Patanjali Foods Ltd. – From Ruchi Soya’s Fall to Patanjali’s FMCG Revival

1. Company Overview

Patanjali Foods Ltd. (earlier Ruchi Soya) has transformed from a commodity-driven edible oil refiner into an FMCG-led diversified food and wellness brand under the Patanjali Group. The acquisition of bankrupt Ruchi Soya in 2019 marked the turning point, giving Patanjali a ready platform in oils, plantations, and soya-based products. Today, the company operates across edible oils, food & FMCG, home & personal care (HPC), nutraceuticals, and oil palm plantations with an expanding footprint in both domestic and international markets.

2. Industry Context & Growth Prospects

Edible Oils: India is the world’s largest importer of edible oils. Government policy shifts (duty cuts on palm, soybean, sunflower oils) directly impact pricing and margins. Domestic refining and palm plantations provide long-term self-reliance opportunities.

FMCG & HPC: Rural demand is outpacing urban, though green shoots of revival are visible. Patanjali is targeting a 50:50 revenue split between FMCG and edible oils in the medium term.

Nutraceuticals: Rapidly growing preventive health and ayurveda segment; Patanjali launched medicated juices and premium herbal products to capture the wellness trend.

Global Market: Exports to 27 countries; HPC products like Dant Kanti are gaining traction abroad.

3. Historical Performance – The Ruchi Soya & Patanjali Era

📌 The fall of Ruchi Soya (FY16–18) saw massive losses and bankruptcy. Post-acquisition, Patanjali stabilized operations, restored margins, and returned to profitability.

4. Q1 FY26 Performance Highlights

Revenue: ₹8,900 Cr (+24% YoY).

EBITDA Margin: 3.7% (vs 9.4% Q1 FY25).

PAT: ₹188 Cr (down 27% YoY due to high raw material cost).

Segmental Mix:

Edible Oils: ₹6,686 Cr (+25% YoY) – 72% branded.

Oil Palm Plantation: ₹592 Cr, doubled YoY.

Food & FMCG: ₹1,661 Cr (–15% YoY).

HPC (Oral, Skin, Hair, Home Care): ₹639 Cr, strong EBITDA margin at 18.7%.

Nutraceuticals: ₹17 Cr, +38% YoY, turned EBITDA positive.

Key Drivers:

Rural demand steady; urban demand showing early revival.

Palm oil duty cuts reduced input costs but hit pricing/margins.

Ghee, biscuits, Dant Kanti oral care, and nutraceuticals showed resilience.

Exports contributed ₹39 Cr, presence in 27 countries.

5. Peer & Global Comparison

Peers in Edible Oils: Adani Wilmar, Cargill India – similar challenges from commodity volatility, but Patanjali gains brand edge via FMCG integration.

Peers in FMCG: HUL, Dabur, ITC – higher margins (15–20%) vs Patanjali (5–8%). The transition to branded FMCG remains the biggest rerating driver.

Global FMCG Majors: Nestlé, Unilever, P&G operate at ~18–22% margins, setting aspirational benchmarks for Patanjali.

