Nestlé India Ltd: Long-Term Investment Outlook 🚀

🏢 Company Overview

Nestlé India Ltd, the Indian arm of global FMCG giant Nestlé S.A., is a market leader in packaged foods with iconic brands like Maggi, Nescafé, KitKat, Milkmaid, Cerelac, and Everyday Dairy. With over 60 years of operations in India, the company enjoys strong brand equity, a wide distribution network, and consistent dividend payouts, making it a core FMCG player in Indian households.

📊 Industry Landscape & Growth Drivers

The Indian FMCG sector is poised for long-term growth, driven by:

Rising disposable incomes in urban and semi-urban India.

Premiumization in packaged foods & beverages.

Health & wellness focus leading to new product launches.

Rural penetration supported by distribution expansion.

Nestlé’s focus on nutrition, convenience, and premium value offerings positions it strongly against peers like HUL, Britannia, ITC Foods, and Tata Consumer.

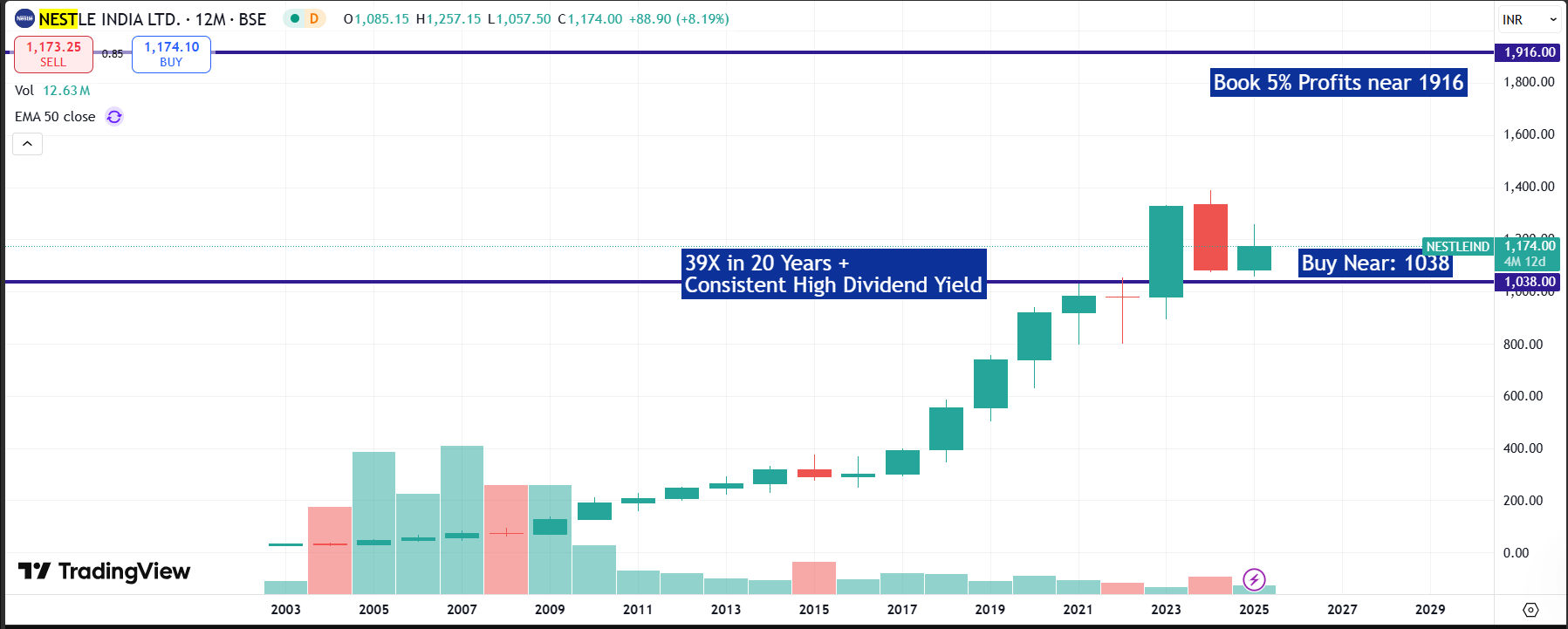

📈 Financial Performance – Historical Growth

➡️ 20-Year CAGR: Sales ~11%, Profit ~12%.

➡️ Margins improved from ~9% (2001) to ~15–16% (latest).

➡️ Despite short-term margin pressure in FY26, Nestlé remains a consistent compounding story.

📌 Valuation History

P/E Range (last 20 years): 18x – 128x

Current (FY26E): 64x – 75x

P/B Range: Historically between 15x – 95x, currently moderating near 50x–59x.

This indicates Nestlé consistently commands premium valuations due to brand leadership and stable cash flows.

🧾 Latest Q1 FY26 Highlights

Revenue: ₹5,074 Cr (↑ 6% YoY)

Net Profit: ₹646 Cr (↓ 13.5% YoY, margin 12.7%)

EPS: ₹6.71 (↓ 13.3%)

Cost pressures: Raw material cost rose 11% YoY, dragging margins.

Segment Mix:

Milk Products & Nutrition: 41%

Prepared Dishes & Cooking Aids (Maggi, etc.): 31%

Confectionery: 16%

Beverages: 12%

⚠️ While sales growth remains steady, profitability dipped due to higher raw material costs.

🔮 Growth Outlook & Estimates

Long-term (FY35): Sales ₹60,132 Cr, Profit ₹8,873 Cr, EPS ₹46.

Fair Value FY26: ₹1,164/share (blended).

Fair Value FY30: ₹1,636/share.

Fair Value FY35: ₹2,567/share.

Expected 8–12% CAGR in sales and profit over the next decade, supported by innovation, premium products, and rural reach.

📊 Peer Comparison (FY25E)

👉 Nestlé commands higher valuations vs peers, justified by strong brands & dividend track record.

⚖️ Long-Term Risks & Rewards

📌 Rewards:

39x stock growth in 20 years 📈.

Strong dividend payout, consistent cash flows.

Premium brands with pricing power.

📌 Risks:

Raw material inflation (milk, wheat, palm oil).

Competition from HUL, ITC, Britannia.

Regulatory risks in packaged food & health categories.

📌 Portfolio Weightage

Based on tactical allocation:

Strategic Weight: 1.1%

Tactical Weight: 0.82%

Nestlé remains a steady compounder, best suited for long-term conservative investors seeking stability + dividends.

✅ Conclusion

Nestlé India exemplifies a compounding FMCG story – with steady sales growth, improving margins, and premium valuations. While near-term profit pressure persists due to input costs, its brand moat, pricing power, and long-term growth runway make it a core portfolio holding.

📌 Disclosure: Profit From It is a SEBI-registered Investment Advisor. This report is for educational purposes and unbiased investor awareness.