JSW Steel's Q3 FY25 financial performance:

Consolidated Results for Q3 FY25 📊

Crude Steel Production 🏭: JSW Steel achieved its highest ever quarterly production at 7.03 million tonnes, a 2% increase year-over-year (YoY).

Saleable Steel Sales 📈: Reached 6.71 million tonnes, marking a 12% increase YoY.

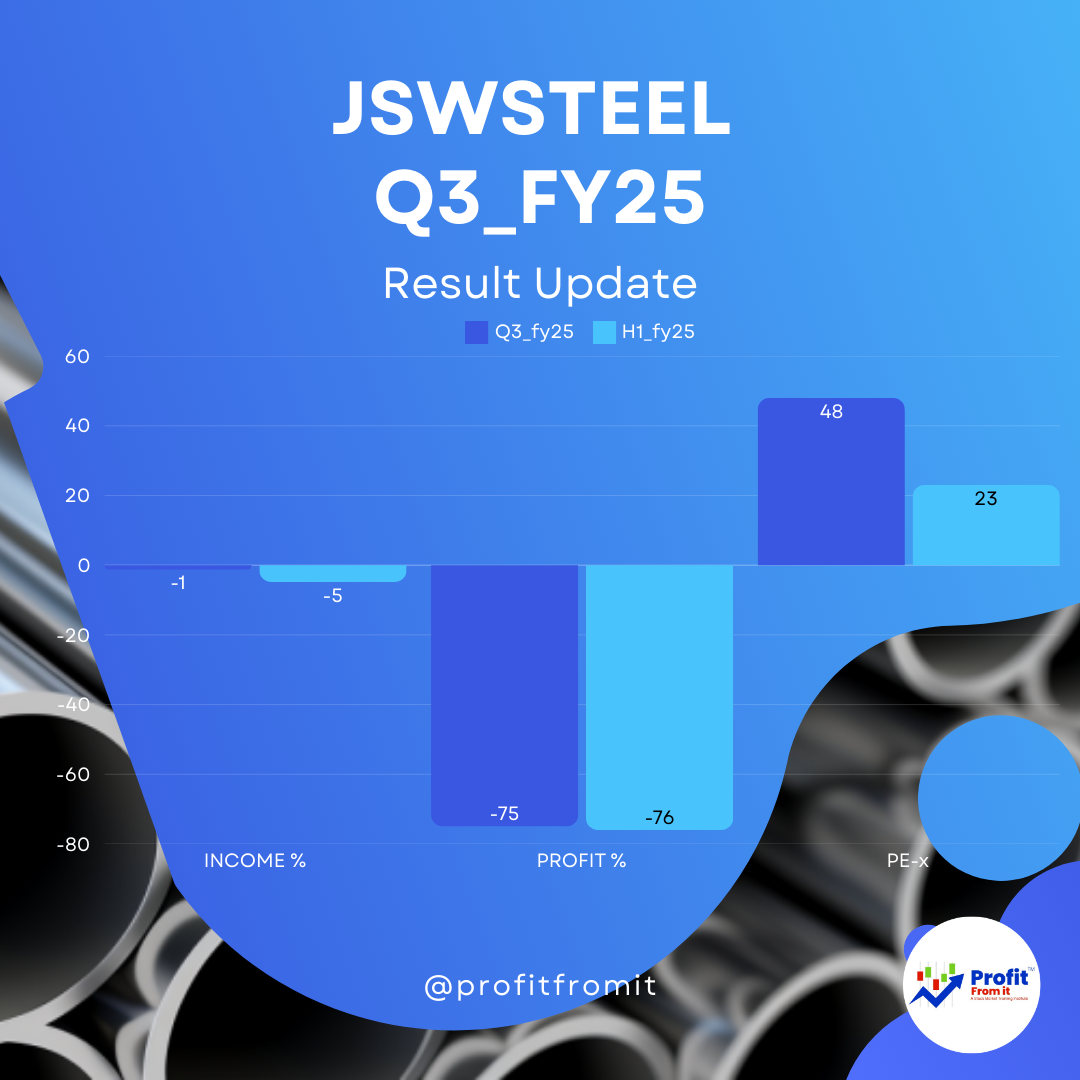

Revenue from Operations 💰: Stood at ₹41,378 crores, slightly below the previous year due to lower sales realization. Decline of 1.34% v.s -4.8% decline during H1_fy25.

Operating EBITDA 💵: Was ₹5,579 crores, down from ₹7,180 crores in the same quarter last year due to increased costs and lower price realizations. This is a decline of -22.3%.

Net Profit 📉: JSW Steel posted a net profit of ₹719 crores, significantly lower than the ₹2,450 crores in Q3 FY24. This is the decline of -75%.

Debt Metrics 🔍: Net Debt to Equity remained stable at 1.00x, and Net Debt to EBITDA was 3.57x, reflecting disciplined financial management despite capital expansions. However this segment is seen with high debt to equity due to large capex.

Segmental and Regional Sales 🌍

Domestic Sales 🇮🇳: Achieved the highest ever quarterly sales in India at 6.542 million tonnes, up 12% YoY, driven by robust demand and expansion efforts.

Export Sales 🌐: Consisted of 0.17 million tonnes from U.S. operations, facing a slight decline due to competitive pressures.

Value-Added Products 🛠️: Accounted for 60% of the sales mix, emphasizing JSW Steel's focus on high-margin products.

Profit Margins and Growth Comparison (Q3 FY25 vs. Q3 FY24) 📉

Profit Margin 💸: Experienced compression due to higher operational costs and lower average selling prices.

Profit Growth 📊: Consolidated profit after tax fell significantly from the previous year, mainly due to the aforementioned challenges and a tough pricing environment globally.

Financial Ratios at Current Market Price (CMP) of ₹932 🔢

Given the market dynamics and JSW Steel's strategic initiatives, financial ratios such as P/E, ROE, and D/E reflect a cautious but stable investment outlook in a volatile steel market.

Near-Term and Long-Term Outlook 🔮

Near-Term ⏳: The company faces headwinds from global economic uncertainties and price volatility. However, domestic demand is expected to remain resilient, supported by government infrastructure spending and robust agricultural output.

Long-Term ⌛: JSW Steel is well-positioned for growth with ongoing capacity expansions and a focus on high-value products. The company's commitment to reducing debt and improving operational efficiencies bodes well for sustainable growth.

Strategic Initiatives 🌱

Digitalization and Innovation 🖥️: Continuing investments in digital technologies to enhance operational efficiency and customer engagement.

Sustainability Goals 🌍: Progressing towards carbon neutrality with initiatives in energy efficiency, waste management, and sustainable mining practices.

Overall, JSW Steel demonstrates a robust operational performance with strategic adjustments to navigate market volatilities and capitalize on long-term growth opportunities in the steel industry.