Bajaj Housing Finance's latest results for Q3 FY25;

🌟 Key Highlights and Performance Metrics:

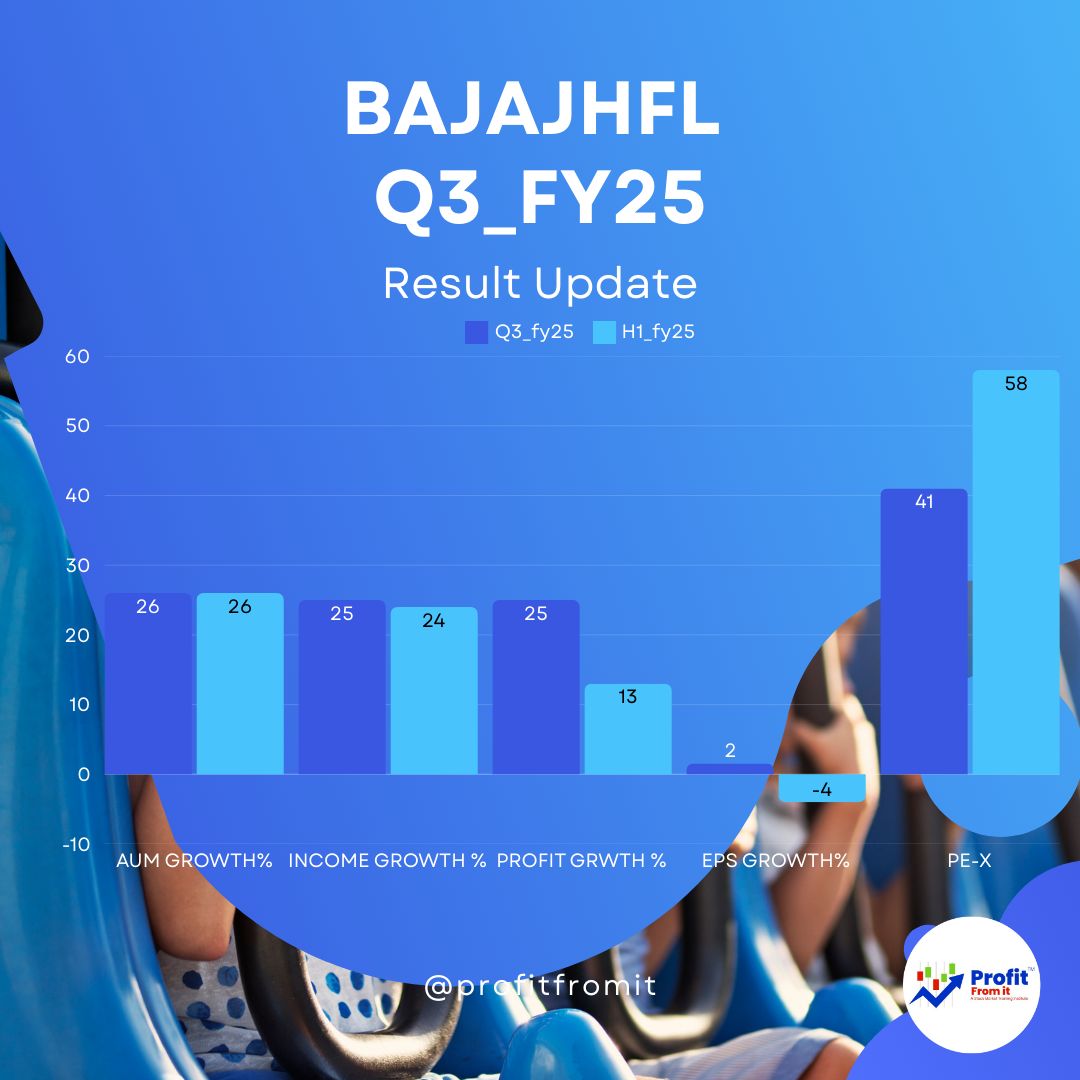

📈 Assets Under Management (AUM) Growth: Inline growth

AUM increased significantly by 26% YoY, reaching ₹1,08,314 crores in Q3 FY25, compared to ₹85,929 crores in Q3 FY24.

💸 Income Growth: Inline growth

Total Revenue from Operations rose by 25%, with interest income increasing from ₹1,845.47 crore in Q3 FY24 to ₹2,321.96 crore in Q3 FY25.

📉 Gross NPA and Net NPA Ratios: Inline NPA’s

Gross NPA was slightly higher at 0.29% in Q3 FY25 compared to 0.25% in Q3 FY24.

Net NPA also increased marginally from 0.10% in Q3 FY24 to 0.13% in Q3 FY25.

💵 Cost of Borrowing: Inline COF

The cost of funds remained steady at 7.9% for Q3 FY25, consistent with Q2 FY25 but up slightly from 7.7% in Q3 FY24.

📊 Profit Margins: Inline PAT

Profit Before Tax (PBT) and Profit After Tax (PAT) both grew by 25% YoY. PBT increased from ₹572 crore in Q3 FY24 to ₹713 crore in Q3 FY25, while PAT increased from ₹437 crore in Q3 FY24 to ₹548 crore in Q3 FY25.

🔑 Important KPIs:

Loan Losses & Provisions increased dramatically to ₹35 crore in Q3 FY25 from just ₹1 crore in Q3 FY24.

Return on Assets (ROA) and Return on Equity (ROE) were 2.4% and 11.5% respectively for Q3 FY25.

💰 Valuation Ratios at CMP of ₹106:

Based on the closing market price (CMP) and the financial performance, key valuation ratios such as Trail EPS would be 2.54 & Trail Price to Earnings ( Trail P/E) would be 41. Adding the Growth for this year F-EPS could reach 3.1 while F_PE should be 34. Valuations are Fair as per current growth and earnings.

📅 Near Term and Long Term Outlook:

🔍 Near Term: The company’s robust growth in AUM and stable cost of borrowing suggest a positive outlook, though increased provisions for loan losses may indicate caution about potential credit risks.

🌱 Long Term: Continued expansion in AUM and strategic focus on maintaining asset quality and improving operational efficiencies suggest a strong foundation for sustained growth. The company’s capital adequacy ratio of 27.86% is well above regulatory requirements, indicating good long-term stability and potential for further business scaling.

This analysis provides a comprehensive view of Bajaj Housing Finance’s financial performance in Q3 FY25, highlighting key areas of strength and potential challenges moving forward.