📊 Bharat Electronics Ltd (BEL): Long-Term Investor Report

1. Company Overview

Bharat Electronics Ltd (BEL) is a Navratna PSU under the Ministry of Defence, established in 1954. It is India’s leading defense electronics company, specializing in radars, communication systems, naval systems, electronic warfare, electro-optics, and missile systems. BEL plays a critical role in India’s defense modernization, supplying strategic systems across Army, Navy, and Air Force.

Market Cap: Among the largest defense PSUs in India.

Business Mix: ~92–93% Defense, ~7% Non-defense (rising via smart city solutions, medical devices, and EVMs).

Subsidiaries & Associates: BEL Optronic Devices, BEL-Thales Systems, GE BE Pvt Ltd, BEL IAI Aerosystems.

2. Industry & Growth Prospects

The Indian defense industry is undergoing structural growth driven by:

🚀 Government push for indigenization (Positive Indigenization List, Make in India, Atmanirbhar Bharat).

📈 Defense budget expansion – India ranks among the top global defense spenders.

🌍 Export opportunity – BEL achieved ~$106M exports in FY25 and is targeting $120M in FY26, with rising traction in Europe amid rearmament.

🛰️ New opportunities – QRSAM (₹30,000 Cr), Project Kusha (indigenous S-400, ₹40,000 Cr potential), NGC corvettes (₹6,000–10,000 Cr), drones, radars, and EW systems.

3. Historical Financial Performance

Revenue & Profit Growth (₹ Cr)

📌 25-Year CAGR

Revenue: ~11%

Profit: ~13%

EPS: ~13%

Margin Expansion: From ~10% → ~23%

4. Latest Q1 FY26 Performance

(Consolidated, ₹ Cr)

🔑 Insights:

Strong profitability despite modest topline growth.

Raw material costs down (-23%), improving gross margins.

Order book robust at ₹71,650 Cr, giving ~3 years revenue visibility.

BEL confirmed fast-tracking execution for emergency procurement orders due to geopolitical tensions.

5. Segmental & Cost Analysis

Revenue Split: 92–93% Defense, 7–8% Non-defense.

Major Costs Q1 FY26: Raw materials (59% of sales), Employee cost (21%), Depreciation (4%), Others (13%). Raw material decline aided margins.

Capex & R&D: ₹900 Cr+ in FY25; guided >₹1,000 Cr annually to support long-term growth.

6. Valuations

Historical Valuations

Low PE (2002–FY26): 2x → 34x

High PE (2002–FY26): 6x → 57x

PBV range: 0.3x → 15.6x

Forward Estimates

BEL is currently at ~₹375/share (Aug 2025), trading ahead of FY26 FV, but justified given order book strength and earnings visibility.

7. Peer Comparison (Defense Sector)

➡ BEL commands premium valuation due to diverse product mix, strong R&D, leadership in radars & electronics, and export potential.

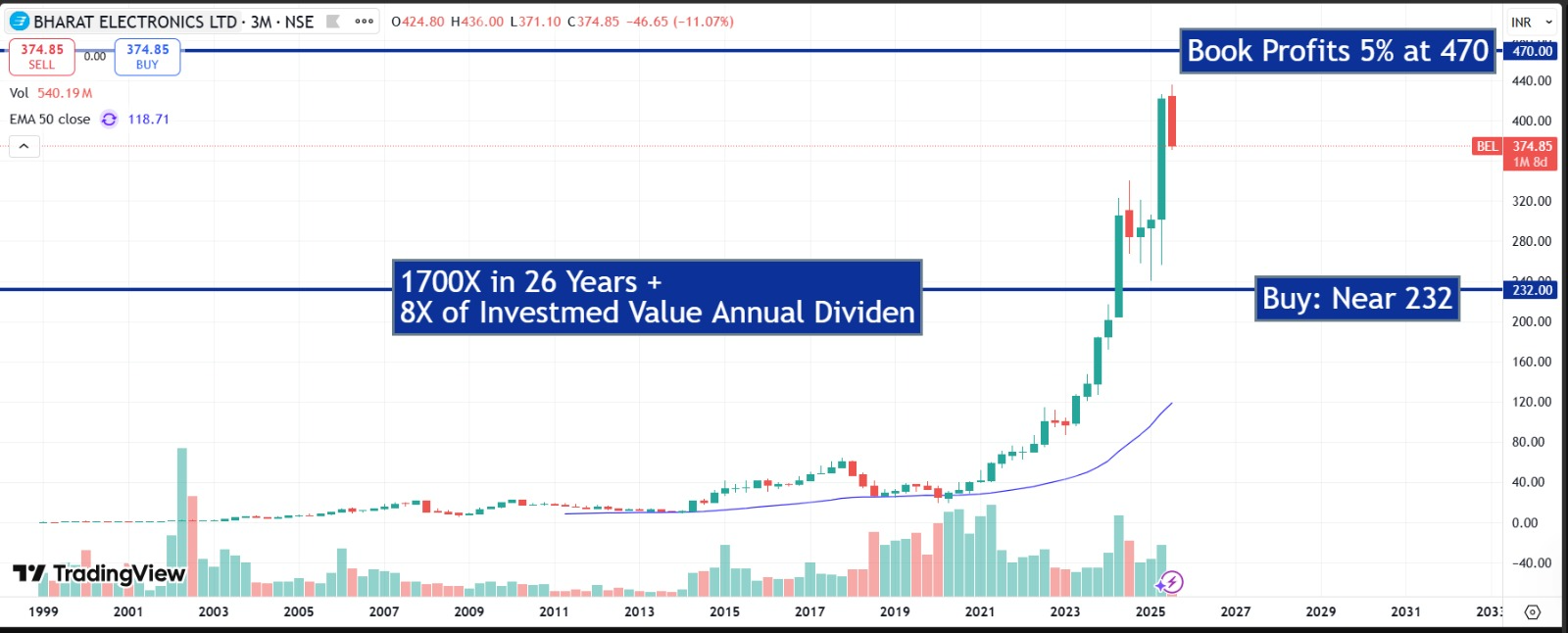

8. Technicals & Long-Term Chart View

Current Price: ₹375

Book 5% Profits at: ₹470

Buy Zone: Near ₹232

Historical: 1700X return in 26 years, delivering ~27% CAGR. Dividend yield significant (annual payout ~8X of invested value over long-term).

9. Long-Term Risks & Rewards

Opportunities 🚀

Strong order book (₹71,000+ Cr).

Expanding export potential ($120M FY26 target).

Indigenization push (QRSAM, Project Kusha, drones, radars).

Consistent margin expansion with scale.

Risks ⚠️

Dependence on government defense budget allocations.

Project delays and execution risks.

Global competition in export markets.

Valuations already stretched (P/E 34–57x range).

🔑 Conclusion

BEL remains a structural long-term defense play with strong growth visibility. With its leadership in indigenous defense electronics, expanding exports, and rising margins, BEL is well-positioned for 15–17% revenue growth and 20%+ profit growth over the next 5 years.

At current levels, valuations are rich, but long-term investors may accumulate on dips (buy zone: ₹232–₹300) with a 3-year target of ₹470 and 10-year fair value potential of ₹538+.

📌 Disclosure: This report is for educational purposes only.