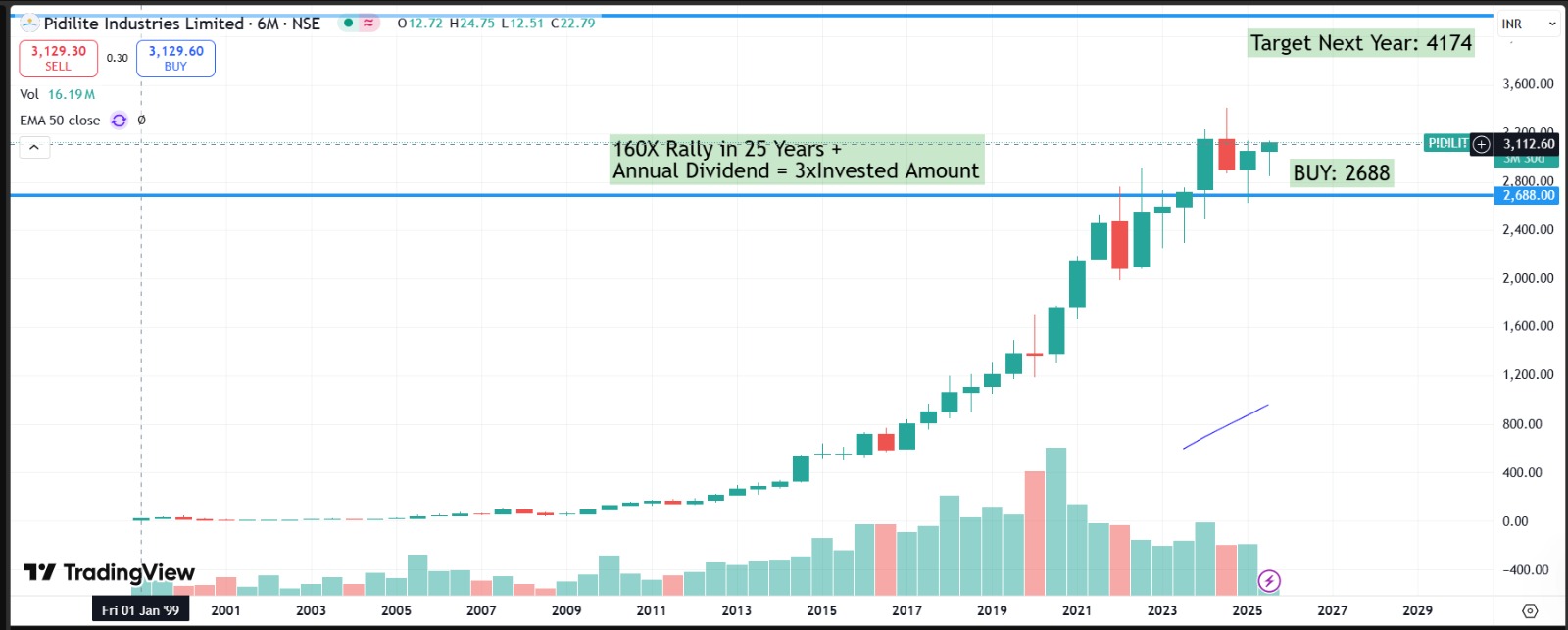

Pidilite Industries Ltd (PIDILITIND): Long-Term Investor Report — FY2002 to FY2026E

Thesis in one line: A dominant consumer-chemicals franchise (Fevicol, Dr. Fixit, Roff, Araldite) compounding through premiumization, deeper rural reach, and category expansion (tile adhesives, waterproofing, professional solutions), with steady double-digit UVG and resilient margins.

1) Company overview & moat

India’s leader in adhesives & sealants, construction chemicals, art & craft, and select B2B resins/pigments; 6,100+ SKUs, 33 plants in India, international manufacturing hubs across Asia/Africa, and 5 R&D centres (incl. Singapore). Brands include Fevicol, Fevikwik, M-Seal, Dr. Fixit, Roff, Fevicryl, Araldite.

Management continues to target profitable, volume-led growth, investing in brands, supply chain, and people.

Q1 FY26 corporate actions: To mark the founder’s 101st birth anniversary, the Board approved 1:1 bonus shares and a ₹10 special interim dividend.

2) Industry & growth prospects

Structural drivers: Housing/income formalization, renovation cycles, shift from cement to tile adhesives, growing penetration of waterproofing, and rising DIY/organized carpentry. Management highlighted strong momentum in Roff (tile adhesives), Dr. Fixit (waterproofing), and innovations in Fevicol (e.g., Nail-Free Ultra, ReLam) aiding premiumization.

Demand lens: Underlying Volume Growth (UVG) remains broad-based across categories and regions; rural outpacing urban for a few quarters, supported by distribution expansion (direct coverage 2x in 5 years; PKD/DFC centres ~3x).

New adjacencies: UnoFin (sprayable exterior finish) is being driven via project-led adoption (architects, masonry contractors; e.g., Jewar Airport base coat), a longer runway category build.

3) Historical financials (₹ crore)

Sales & Profit (reported by you)

Profitability (NPM)

NPM trended 10–17% historically; recent Trail FY26 ~16.3% vs FY25 16.0%, reflecting mix + soft input costs. (Table provided by you; commentary aligns with management’s “benign inputs” and tactical pricing stance.)

4) Historical valuation bands

PE: From single-digits in early 2000s to a quality-compounder range; Trail FY26: 65–73.

