📊 Page Industries Q3 FY25 Analysis & Investment Insights 🏭📈

🔹 1. Volume Growth (Q3 FY25)

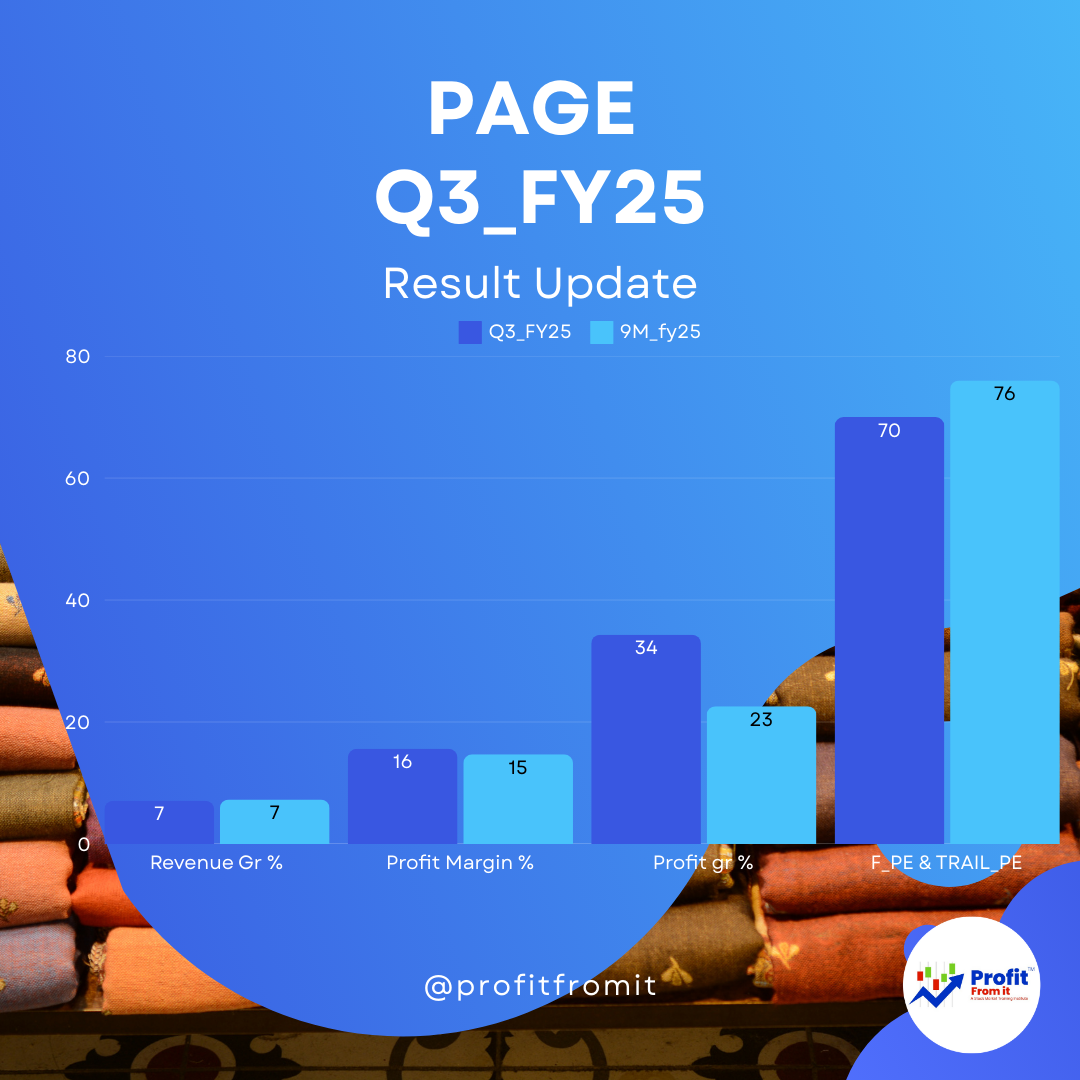

📦 Sales Volume Growth: 4.7% YoY

📊 Total Units Sold: 57.8 million pieces

🔹 2. Sales Growth (Q3 FY25 & 9M FY25)

💰 Revenue Growth:

Q3 FY25 Revenue: ₹13,131 million (+7.1% YoY) 📈

9M FY25 Revenue: ₹38,368 million (+7.3% YoY) 📊

🔹 3. Profit Margins (Q3 FY25 vs Q3 FY24)

💹 Profitability Margins Improved Significantly:

✅ Better cost control & strong revenue helped in margin expansion.

🔹 4. Profit Growth (Q3 FY25 & 9M FY25)

📊 Net Profit (PAT) Growth:

Q3 FY25 PAT: ₹2,047 million (+34.3% YoY) 🚀

9M FY25 PAT: ₹5,651 million (+22.6% YoY) 🚀

🔹 5. Profitability, Solvency, Liquidity & Valuation Ratios 📈💰

👉 3rd Interim Dividend of ₹150 per share, record date 13th Feb 2025, payout by 7th March 2025.

🔹 6. Near-Term & Long-Term Outlook 🔮

📉 Near-Term Challenges

⚠️ Dampened Consumer Demand after festive season.

⚠️ Rising Costs & Competition in premium innerwear & athleisure.

📈 Long-Term Growth Drivers

✅ E-commerce & Modern Retail Expansion 🏪

✅ Product Innovation & Digital Transformation 🌐

✅ Urbanization & Rising Disposable Income fueling apparel demand 👕

📌 Investment Perspective

🔵 Positives ✅

✔ Consistent revenue & profit growth

✔ Strong brand leadership (Jockey & Speedo) 🌟

✔ ROCE of 75% = High capital efficiency

✔ Regular dividends & strong cash flow 💵

🔴 Risks ⚠️

❌ Very high valuation (Trail P/E ~76x) 📊

❌ Short-term demand weakness may affect next few quarters 😟

❌ Intense competition in premium innerwear 🛒

📢 Investor Takeaway:

🔹 Page Industries is a strong long-term play, but high valuation suggests caution.

🔹 Best suited for long-term investors willing to withstand short-term volatility. 🚀📊

🎯 Final Verdict: BUY on Dips 🔽 or HOLD for long-term gains! 🏦🚀

📢 Disclaimer & Disclosure Statement

Important Investor Advisory Notice

This research analysis is for informational purposes only and should not be considered as financial, investment, or legal advice. The information provided herein is based on publicly available financial reports, market data, and our analysis. Investors are advised to exercise caution and discretion before making any investment decisions.