Indian Railway Finance Corporation Limited (IRFC) for Q3 FY25:

Q3 FY25 Financial Highlights:

Revenue from Operations: 💹 Revenue for Q3 FY25 stood at ₹6,764 crore, marking a slight increase of just 0.4% from the previous year's same quarter revenue of ₹6,736.57 crore.

Profit Before Tax: 💰 Profit before tax reached ₹1,630.66 crore in Q3 FY25, a modest rise of 2% from ₹1,598.93 crore in the same quarter the previous year.

Net Profit After Tax: 📈 Remained stable at ₹1,630.66 crore, similar to the profit before tax due to no exceptional items or tax expenses reported.

Earnings Per Share (EPS): 📊 Basic and diluted EPS for the quarter was ₹1.25.

Segmental Growth:

Interest Income: 🏦 Grew to ₹2,010.53 crore in Q3 FY25 from ₹2335 crore in the Q3_FY24 which is decline of -14%.

Lease Income: 🚂 Increased from ₹4,401.73 crore in Q3 FY24 to ₹4,752.90 crore in Q1 FY25 which is 7.97% growth.

Profitability, Liquidity, and Solvency Ratios at CMP of 147:

Debt-Equity Ratio: ⚖️ Stood at 7.81, indicating a high level of debt used in the company’s capital structure.

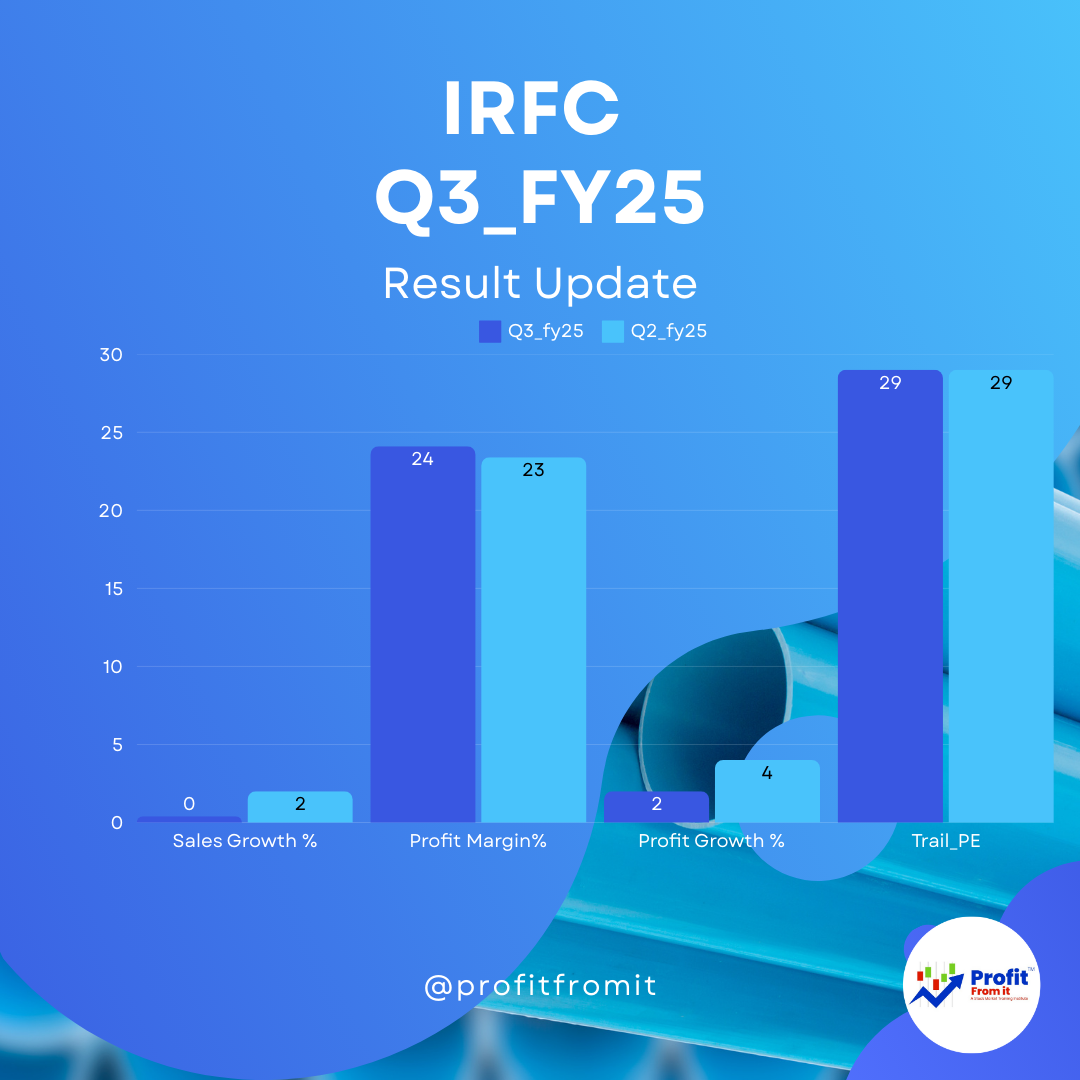

Operating Profit Margin: 📑 Was 24.07% for the quarter.

Net Profit Margin: 📝 Also reported at 24.10%.

Key Performance Indicators (KPIs):

Total Comprehensive Income: 📘 Recorded at ₹1,627.62 crore for the period, indicating the overall profitability from both regular and other activities.

Valuation Ratios:

Price-to-Earnings (P/E) Ratio: 🔍 Based on the closing price of ₹147 and Trail EPS of ₹5.01, the Trail P/E ratio is approximately 29.3, suggesting a higher valuation compared to the muted growth.

Near-Term and Long-Term Growth Estimates:

Near-Term Growth: 🔝 Expected to continue benefiting from increased lease income and stable interest income. The strategic focus on leasing to the Railway sector underpins consistent revenue streams.

Long-Term Growth: 🌟 Supported by the Indian government's continued investment in railway infrastructure, long-term growth is expected to be robust. Strategic expansions in leasing activities and maintaining a strong balance sheet are key to sustained growth.

This analysis provides an overview of IRFC's performance and expectations based on the latest available financial data. For investment decisions, consider this alongside broader market conditions and your investment strategy.

---------------------------------------------------------