📊 Kajaria Ceramics Q3 FY25 Analysis 📊

📈 1. Volume Growth

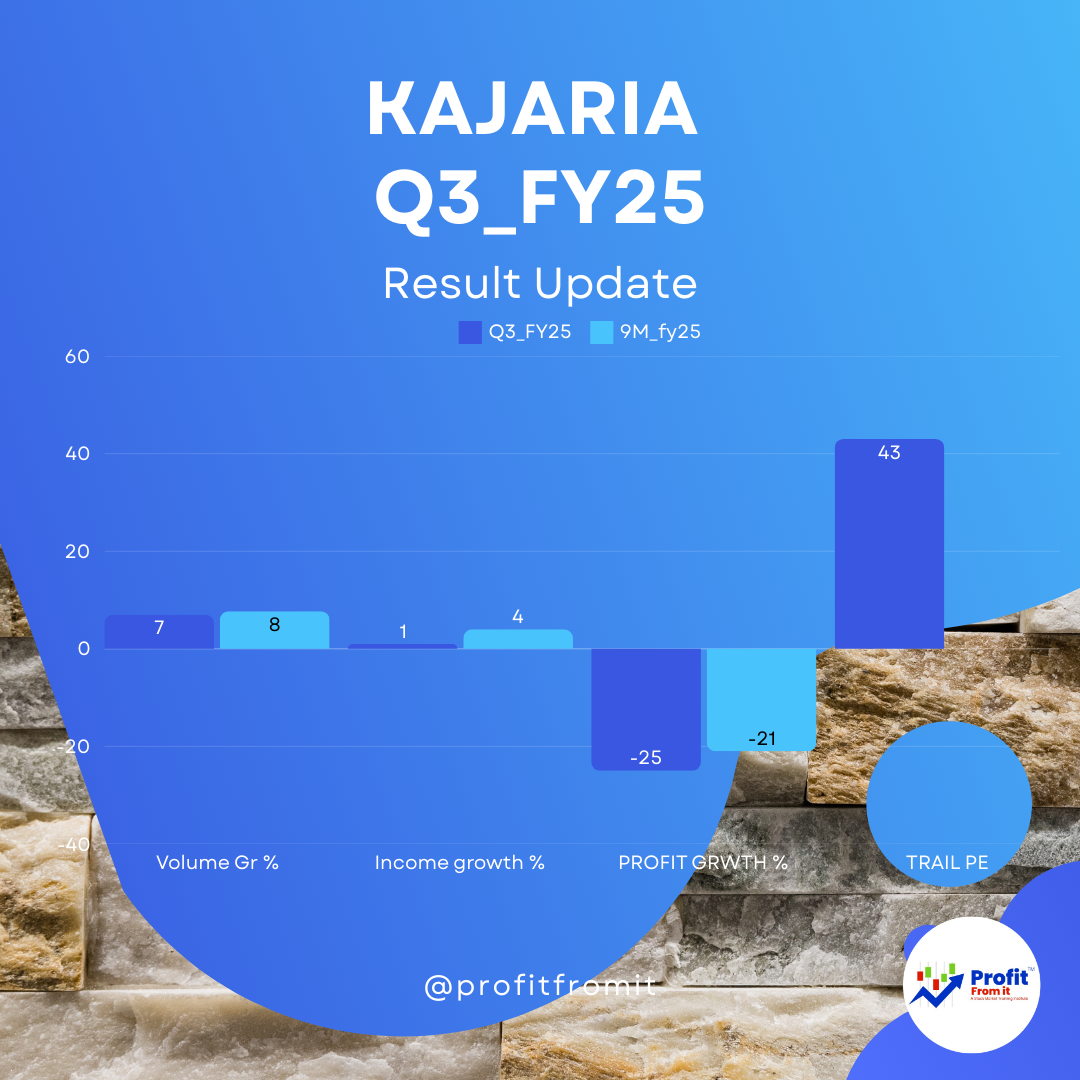

Q3 FY25: 🏭 Tile volumes grew by 7% YoY to 28.90 MSM 📦.

9M FY25: 📦 Tile sales volume increased from 78.56 MSM to 84.58 MSM, reflecting a 7.66% growth YoY 📊.

💰 2. Consolidated Sales Growth

Q3 FY25: 📈 Revenue increased by 1% YoY, from ₹1,151.75 Cr to ₹1,163.71 Cr 🏗️.

9M FY25: 📊 Revenue increased by 4% YoY, from ₹3,337.60 Cr to ₹3,456.67 Cr 💸.

📍 3. Segment-wise & Region-wise Growth

🟢 Tiles (largest segment):

Revenue in Q3 FY25 grew by 3.5% YoY to ₹1,061.11 Cr 🏠.

9M FY25: Tiles revenue increased to ₹3,137.55 Cr (up 4.4% YoY) 🏗️.

🛁 Sanitaryware & Faucets: 🚿 Revenue declined in Q3 due to losses in the new Morbi sanitaryware unit.

🌍 Region-wise: Domestic demand remained soft, while exports remained weak, impacting overall growth 🚢.

📉 4. Profit Margins

Q3 FY25 vs. Q3 FY24:

📉 EBITDA margin declined from 15.52% to 12.78% ⚠️.

🔻 PAT decreased from ₹104.19 Cr to ₹77.74 Cr (-25%) 🚨.

9M FY25 vs. 9M FY24:

📉 EBITDA margin dropped from 15.81% to 13.73% 📊.

🔻 PAT declined from ₹319.67 Cr to ₹251.83 Cr (-21%) 🔥.

💵 5. Consolidated Profit Growth

Q3 FY25: 🔻 PAT fell by 25% YoY, from ₹104.19 Cr to ₹77.74 Cr ⚠️.

9M FY25: 📉 PAT decreased by 21% YoY, from ₹319.67 Cr to ₹251.83 Cr 🛑.

📊 6. Profitability, Solvency, Liquidity & Valuation Ratios

💼 Profitability Ratios:

🏦 ROE (Return on Equity): 12.63% (declined YoY) 📉.

📊 ROCE (Return on Capital Employed): 17.63% 🔄.

⚖️ Solvency Ratios:

💰 Net Debt-to-Equity Ratio: (-0.11x), indicating a strong balance sheet 🏆.

💧 Liquidity Ratios:

⏳ Working Capital Days: 59 days 🏭.

📈 Valuation Ratios (at CMP ₹962):

📊 Trail_EPS (Trailing 12 Months): ₹22.40 🏦.

💰 PE Ratio: 43x (expensive compared to historical averages) 📉.

🔮 7. Near-Term & Long-Term Outlook

⏳ Near-Term:

📉 Demand softness and weak exports continue to impact sales growth 📉.

📉 Pressure on EBITDA margins due to lower realizations and the loss in bathware division 🛁.

🚀 Long-Term:

🏗️ Expansions in Morbi & Rajasthan will support growth.

📈 Tile demand expected to improve, but short-term margin pressure persists.

🏦 Strong liquidity position & low debt provide financial stability 🔄.

📌 Conclusion

✅ Kajaria Ceramics is facing short-term margin pressure but remains fundamentally strong with healthy liquidity and expansion plans.

⚠️ However, the high valuation (P/E of ~43x) makes it relatively expensive at the current market price of ₹962 💸.

📈 Long-term investors may focus on improving demand trends and margin recovery 🔄.