📌 Company Overview

ITC Hotels, a part of the ITC Limited conglomerate, is one of India’s largest hotel chains operating under renowned brands such as ITC Hotels, Welcomhotel, Fortune, and Storii. The company focuses on providing luxury, business, and leisure hospitality across major metros and growing Tier-2 and Tier-3 cities.

🌍 Industry Outlook

India’s hospitality sector is witnessing a strong resurgence post-COVID, driven by:

Rising domestic tourism

Business travel rebound

G20 & global events

Increasing penetration of leisure travel in Tier-2/3 cities

Government focus on tourism infrastructure

With projected double-digit growth in the Indian hotel industry over the next decade, companies like ITC Hotels are poised for consistent expansion.

🕰️ Historical Expansion & Financial Performance

🔺 Hotels count is expanding at ~12 per year.

📈 Sales and profit show consistent upward momentum.

📊 Valuation Trends – PE & PBV History

Price-to-Earnings (PE)

Price-to-Book Value (PBV)

These valuation ranges help define historical fair price zones for long-term investors.

📈 Q1 FY26 Performance Snapshot

💼 Hotel additions, stronger room rates, and tight cost control are driving profitability improvements.

🔍 Cost Structure Analysis – Q1 FY26

🔸 Employee and other overheads are key cost drivers but remain well-managed.

📅 FY26 and Long-Term Estimates

📈 The long-term view assumes steady hotel expansion, 20% sales and profit CAGR, and healthy EPS compounding.

💰 Valuation Estimates – Price Ranges

⚠️ Note: These are only valuation reference ranges based on historical PE/PBV.

📦 Portfolio Weightage Consideration

⚖️ Balanced allocation ideal for long-term portfolio due to moderate risk and scalable growth.

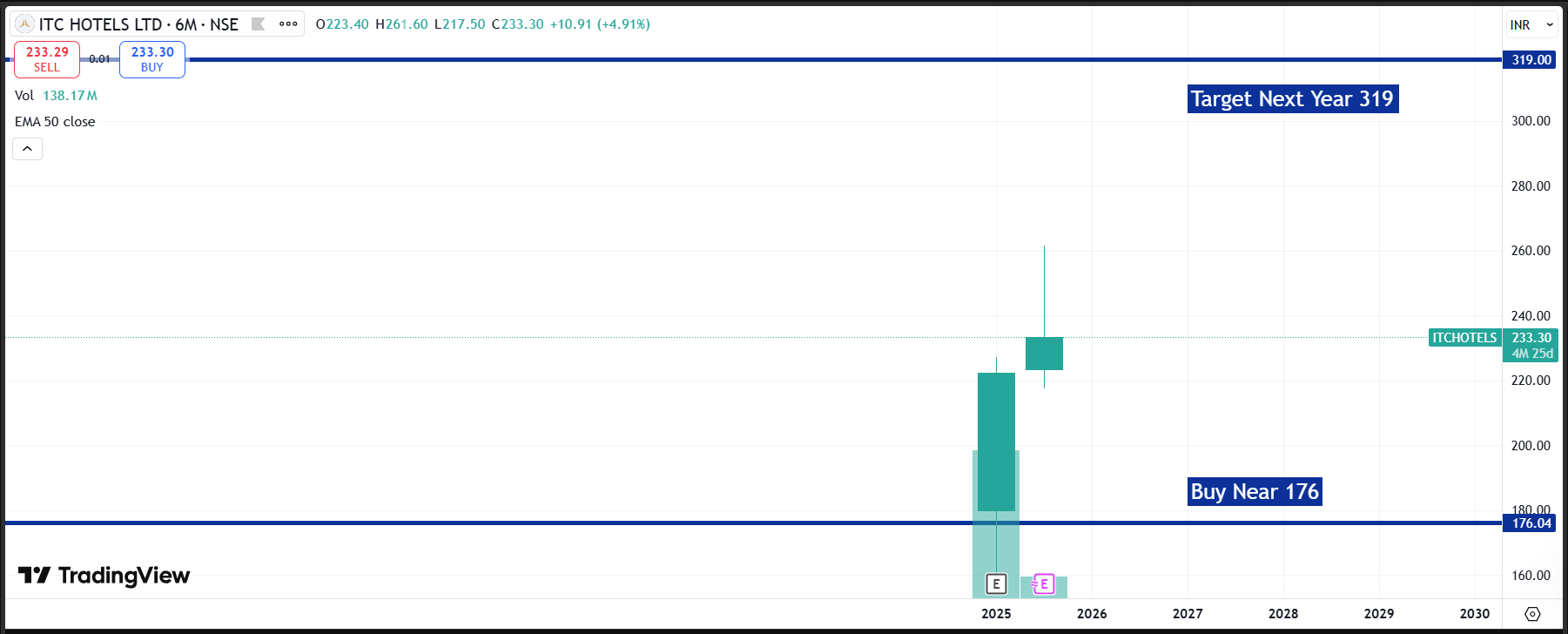

📉 Technical Chart Overview

💡 Currently trading at ₹233, ITC Hotels is in a steady uptrend with rising support zones and improving volume.

✅ Conclusion – Long-Term Risk & Reward

📈 Growth Positives:

Consistent hotel additions

Expanding margins from ~14% to ~20%

Strong ICR and negligible finance cost

India’s booming travel and tourism industry

Long-term brand equity under ITC umbrella

⚠️ Risks to Watch:

High valuations (PE ~60–80x)

Sensitive to economic cycles & travel restrictions

Cost inflation in F&B and manpower

Real estate and capex-intensive model

🎯 Ideal for investors looking at 5–10 year wealth compounding with patience. SIP-style accumulation strategy preferred.

📢 Disclosure

This blog is meant for educational and informational purposes only. All projections are based on publicly available data and reasonable assumptions. This is not a stock recommendation. Investors are advised to perform their own due diligence.