Tata Consumer Products Ltd – Long-Term Investor Report

(All figures in ₹ Crores unless specified)

1. Company Overview

Tata Consumer Products Ltd. (TCPL), part of the Tata Group, is one of India’s largest FMCG companies. It has a strong portfolio of tea, coffee, packaged water, salt, pulses, spices, ready-to-cook foods, and beverages under brands like Tata Tea, Tetley, Eight O’Clock, Himalayan, Tata Salt, and Tata Sampann.

In recent years, the company has scaled up India Branded Foods & Beverages, while also building a global portfolio across tea and coffee markets. With entry into non-branded foods and premium packaged goods, TCPL is positioning itself as a holistic FMCG player.

2. Industry & Growth Prospects

FMCG Sector in India

Expected CAGR: 10–12% over the next decade.

Growth Drivers: Urbanisation, rising disposable incomes, e-commerce penetration, premiumisation, and health-conscious consumer trends.

Opportunities: Rural distribution, value-added products, and global tea/coffee exports.

TCPL’s Competitive Advantage

Strong brand equity with 200+ million Indian households.

Synergies with Tata Group distribution (Starbucks JV, Tata Digital tie-ups).

Premiumisation strategy in beverages, salt, and packaged foods.

3. Historical Performance (20 Years)

Growth Rates:

20 Years: Sales CAGR 9%, Profit CAGR 10%

10 Years: Sales CAGR 8%, Profit CAGR 19%

5 Years: Sales CAGR 13%, Profit CAGR 25%

Margins improved from ~3% (2002–05) → ~8% now.

4. Latest Q1 FY26 Highlights

👉 Despite double-digit revenue growth, margins remain below peak levels due to higher material and stock costs.

5. Segmental Growth (Q1 FY26)

👉 Growth remains broad-based, led by India Branded business.

6. Cost Structure (Q1 FY26)

7. Valuation Trends

PE Range (FY2020–FY2026): 39–103 historically, currently ~66–93.

PBV Range: 3.7–7.5 recent, currently ~4.4–6.2.

Long-term sustainable range: PE 55–85, PBV 4–6, given sector peers.

8. Forward Estimates

9. Peer Comparison (FY25)

👉 Tata Consumer trades at a premium vs ITC, closer to Nestle / HUL multiples, though margins are lower.

10. Portfolio Allocation

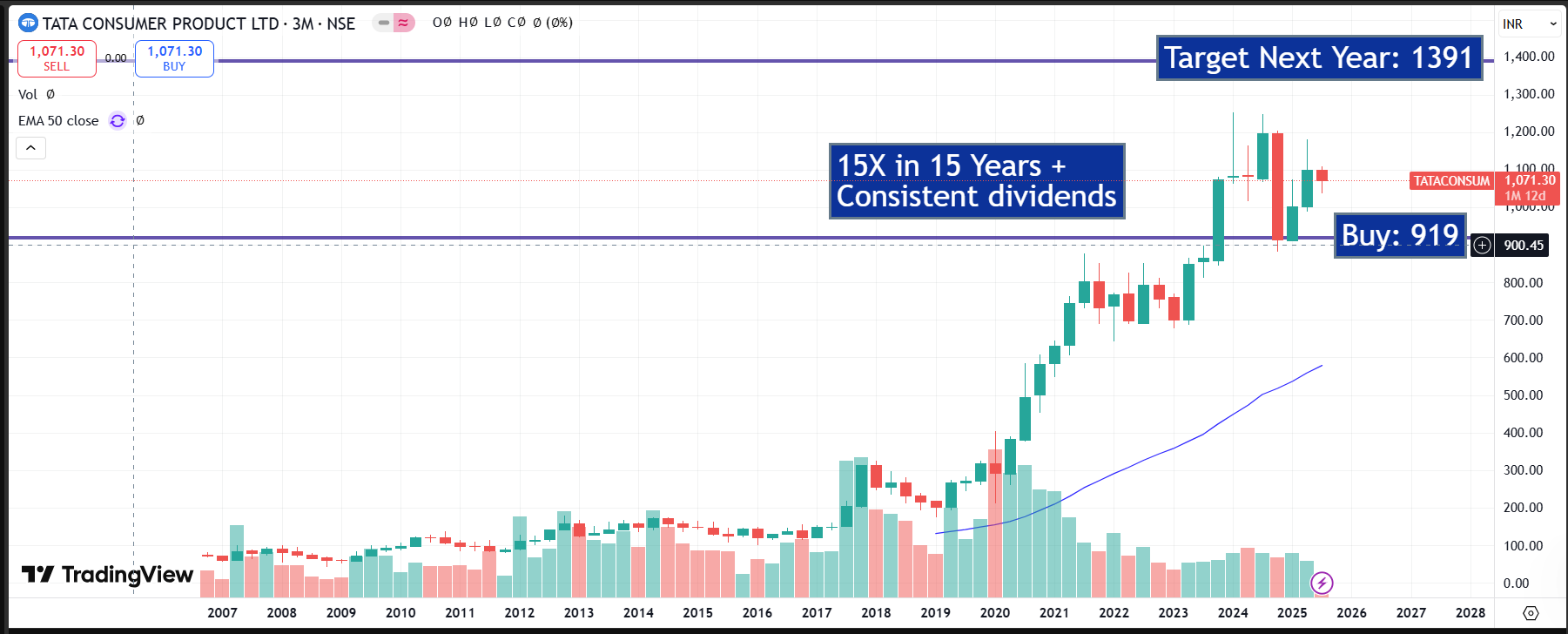

Current Price: ~₹1,073

Strategic Weightage: 2% in long-term portfolio

Tactical Weightage: ~1.06% (based on valuation factors)

11. Risks & Rewards

Positives:

✅ Diversified FMCG portfolio with strong brands

✅ Consistent double-digit sales growth

✅ Expansion into premium, health & wellness categories

Risks:

⚠️ Global tea/coffee volatility

⚠️ Rising raw material costs impacting margins

⚠️ Valuations already factoring in strong growth

Conclusion

Tata Consumer is evolving into a strong FMCG play beyond tea & salt. With consistent growth, expanding premium categories, and strong Tata brand equity, it is a long-term compounder. However, valuations are rich, and sustained margin expansion will be key to justify upside.

Disclosure: This is an unbiased educational analysis, not a buy/sell recommendation.