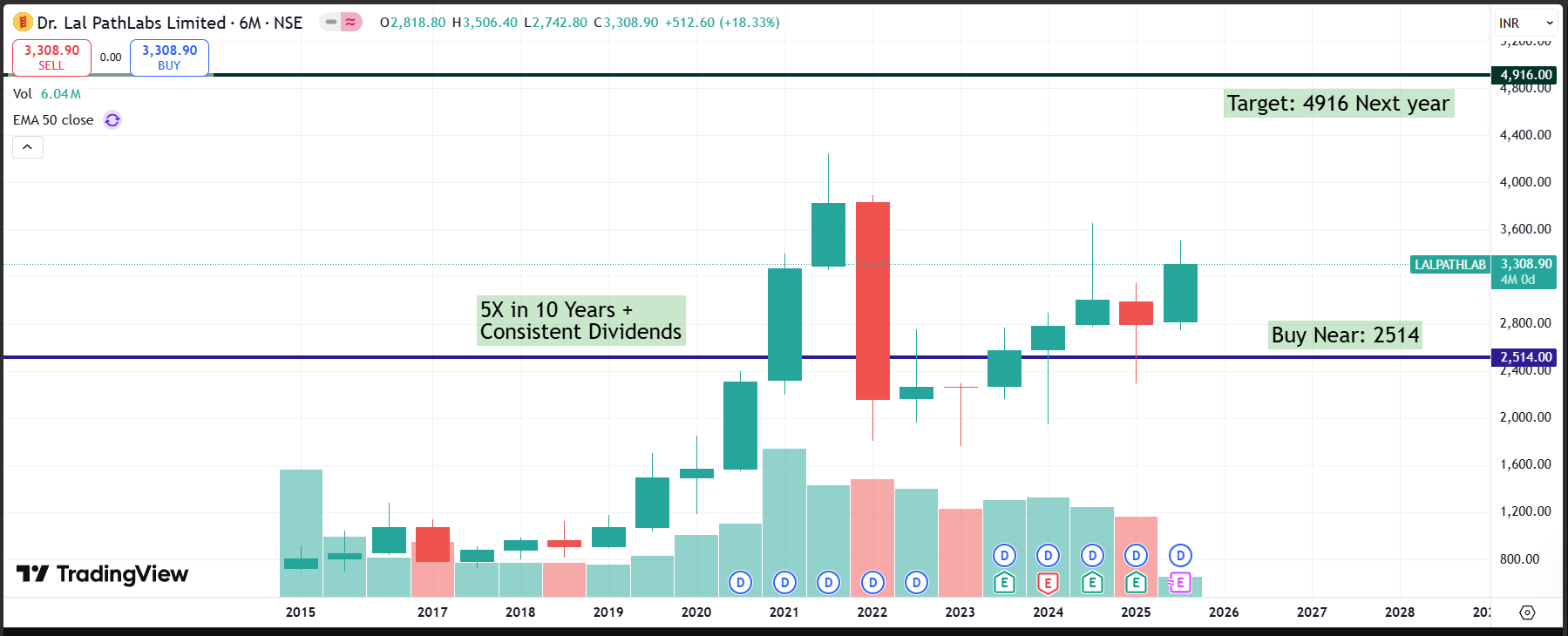

8. Technical & Portfolio Weightage

Current Price: ₹3,315

Strategic Weightage (long-term portfolio): 2% base allocation

Adjusted for factor score: 1.5% tactical weightage (quality stock but premium valuation)

Technical Chart: Supports accumulation on dips towards ₹3,000–3,100 range

9. Conclusion – Risk & Reward

✅ Strengths: Pan-India brand, high profitability, preventive care leadership (SwasthFit), tech adoption, structural demand tailwinds.

⚠️ Risks: High valuations, competition from online/e-commerce & hospital chains, regulatory pricing pressures, slower-than-expected growth in Tier-III/IV markets.

Investor View:

Dr Lal PathLabs remains a core defensive healthcare play in India. Investors can hold existing positions, accumulate gradually on dips, and expect steady compounding returns with lower volatility compared to cyclical sectors.

📌 Disclosure

This report is prepared for educational purposes only and reflects data from company filings, earnings presentations, and analyst interactions.

It is not investment advice. Investors must perform independent due diligence before making financial decisions.