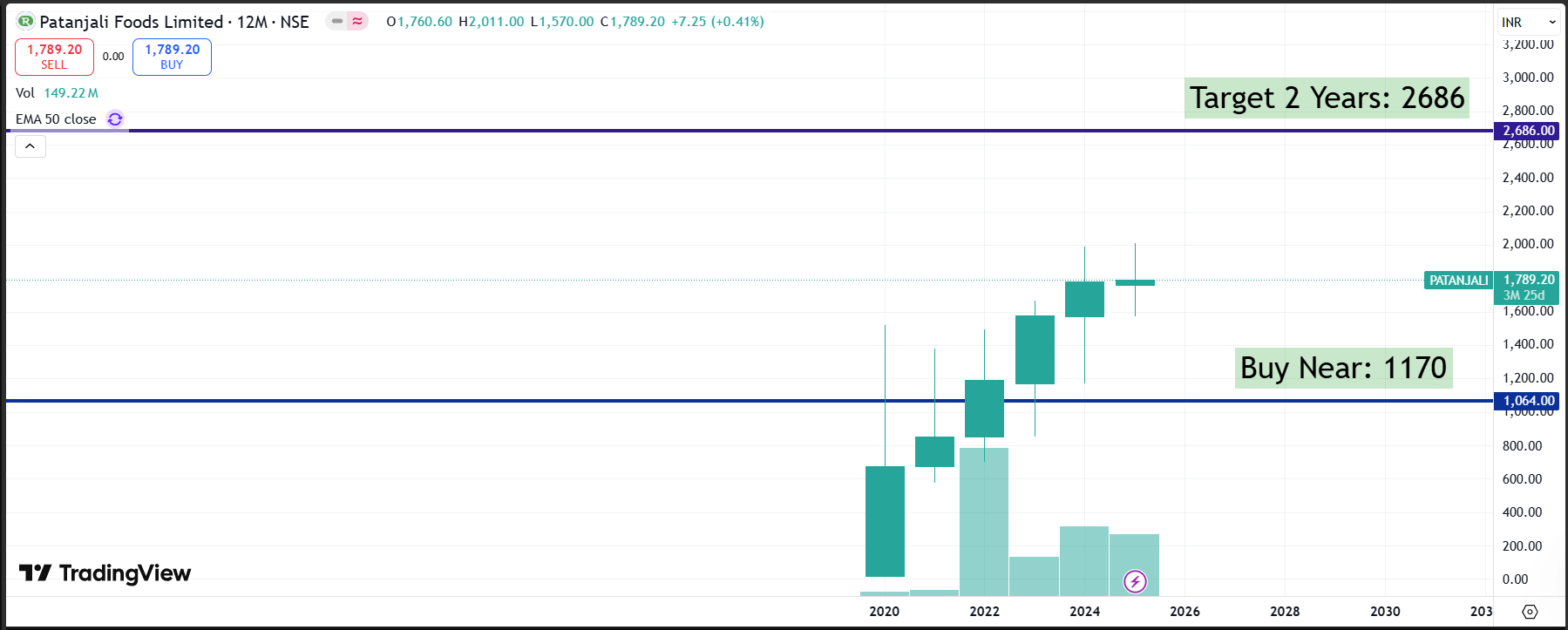

6. Valuations & Financial Ratios

P/E Band: 23–67x (FY22–26), currently ~53x trailing, ~67x forward EPS.

P/BV Band: 3–11x historically; currently ~5–6x.

Margins: Long-term margin guidance – 8–10% at company level.

Debt: Reduced significantly post Ruchi restructuring, focus now on FMCG capex.

7. Growth Strategy & Future Outlook

Target: ₹50,000 Cr revenue by FY30 – equal split between FMCG and Oils.

Premiumization: Focus on Dant Kanti Advanced, herbal juices, nutraceuticals.

Distribution: Expanding omni-channel (modern trade, e-commerce, D2C, rural Gramin Mitra network).

Palm Plantation: 92,133 hectares planted; long-term annuity-type revenue driver.

Rural Focus: Affordable SKUs (e.g., ₹370 for 450ml ghee pack) to defend share against regional players.

8. Risks

Commodity volatility (palm oil, wheat, sugar).

Regulatory risks (duty changes).

Margin pressure from competition and input costs.

Urban market recovery slower than expected.

9. Conclusion – Long-Term Risk & Reward

Patanjali has successfully revived a bankrupt edible oil company into a growing FMCG + oils hybrid. While short-term pressures on margins remain, the long-term story rests on FMCG premiumization, nutraceutical growth, and oil palm self-reliance. If execution stays on track, margins could expand towards double digits and valuations may rerate closer to FMCG peers.

10. Disclosure

This report is for educational purposes only. It does not constitute investment advice or a recommendation. Investors should do their own due diligence before making investment decisions.