Bajaj Housing Finance Ltd – Long-Term Investor Report

(All figures in ₹ Crores unless mentioned)

1. Company Overview

Bajaj Housing Finance Ltd. (BHFL), a subsidiary of Bajaj Finance Ltd., is a fast-growing housing finance company offering home loans, loans against property, and developer financing. Since inception in FY18, BHFL has delivered strong growth, stable profitability, and one of the best asset quality track records in the HFC industry.

2. Industry & Growth Prospects

Housing Finance Sector

Growth Drivers: Urbanisation, rising disposable incomes, affordable housing push, and Tier-2/3 city penetration.

Sector CAGR: Housing finance in India is expected to grow 12–15% CAGR in AUM over the next decade.

Regulatory Support: Government schemes (PMAY, CLSS) and stable interest rate environment support demand.

BHFL’s Competitive Advantage

Strong parental backing from Bajaj Finance ensures funding access.

Tech-driven underwriting keeps costs low and reduces NPAs.

Pristine Asset Quality: GNPA at 0.28% among the lowest in the industry.

3. Historical Performance

5-Year CAGR (FY18–FY25):

AUM: 29%

Income: 29%

Profit: 39%

Margins: expanded from 9.4% → 22.7%

4. Asset Quality (NPA Trend)

👉 Asset quality has remained excellent, consistently below 0.3% GNPA.

5. Latest Q1 FY26 Highlights

Major Cost Structure (Q1 FY26)

Finance Cost: 86% of total (₹1,606 Cr, +15%)

Employee Cost: 7% (+20%)

Impairment: 2% (+310%)

Other Exp.: 3% (+45%)

👉 BHFL’s largest expense remains funding cost, but credit cost remains under control.

6. Valuation Analysis

PE Range (limited history): IPO at 55–71x, Tr. FY26 estimated 40–50x.

PBV Range: IPO at 6–8x, currently ~5–6x.

Given limited history, future PE band (30–50x) and PBV band (3–6x) appear sustainable.

7. Forward Estimates

FY2026E:

AUM: ₹1,39,957 Cr

Profit: ₹2,629 Cr

EPS: ₹3.2

BV: ₹27

Blended Fair Value: ~₹107

FY2030E:

AUM: ₹3,41,692 Cr

Profit: ₹5,990 Cr

EPS: ₹7.4

BV: ₹66

Blended Fair Value: ~₹252

FY2035E:

AUM: ₹8,50,240 Cr

Profit: ₹14,904 Cr

EPS: ₹18

BV: ₹165

Blended Fair Value: ~₹627

8. Peer Comparison (FY25)

👉 BHFL has superior margins and asset quality compared to peers, though on a smaller AUM base.

9. Portfolio Weightage

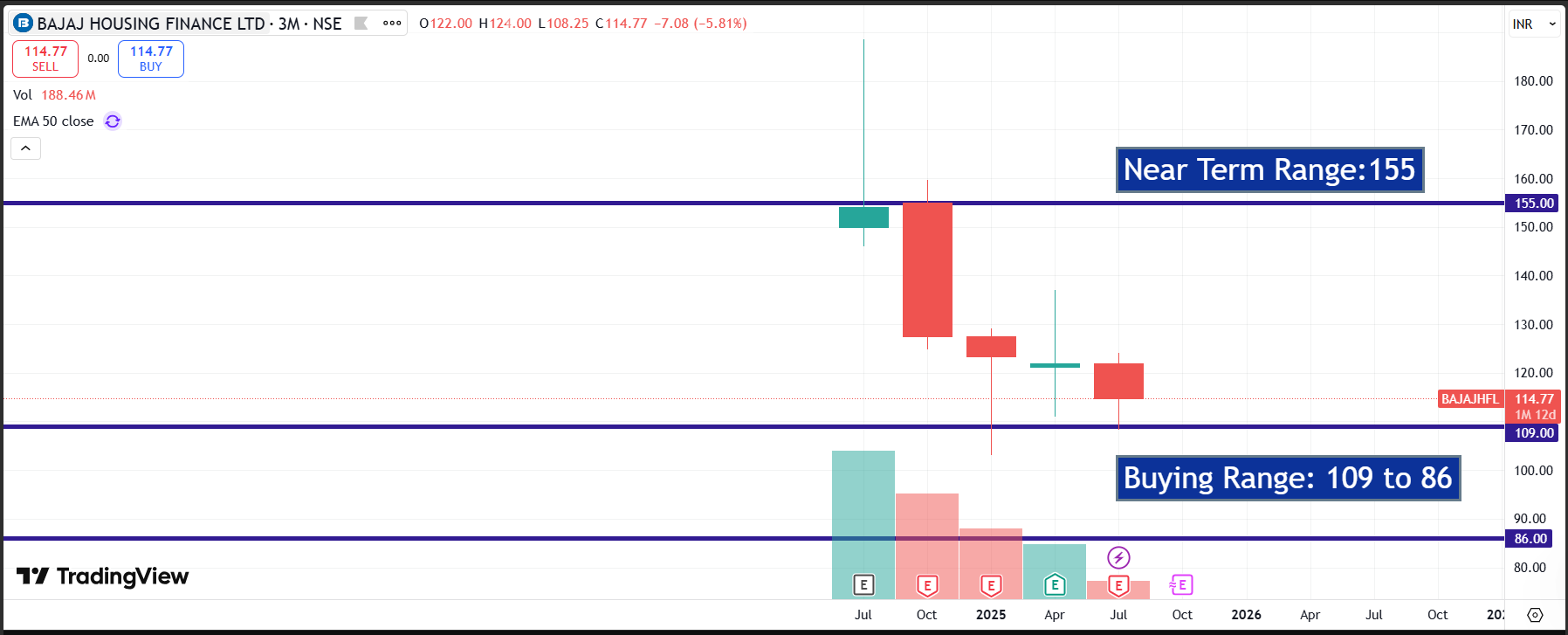

Current Price: ₹115 (IPO range proxy)

Strategic Weight: 2.4% in a long-term diversified portfolio

Tactical Weight: ~1.9% based on current valuations

10. Risks & Rewards

Positives:

✅ High growth trajectory in AUM & profits

✅ Superior margins (22%+) and low NPAs

✅ Strong Bajaj parentage ensures funding advantage

Risks:

⚠️ Short operating history vs. mature peers

⚠️ Sensitivity to RBI rate hikes (funding cost)

⚠️ Real estate downturn risk

Conclusion

Bajaj Housing Finance is a fast-growing, high-quality housing finance company with industry-best asset quality and strong profitability. While still at a relatively small scale compared to HDFC or LIC Housing, its growth trajectory and Bajaj group backing make it a long-term compounder in the housing finance sector.

Disclosure: This is an unbiased educational analysis, not a buy/sell recommendation.