Jubilant FoodWorks (JUBLFOOD) Investor Report – FY2026 Outlook & Long-Term Growth

📌 Company Overview

Jubilant FoodWorks Limited (JFL) is India’s leading multi-brand food-tech company, operating iconic QSR brands like Domino’s Pizza, Dunkin’, Hong’s Kitchen, Popeyes, and COFFY. With a strong digital backbone, 37 million loyalty members, and 15 million monthly active users, JFL combines scale with innovation, making it the largest Domino’s franchise outside the U.S.

As of Q1 FY26, JFL operates 3,387 restaurants across 5 countries, including 2,240 Domino’s in India, and continues to expand aggressively.

📈 Industry Overview & Growth Prospects

The Indian QSR industry is poised to grow at 15–17% CAGR (FY25–FY30), led by:

Rising disposable incomes & urbanization.

Higher preference for delivery & takeaway (73% of Domino’s India revenues).

Growth of Tier-2/Tier-3 consumption.

Increasing adoption of digital ordering & loyalty-driven repeats.

Within this, Pizza & Chicken categories are expected to outperform due to high repeat consumption. JFL’s early leadership in digital & delivery positions it strongly vs. peers.

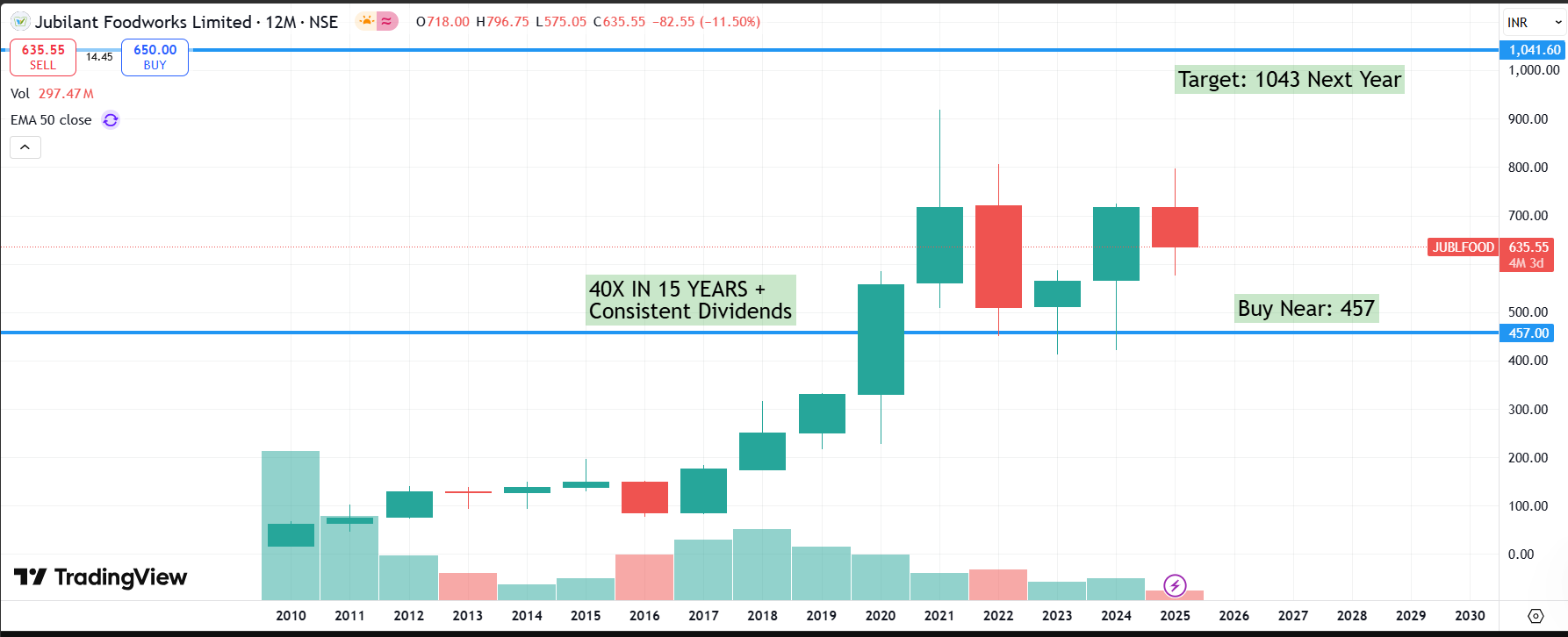

🔄 Historical Growth (2005–2026E)

👉 Over the last 20 years, Sales CAGR = 22%, Profit CAGR = 19%, though margins have fluctuated.

🚀 Q1 FY26 Performance Highlights

Revenue: ₹2,261 Cr (+17% YoY).

PAT: ₹94 Cr (+62% YoY).

EBITDA Margin: 19.4% (-44 bps YoY due to value-led pricing).

Domino’s India LFL Growth: +11.6%, with Delivery LFL at +20.1%.

Digital Strength: MAUs at 15 mn (+21.5% YoY); Loyalty members at 37 mn (+48.6%).

Store Expansion: +71 net additions; Domino’s India now in 484 cities.

International: Turkey & COFFY delivered 9.4% PAT margins despite inflation.

🏢 Segment & Brand Performance

Domino’s India: Core revenue driver; strong order growth (17.3%).

Popeyes: Expanding across South & now West India; double-digit SSG growth.

COFFY (Turkey): 167 cafes, consistent margin improvement.

Dunkin’ & Hong’s Kitchen: Small contributors, strategic for multi-brand positioning.

📊 Profit Margins Trend

Margins peaked at 10–11% in FY11–12, but have trended lower due to competitive intensity, free delivery, and promotional pricing.

FY2022: 9.5%

FY2024: 7.1%

FY2025: 2.7%

Tr. FY26: 3.0%

Management Commentary: Margins are expected to improve through menu re-engineering, supply-chain optimization, and calibrated pricing, though competitive pressures will keep gross margins under check.

🔍 Peer Comparison (QSR India)

👉 JFL commands a premium valuation due to market leadership, digital scale, and strong brand loyalty. Last Year’s low Profits Margin were due to heavy investments in International expansion.

📈 Valuation & Price Ranges

Historical Valuations:

PE Band: 70–230x (last 10 yrs).

PBV Band: 13–31x.

Future Estimates (Investor Model):

⚖️ Long-Term Risks & Rewards

Opportunities

✅ Underpenetrated QSR Market in India.

✅ Strong digital ecosystem & loyalty program driving repeat orders.

✅ Brand leadership in pizza + expansion into chicken & coffee.

✅ Aggressive store expansion in Tier-2/Tier-3 towns.

Risks

⚠️ Margin pressures from pricing wars & inflation.

⚠️ High PE valuation leaves little room for error.

⚠️ Dependence on Domino’s (~85% revenue).

⚠️ International expansions carry execution risks.

🎯 Conclusion

Jubilant FoodWorks is a long-term structural growth story in Indian consumption and QSR space. While margins remain under pressure in the short term, the company’s dominant scale, digital-first model, and multi-brand diversification make it a compelling long-term compounder.

However, at current valuations, investors should balance growth optimism with margin caution. Portfolio allocation should be measured, not momentum-driven, with an eye on EPS & cash flow compounding beyond FY2030.

📌 Disclosure

This report is for educational purposes only and not investment advice. Please do your own research or consult a registered advisor before investing.