📊 Waaree Energies Q3 FY25 and 9M FY25 Performance Analysis 🚀

📈 1. Order Book Growth for Q3 FY25 and 9M FY25

📌 Total Order Book: 26.5 GW

📌 Order Book Value: ~₹ 50,000 Cr

📌 Regional Split:

🇮🇳 India: 46%

🌍 Overseas: 54%.

💰 2. Consolidated Sales Growth for Q3 FY25 and 9M FY25

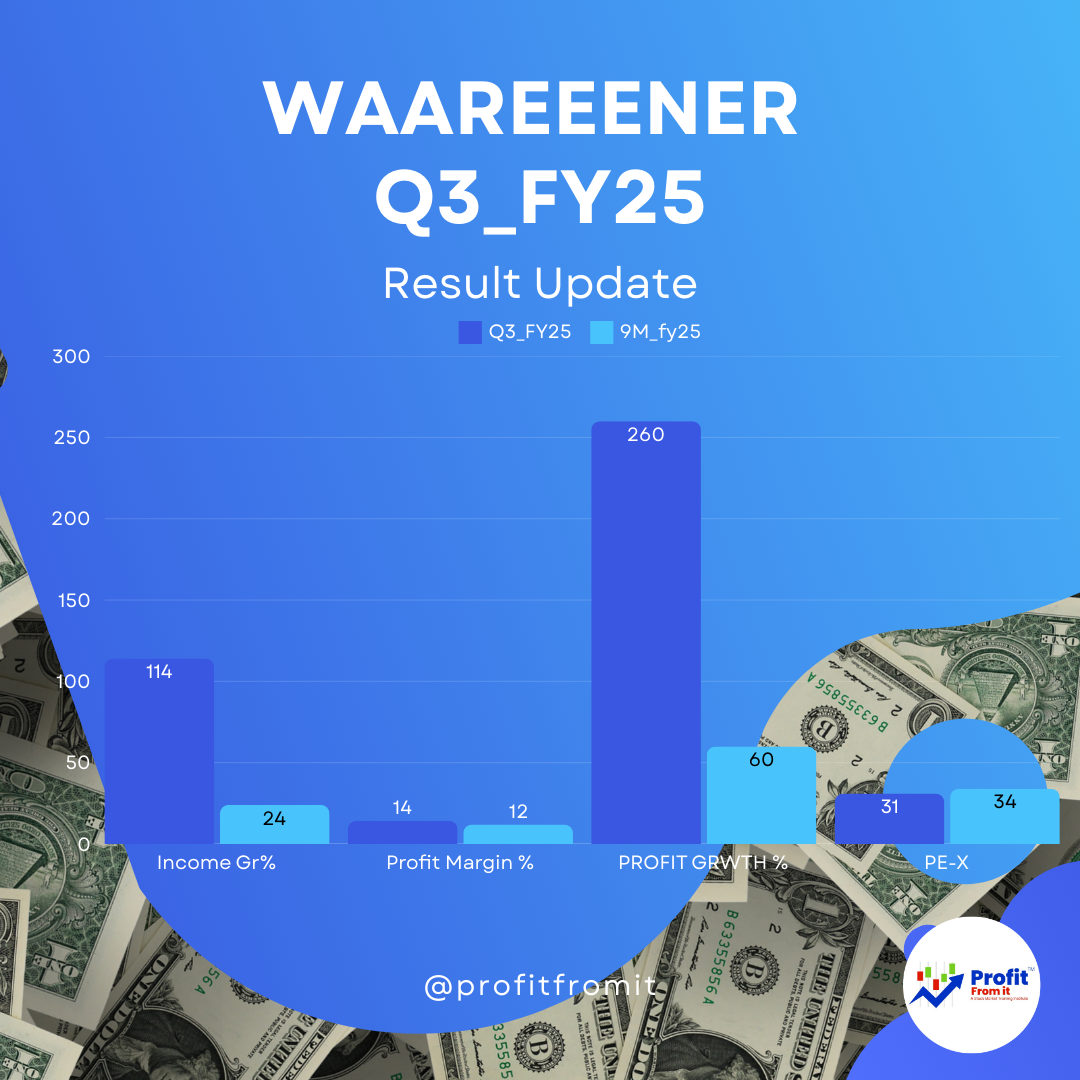

📈 Q3 FY25 Revenue: ₹ 35,452.65 Mn (⬆️ 114.63% YoY)

📈 9M FY25 Revenue: ₹ 107,051.41 Mn (⬆️ 24.11% YoY).