PBV: Upshift with brand/ROCE compounding; Trail FY26: 14.5–16.3x.

These bands frame long-term buy-on-weakness / trim-at-euphoria disciplines for quality compounding stories.

5) Mix & geography

C&B vs B2B: FY25 standalone sales mix ~81% C&B / 19% B2B; C&B PBIT margin ~32% in Q1 FY26 vs ~19% for B2B.

Category mix (FY25 base): Adhesives & Sealants ~53%, Construction & Paint Chemicals ~22%, Art & Craft ~6%, Industrial Adhesives ~5%, Industrial resins/project chems ~9%.

Regional lens: Management tracks performance state/district/town level; prior softness in AP & Gujarat has eased, while Kerala flagged as a current outlier; rural > urban growth trend persists.

International subsidiaries: Q1 FY26 sales up ~6–7% with margin improvement; both ME/Africa and Asia saw EBITDA growth (constant currency).

6) Q1 FY26 scorecard (Consolidated)

Net Sales ₹3,742 cr (+10.6% YoY); UVG 9.9% (C&B 9.3%, B2B 12.6%).

EBITDA ₹941 cr (+15.8%); EBITDA margin ~25–26%, +~100 bps YoY; PAT ₹678 cr (+18.7%).

Input costs benign; pricing to remain tactical; margin corridor 20–24% for FY26 with bias to the higher end if macros stay supportive.

Standalone segment snapshot (Q1 FY26): Net Sales ₹3,467 cr (+10.6%), C&B PBIT margin 32.1%, B2B 18.7%.

7) Latest operating analysis

a) Segmental & regional mix

Adhesives & Sealants 53% | Construction & Paint Chems 22% | Art & Craft 6% | Industrial Adhesives 5% | Resins & project chems 9% | Pigments 4% | Others 0%

b) Cost structure

Material 1,393 (48%), Stock-in-trade 207 (7%), Inventory change 122 (4%), Employee 464 (16%), Other exp 626 (21%), Finance 14, D&A 97 → Total 2,923.

Read-through: soft raws + scale leverage keep EBITDA at ~25%; management remains watchful on geopolitics/supply chains, but highlights multi-sourcing preparedness.

c) “Current trend” trackers

Sales growth: H1 FY25 4% → 9M 5% → FY25 6% → Q1 FY26 11% → FY26E 13%

Profit growth: 19% → 16% → 20% → 19% → 28%

Margin: 18.1% FY26E (vs 16.0% FY25)

8) Peer comparison (qualitative)

(Where specific numbers are required, we reference company filings for each peer; here we keep the comparison directional to avoid unverified figures.)

9) Valuation framework (your bands & estimates)

a) Price ranges by EPS & PBV (₹)

Interpretation at CMP ~₹3,131 (your input):

FY26E Blended fair ~₹2,963 (near CMP); optimistic band ₹3,794–3,919 if the market rerates closer to historical high multiples; long-term blended fair accretes to ~₹3,941 (FY30E) and ~₹6,378 (FY35E) given your growth path.

10) Portfolio weightage & technicals (your inputs)

Strategic weight: 2.0% of equity portfolio

Valuation factor: 0.73 → Technical weight: ~1.47%

Chart cues: Buy zone ₹2,688; next-year target ₹4,174 (6M candles; mean-reversion + higher-high potential). (Use as a tactical overlay on top of fundamental bands.)

11) What to track (execution KPIs)

UVG vs category: sustain high-single/low-double-digit underlying growth.

Mix premiumization: Roff/Dr. Fixit innovations; Fevicol new SKUs (Nail-Free Ultra, ReLam).

Margin corridor 20–24% (watch VAM/latex/petro inputs; spread management).

Rural distribution & PKD/DFC expansion, dealer tinting for Haisha Paints pilots.

International subsidiaries: MEA/Asia scaling with margin uptick.

12) Risks

Raw-material volatility (petrochemical derivatives like VAM); geopolitical/supply chain disruptions.

Competitive intensity in tile adhesives (regional pockets like Hyderabad) and paints; continued need for innovation and applicator engagement.

Macro demand (construction/home improvement cycles), FX for international ops.

13) Conclusion

Pidilite remains a franchise-quality compounder with broad-based UVG, improving project solutions (Roff/Dr. Fixit/UnoFin), and a distribution-led rural moat. With CMP near your FY26 blended fair value and long-term fair values compounding into FY30/FY35, the stance that fits many wealth portfolios is “accumulate on dips; maintain core allocation”, while using the historical PE/PBV bands to tactically trim/add around fair value. Near-term drivers: sustained double-digit UVG, premium mix, and margins trending toward upper-band of 20–24% for FY26, subject to input-cost stability.

14) Disclosure

This report is created for long-term investor education. It summarizes public company communications (press release, investor presentation, results, concall transcript) and financial/valuation tables.

Sources: company Q1 FY26 press release, earnings presentation, results and concall transcript.

Appendix A — Q1 FY26 headline numbers (as per company)

Consolidated: Sales ₹3,742 cr (+10.6%), EBITDA ₹941 cr (+15.8%), PAT ₹678 cr (+18.7%).

Standalone: Sales ₹3,467 cr (+10.6%), PBT ₹879 cr (+18.5%); C&B PBIT margin 32.1%, B2B 18.7%.

Guidance contours: Pricing tactical; input costs benign; full-year margins within 20–24% band (seasonality applies).