Kajaria Ceramics (Kajaria Cera) – Long-Term Investment Analysis 🏗️📊

1. Company Overview 🏢

Kajaria Ceramics is India’s largest manufacturer of ceramic and vitrified tiles. With strong brand presence, wide distribution, and product diversification, it has established itself as a leader in the building materials sector. The company benefits from real estate recovery, rising urban housing demand, and premiumization trends in home décor.

2. Industry & Growth Prospects 🌍

Indian Tiles Industry Size: Estimated at over ₹60,000 crore, growing at ~8–10% CAGR.

Drivers of Growth: Real estate demand, government housing schemes, smart cities, and rising per capita income.

Trends: Shift from unorganized to organized players, preference for branded & premium tiles, and exports growth.

Peer Comparison: Kajaria leads with strong brand and margins, followed by Somany Ceramics, Orient Bell, and Nitco.

3. Historical Financial Performance 📈

Income & Profit Growth (₹ Cr)

FY2002 → FY2025: Income grew from ₹228 Cr → ₹4,481 Cr (20x in 23 years).

Net Profit grew from ₹3 Cr → ₹300 Cr in the same period.

Margins have fluctuated between 6–11%, with peak profitability in FY21–22.

👉 Key Insight: Growth has slowed in the last 2 years, but FY26 profit trend shows early signs of recovery.

4. Valuation History ⚖️

PE Valuation Range (Historical)

Low PE: 2 (FY2003) → 41 (FY2023–25)

High PE: 16 (FY2002) → 85 (FY2025)

Current trading band is 39–80x PE, reflecting premium valuations for a sector leader.

PBV Range

FY25 valuations: Low PBV 4.4x → High PBV 9.2x

Current PBV range is historically elevated, in line with other premium building material companies.

5. Q1 FY26 Performance Snapshot 📰

Sales: ₹1,103 Cr (+1% YoY)

Profit: ₹110 Cr (+20% YoY)

Margin: 10% vs 8.4% LY

EPS: ₹6.84 (+21%)

ICR: Declined from 43 → 29, due to higher finance costs

Cost Breakdown:

Power & Fuel (23%) – +6% YoY

Raw Materials (27%) – +3% YoY

Stock-in-trade (23%) – flat

Employee (14%) – stable

Finance Costs (1%) – +67% YoY

👉 Takeaway: Despite muted topline growth, efficiency and cost control improved profitability.

6. Growth & Projections 🚀

Short Term (FY26E)

Revenue: ₹4,526 Cr

Net Profit: ₹453 Cr

EPS: ₹28

Expected Fair Value: ₹1,073 (blended)

Mid Term (FY30E)

Revenue: ₹7,379 Cr

Net Profit: ₹609 Cr

EPS: ₹38

Blended Fair Value: ₹1,428

Long Term (FY35E)

Revenue: ₹13,005 Cr

Net Profit: ₹1,073 Cr

EPS: ₹66

Blended Fair Value: ₹2,269

7. Portfolio Weightage 🎯

Suggested allocation: 0.7% Strategic Weight

Factor-adjusted weight: 0.65 → Tactical: 0.45%

👉 Suitable as a satellite holding in a diversified portfolio.

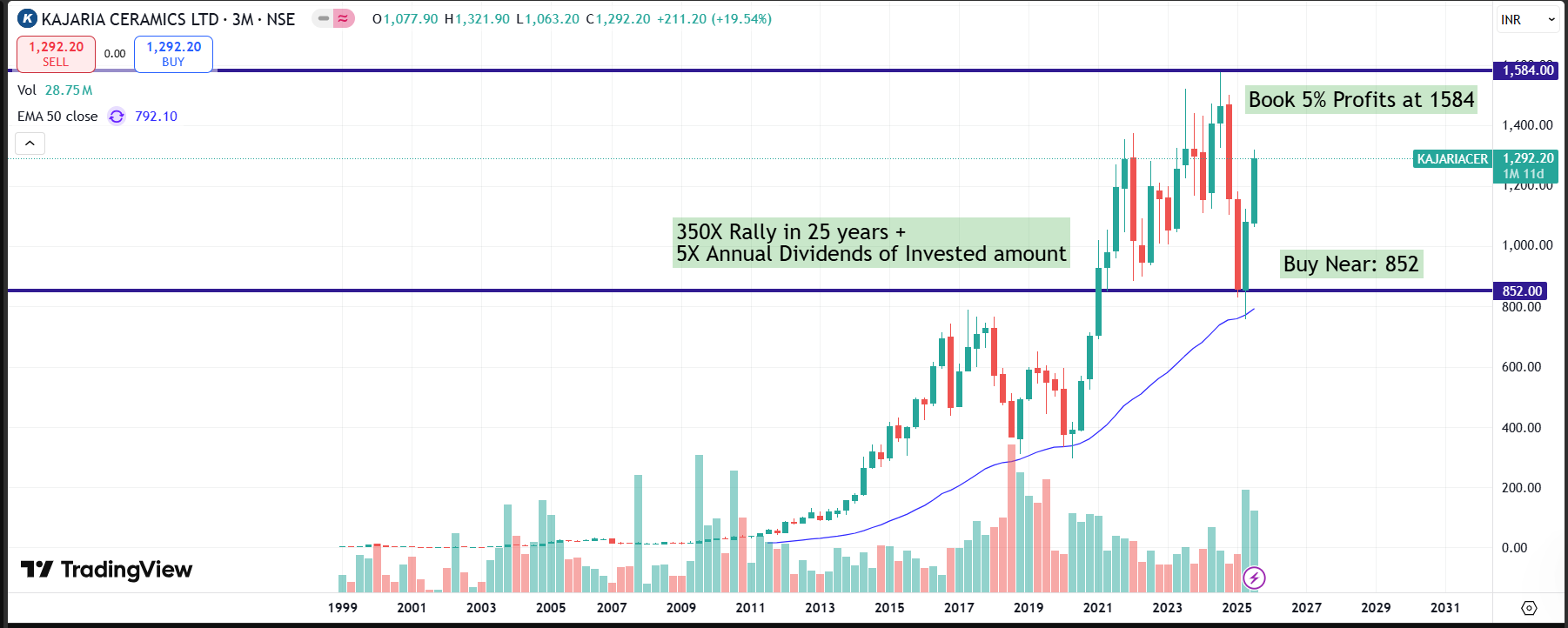

8. Technical View 📉

Stock is consolidating around ₹1,290, trading at 41–85x PE.

Support levels: ₹850

Resistance: ₹1580 (Till Demand Returns)

9. Risks ⚠️

Cyclical nature of real estate demand

High valuations vs peers

Rising input costs (power & gas)

Import/export competition in tiles

10. Conclusion ✅

Kajaria Ceramics remains a premium consumer building material play with strong brand equity, steady financials, and leadership in the tiles industry. While short-term growth is muted, margins are recovering and long-term demand drivers remain intact.

📌 Risk-Reward: Moderate risk, consistent compounder potential.

📌 Best suited for: Long-term investors looking for steady consumption play with exposure to housing & infrastructure growth.

Disclosure

This analysis is for educational purposes only, not investment advice.