🎢 Wonderla Holidays Ltd – Riding the Waves of Leisure & Growth

📌 Company Overview

Wonderla Holidays Ltd is India’s most loved amusement park operator, with 46+ million visitors since inception. With 4 operational parks (Bengaluru, Kochi, Hyderabad, Bhubaneswar) and the Wonderla Resort in Bengaluru, the company offers a complete entertainment ecosystem.

Recently, Wonderla also launched “The ISLE” luxury glamping pods at Bengaluru, marking a step towards blending hospitality with leisure parks.

🏭 Industry Landscape & Growth Prospects

The Indian amusement and theme park industry is expected to grow at double-digit CAGR (12–15%) over the next decade, driven by:

Rising middle-class disposable incomes.

Increasing preference for family leisure & outdoor entertainment.

Growth in domestic tourism.

With government support for tourism, regional park expansion, and higher per-capita spending on leisure, Wonderla is well-positioned to capture long-term demand.

📊 Historical Performance – Sales & Profits (₹ Cr)

👉 Key Trend: Visitor footfalls have broadly stabilized, but profitability has declined from 33–35% NPM to 22–24%, showing margin pressure due to rising operating costs.

⚖️ Q1 FY26 Results Snapshot

Revenue: ₹168 Cr (down 3% YoY).

Footfalls: 9.17 lakh (down 8.5% YoY).

ARPU: ₹1,775 (up 6% YoY).

PAT: ₹53 Cr (down 17% YoY).

EBITDA Margin: 45.9% vs 52.7% last year.

👉 Despite higher ARPU and non-ticket spends, declining footfalls and rising costs weighed on profits.

🌍 Segmental & Regional Growth

⚡ Growth Driver: Bhubaneswar park (+46% YoY) offset weakness in mature parks.

🔍 Peer Comparison (Theme Parks & Leisure Sector)

Imagicaaworld Entertainment: Higher leverage, slower growth.

Nicco Park: Regional presence, lower ARPU.

Wonderla stands out for its debt-free balance sheet, strong brand, and higher margins despite near-term volatility.

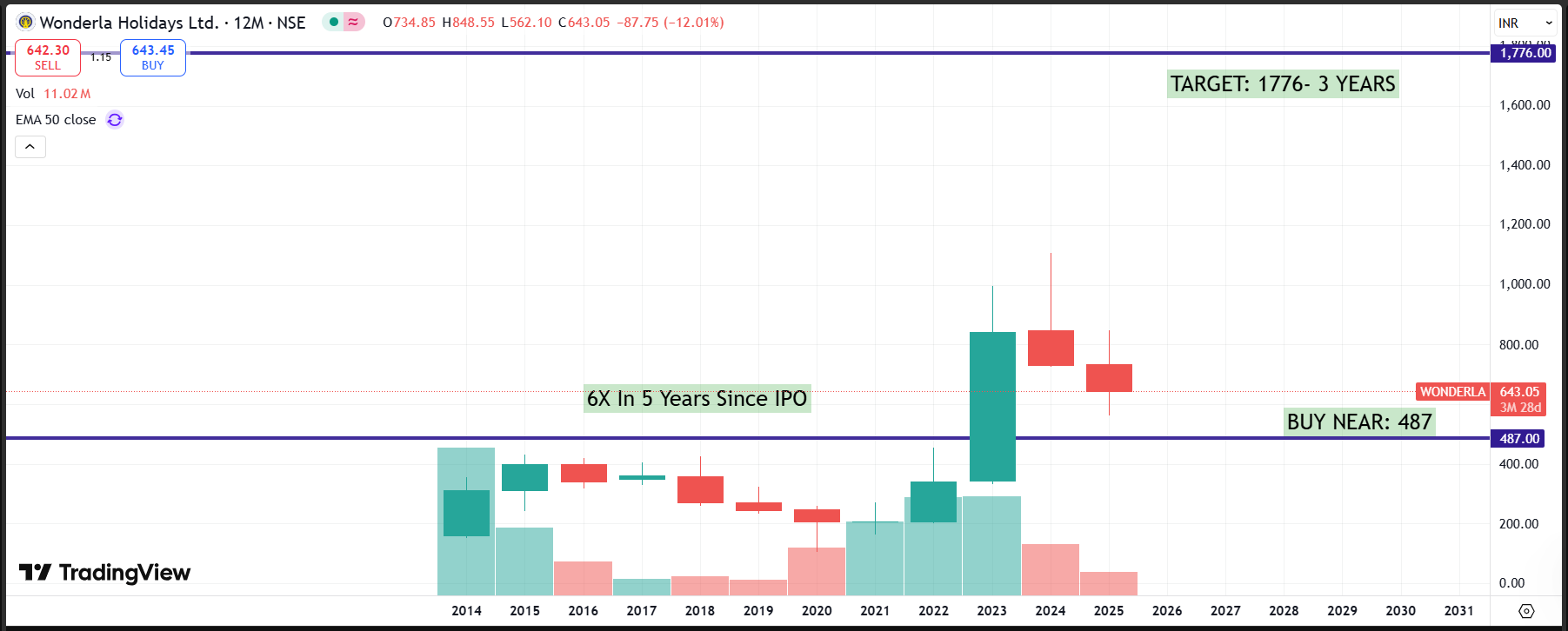

📈 Valuations – Historical Multiples

P/E Range: 15x – 59x (post-COVID normalisation). Currently trading at ~35–44x.

P/BV Range: 2.1x – 5.6x; now ~2.1–2.6x.

Fair Value Estimates (Blended):

FY26: ₹634

FY30: ₹1,123

FY35: ₹2,198

⚡ Strategic Outlook & Growth Drivers

Expansion of Chennai Park (construction ongoing, with 10-yr local body tax exemption).

Leveraging digital & social media marketing to boost footfalls.

Diversification into hospitality (resorts, glamping pods) for higher per-visitor monetization.

Focus on in-house ride design & cost efficiencies.

📝 Conclusion – Long-Term Risk & Reward

✅ Positives: Strong brand, debt-free balance sheet, expansion into new cities, resilient ARPU growth.

⚠️ Concerns: Footfall slowdown, cost pressures, dependence on seasonal tourism.

🎯 For long-term investors, Wonderla represents a unique consumer play on India’s rising leisure & tourism spending.

📌 Disclosure

This report is prepared for educational purposes only, not a buy/sell recommendation. Investors should do their own due diligence before making investment decisions.