🌞 Waaree Energies Ltd: Riding India’s Renewable Energy Wave

1. Company Overview

Founded in 1990, Waaree Energies Ltd. (WAAREE) is India’s leading solar PV module manufacturer with ~15 GW installed module capacity and ~5.4 GW solar cell capacity. The company also has a global presence across 25+ countries, offering modules, EPC, rooftop systems, and utility-scale projects.

Waaree listed in October 2024 via a ₹4,321 Cr IPO. Despite being a new entrant in the markets, it has quickly gained investor attention given its strong financial growth trajectory and leadership in India’s solar manufacturing ecosystem.

2. Industry Outlook 🌍

India aims to reach 500 GW of renewable capacity by 2030, with solar expected to account for more than half.

Government policies such as PLI schemes, ALMM mandates, and safeguard duties favor domestic manufacturers like Waaree.

Global expansion in USA (Texas 1.6 GW module capacity) and India’s Chikhli (3.2 GW) facility expansion position Waaree as a global player.

New diversification into green hydrogen, batteries, and inverters could unlock additional growth vectors.

3. Financial Performance 📊

Revenue & Profit Growth (₹ Cr)

5-Year CAGR: Sales 49% | Profit 114% | Margins expanded from 2–3% to ~14%.

4. Latest Q1 FY26 Results (June 2025)

Revenue: ₹4,597 Cr (+31% YoY)

PAT: ₹773 Cr (+93% YoY)

EBITDA Margin: 25.4% vs 18.3% YoY

Net Profit Margin: 16.8% vs 11.5% YoY

Achieved highest-ever module production at 2.3 GW.

Order book 25 GW (₹49,000 Cr), with a global pipeline of 100+ GW.

5. Segmental Growth ⚡

Modules: 87% of Q1 revenue (₹3,872 Cr, +22% YoY)

EPC: 13% of Q1 revenue (₹589 Cr, +161% YoY)

Power Generation: Stable, minimal contribution

6. Cost Structure Insights

Material cost: 81% of revenue, up 65% YoY.

Inventory adjustments gave temporary margin lift.

Other manufacturing costs +168% YoY.

EBITDA growth outpaced sales, showing operating leverage.

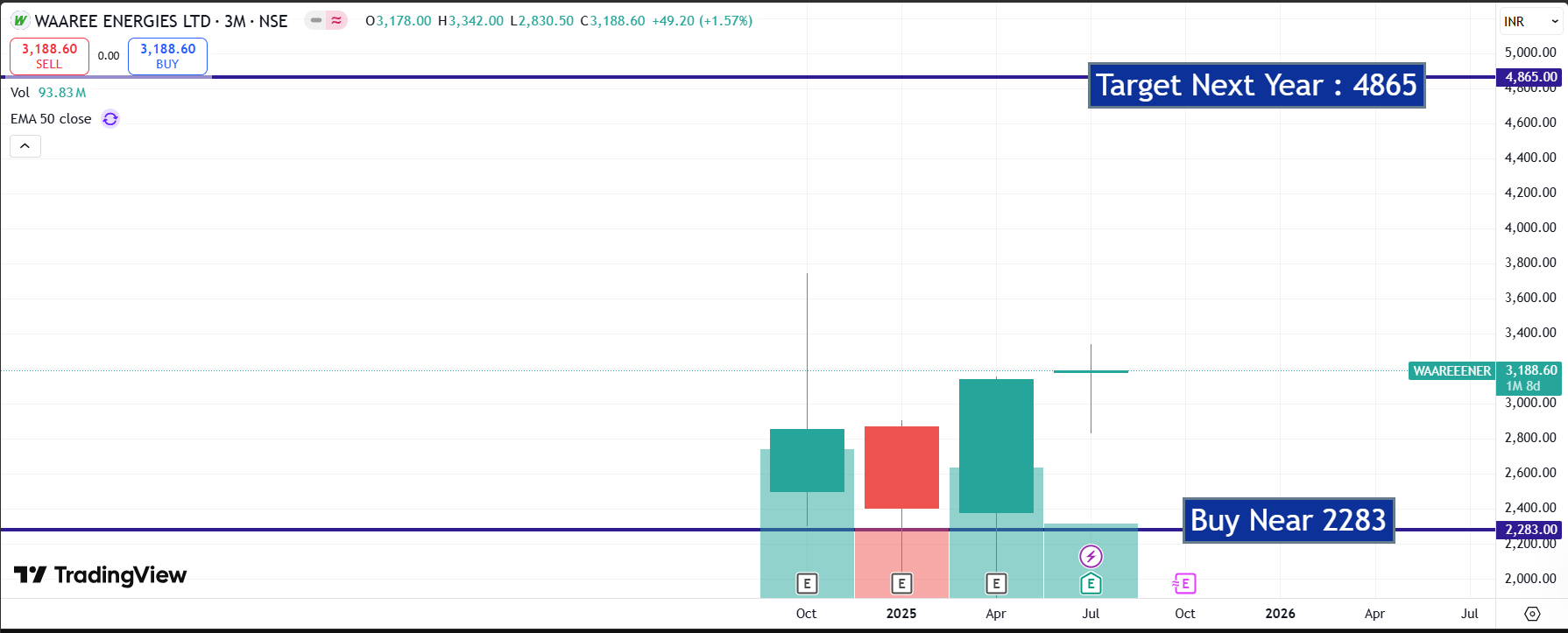

7. Valuation Framework 📈

Since Waaree is newly listed, historical PE/PBV bands are limited. Current observations:

FY25 Band: PE 30–55 | PBV 6–11

FY26 Trailing Band: PE 24–42 | PBV 6–10

👉 For the next 10 years, investors can use:

Low PE: ~25

Fair PE: ~40

High PE: ~55

Low PBV: ~6

Fair PBV: ~9

High PBV: ~12

This framework allows staged allocation—accumulate near low PE/PBV, hold around fair, and book profits near high multiples.

8. Long-Term Estimates (Blended Fair Value)

9. Peer Comparison 🏭

Adani Green: Focused on solar/wind projects (developer model).

Tata Power Solar: Diversified power + solar EPC.

Waaree: Pure-play manufacturing leader with global ambitions.

Competitive edge = scale, backward integration, order book visibility.

10. Investment Outlook 🚀

Positives:

✔ Strong CAGR in revenue & profits

✔ Expanding global manufacturing footprint

✔ Robust order book & demand visibility

✔ Operating leverage driving margins

Risks:

⚠ Raw material dependency (polysilicon prices)

⚠ Execution risks in new capex (Gujarat, Maharashtra, Texas)

⚠ Global competition from Chinese players

📌 Conclusion

Waaree Energies is emerging as India’s solar manufacturing champion, with exponential financial growth, robust margins, and global expansion. Though valuations may appear stretched post-IPO, using the Low–Fair–High PE/PBV framework provides investors with a disciplined approach for entry and profit booking.