🌍 3. Segmental & Regional Sales Growth

📌 Revenue Mix:

🇮🇳 India: 79%

🌍 Overseas: 21%

📌 Production Volume Growth:⚡ Q3 FY25: 1.81 GW (⬆️ 68% YoY)

⚡ 9M FY25: 5.07 GW (⬆️ 48% from 3.42 GW in 9M FY24).

📊 4. Profit Margins Comparison (Q3 FY25 vs Q3 FY24 & 9M FY25 vs 9M FY24)

📉 EBITDA Margins:

Q3 FY25: 22.84% 🆙 (vs. 13.73% in Q3 FY24)

9M FY25: 19.28% 🆙 (vs. 15.30% in 9M FY24)

💰 PAT Margins:

Q3 FY25: 14.30% 🆙 (vs. 8.52% in Q3 FY24)

9M FY25: 11.99% 🆙 (vs. 9.27% in 9M FY24).

💹 5. Consolidated Profit Growth for Q3 FY25 and 9M FY25

📈 Q3 FY25 PAT: ₹ 5,068.76 Mn (⬆️ 259.98% YoY)

📈 9M FY25 PAT: ₹ 12,836.60 Mn (⬆️ 60.62% YoY).

📊 6. Profitability & Valuation Ratios

📈 Profitability Ratios:

✅ EBITDA Margin: 22.84% (Q3 FY25), 19.28% (9M FY25)

✅ PAT Margin: 14.30% (Q3 FY25), 11.99% (9M FY25)

🏦 Solvency & Liquidity Ratios:

📉 Valuation Ratios at CMP of ₹ 2,191:

💰 Earnings Per Share (EPS):

Q3 FY25:

🔹 Trail Basic EPS: ₹ 64 Gives the Trail PE of 35

🔹 Forward EPS: ₹ 73 Gives the Trail PE of 31

🚀 7. Near-Term & Long-Term Outlook

🔜 Near-Term Outlook:

✔️ Production & Expansion:

⚡ 5.4 GW Solar Cell Plant (Trial production started)

🇺🇸 1.6 GW Solar Module Plant in USA (Commercial production started)

✔️ Acquisition: ✅ Enel Green Power India (₹ 792 Cr) → Adding 640 MW of solar & wind capacity

✔️ PLI Scheme Investments:💰 ₹ 551 Cr for 300 MW Electrolyser plant

🔋 ₹ 2,073 Cr for 3.5 GWh Lithium-Ion battery plant

🏗️ ₹ 650 Cr for Renewable Power Infrastructure

⚙️ ₹ 130 Cr in Inverters business

✔️ Revenue Growth Momentum Expected 🚀.

🔭 Long-Term Outlook:

🌍 Global Expansion:

🇺🇸 USA contributing ~15-20% of revenue

📈 Strengthening presence in high-potential international markets

☀️ Solar & Energy Transition Leadership:🏭 Expanding into solar modules, battery storage, and green hydrogen

📌 Strategic positioning in the global renewable energy transition

📊 Order Book Strength:🔹 26.5 GW (~₹ 50K Cr) provides long-term revenue visibility

📈 Focus on scalability and efficiency in execution.

🎯 Final Summary

✅ Waaree Energies is experiencing exceptional growth across revenue, profitability, and production volumes, while expanding globally.

✅ A strong order book, investments in solar, batteries, and green hydrogen, and strategic acquisitions make it well-positioned for long-term leadership in renewable energy.

✅ The company remains financially strong, with improving profit margins and valuation ratios.

📢 Disclaimer & Disclosure Statement

Important Investor Advisory Notice

This research analysis is for informational purposes only and should not be considered as financial, investment, or legal advice. The information provided herein is based on publicly available financial reports, market data, and our analysis. Investors are advised to exercise caution and discretion before making any investment decisions.