📊 Affle (India) Ltd. – A Long-Term Investment Outlook

🏢 Company Overview

Affle (India) Ltd. is a global technology company that delivers consumer intelligence-driven mobile advertising solutions. Its CPaaS (Consumer Platform as a Service) enables brands to drive user acquisition, engagement, and conversions using AI, big data, and predictive algorithms.

Affle’s revenue model is primarily transaction-linked, meaning it earns when a user engages in a purchase or action for its clients. This ensures higher ROI for advertisers and sticky long-term relationships.

🌐 Industry & Growth Prospectus

Digital AdTech Growth: The Indian and global adtech markets are expanding rapidly, with digital ad spends expected to grow at ~20% CAGR till 2030.

Mobile-first Economy: With smartphone penetration, India’s 700+ million internet users provide a huge TAM (total addressable market).

Data & AI Edge: AI-driven ad personalization, fraud detection, and consumer insights give Affle a competitive edge over traditional advertisers.

Key Growth Drivers:

✅ Surge in mobile advertising spends

✅ Expansion in emerging markets (India, SEA, Africa)

✅ Increasing adoption of AI & machine learning in advertising

✅ Rising demand for performance-based marketing models

🏭 Peer Comparison (AdTech & Digital Platforms)

📌 Affle stands out for its stable margins, global client base, and sustained user growth, though valuations are premium compared to peers.

📈 Historical Performance

Users, Sales & Profits Growth

💡 Sales CAGR (FY16–25): ~42% | Profit CAGR: ~37% | User base expanded from 4 Cr in FY18 to 39 Cr in FY25.

🔍 Q1 FY26 Highlights

Revenue: ₹620 Cr (+19% YoY)

Net Profit: ₹105 Cr (+22% YoY)

EPS: ₹7.52 (+22%)

EBITDA Margin: 22% vs 20% last year

Regional Growth:

India & Emerging Markets – 18%

Developed Markets – 23%

Key Costs:

Inventory cost: 74% of revenue (up 18%)

Employee cost: 12% (up 3%)

Depreciation & Amortization: +37%

Finance cost down 53% (lower debt pressure)

📉 Valuations & Price Behavior

Historical PE Range

FY20: 29–88

FY21: 18–119

FY25: 38–69

FY26E: 44–71

PBV Range

FY20: 8.3 – 25.5

FY25: 4.9 – 9.0

FY26E: 5.9 – 9.7

📌 Current Price ~₹1,950

Fair Value (FY26E): ₹2,042

2030 FV: ~₹5,066

2035 FV: ~₹12,607

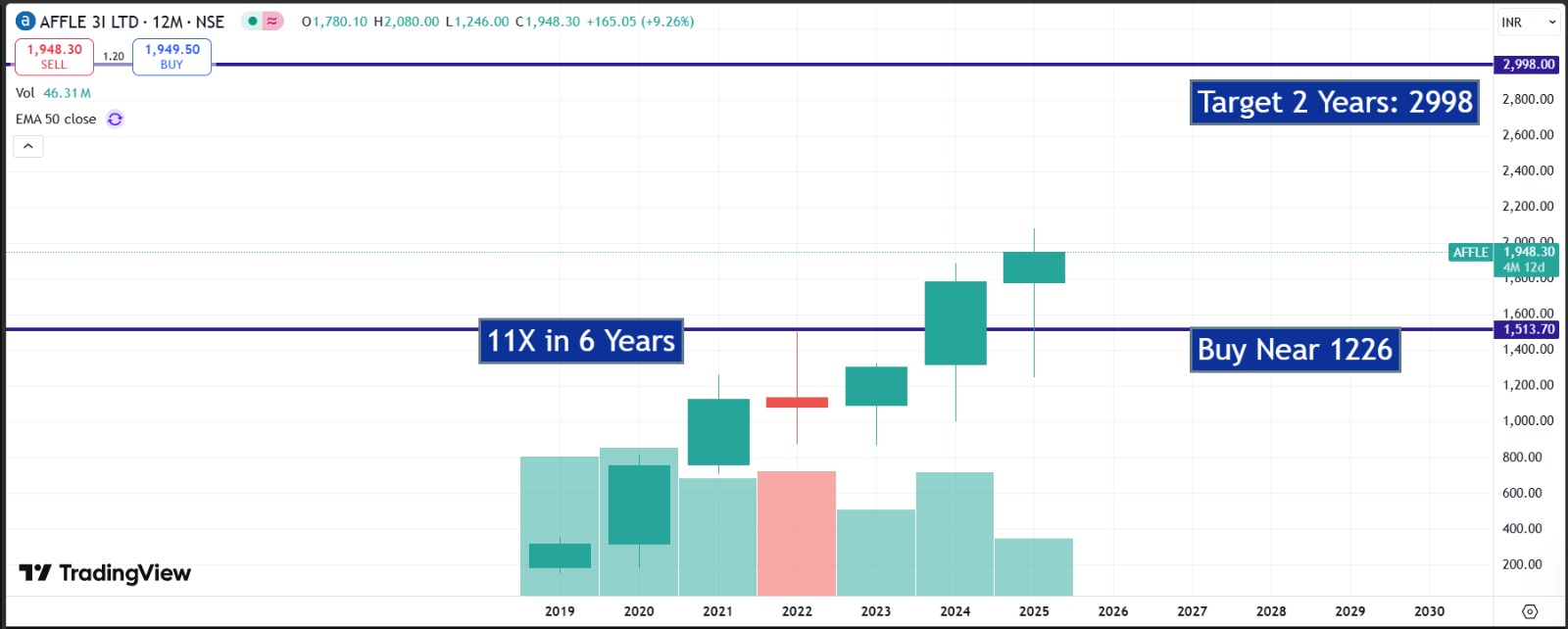

📊 Technicals

Current price around ₹1,950 (near mid-valuation range).

Key supports: ₹1226.

Resistance: ₹2998.

Trend: Consolidation with long-term bullish outlook.

⚖️ Risk & Reward

✅ Rewards

High growth in mobile adtech industry

Strong user acquisition engine (39 Cr → 163 Cr by FY35E)

Premium clients across e-commerce, fintech, gaming, FMCG

Expanding margins with scalable AI-driven model

❌ Risks

Premium valuations (PE ~45–70)

High dependence on digital ad spending cycles

Intense competition from InMobi & Many others etc.

Inventory-led cost structure may impact margins

📌 Conclusion

Affle is a unique digital adtech play in India with a proven ability to scale users, sales, and profits at 20%+ CAGR. While near-term valuations appear rich, long-term investors may benefit from compounding as Affle’s revenues and profits are expected to 4–5x by FY35.

🎯 Strategic Portfolio Allocation: 2.3% weight suggested.

⚖️ Risk-reward balanced; best suited for investors with a 10-year+ horizon.

📜 Disclosure

This analysis is prepared for educational purposes only and reflects unbiased insights based on publicly available data.