AU Small Finance Bank Limited's Q3 FY25:

Key Financial Highlights for Q3 FY25 vs Q3 FY24: Improving Financials.

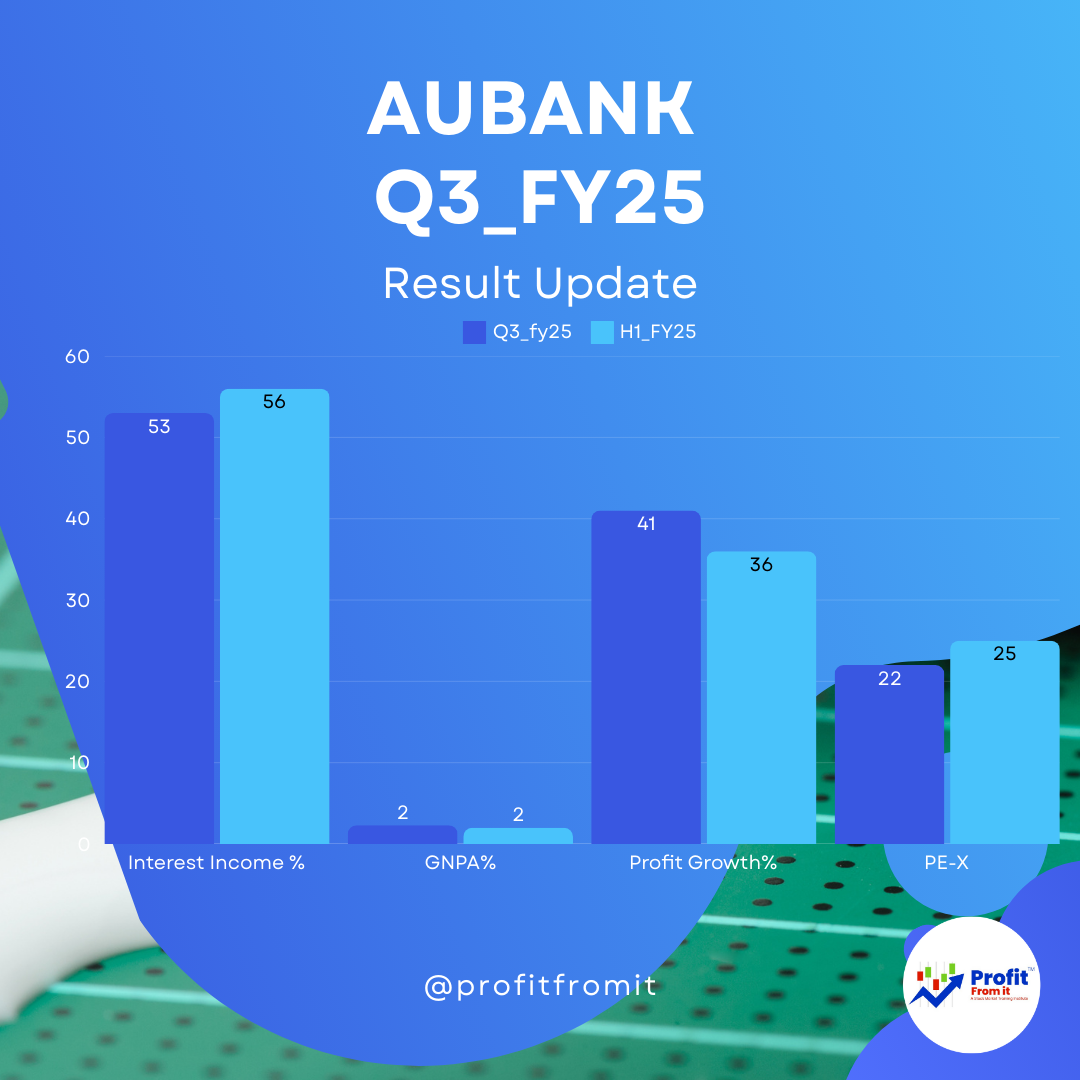

Net Interest Income (NII): 📈 grew by 53% year-over-year (YoY) to ₹2,023 Crore.

Operating Profit (PPoP): 💼 increased by 85% YoY to ₹1,205 Crore.

Profit After Tax (PAT): 🚀 grew by 41% YoY to ₹528 Crore.

Net Interest Margin (NIM): 📊 was at 5.9%, up from 5.5% in Q3 FY24.

Cost to Income Ratio: 🔧 improved, reducing by 886 basis points YoY to 54.4%.

Advances & Deposit Growth: Good Growth.

Total Deposits 💰 grew by 14.9% year-to-date (YTD) to ₹1,12,260 Crore.

Gross Loan Portfolio 📊 stood at ₹1,08,921 Crore, registering a YTD growth of 12.9%.

The Credit to Deposit ratio (CD ratio) 🔗 was at 81%.

Asset Quality: Decreased.

Gross NPA ratio 📉 increased slightly to 2.31% from 1.98% in the previous quarter.

Net NPA ratio 📉 also increased to 0.91% from 0.75%.

Provision Coverage Ratio (PCR) 🛡️ stood at 80%.

Cost and Margins: Increased cost.

Cost of Funds (CoF) 💸 increased slightly by 2 basis points during the quarter to 7.06%.

Return on Assets (RoA) 💹 for Q3 FY25 was at 1.5% and for the nine months ended at 1.6%.

Return on Equity (RoE) 💹 for Q3 FY25 was at 13.0% and for the nine months ended at 13.5%.

Valuation and Outlook:

🏷️ With the share price at ₹594, the valuation ratios indicate strong profitability and growth trajectory. Trail EPS is 27.09 which gives Trail PE at 22. F_EPS assumed at 30.6 and F-PE comes to 19 which is favourable valuations.

🌟 The near-term outlook seems positive with continued focus on managing CoF and operational efficiency.

🌐 In the long-term, the bank's strategic focus on secured loans and integration of services post-merger suggests a robust growth path, although the unsecured segment poses credit risk concerns.

These insights provide a comprehensive overview of AU Bank's current financial health and strategic positioning, aiding investment decision-making for both short-term and long-term perspectives.