Indian Energy Exchange (IEX) Q3 FY25:

Revenue Growth 📈

Q3 FY25 Revenue: ₹160.5 crores

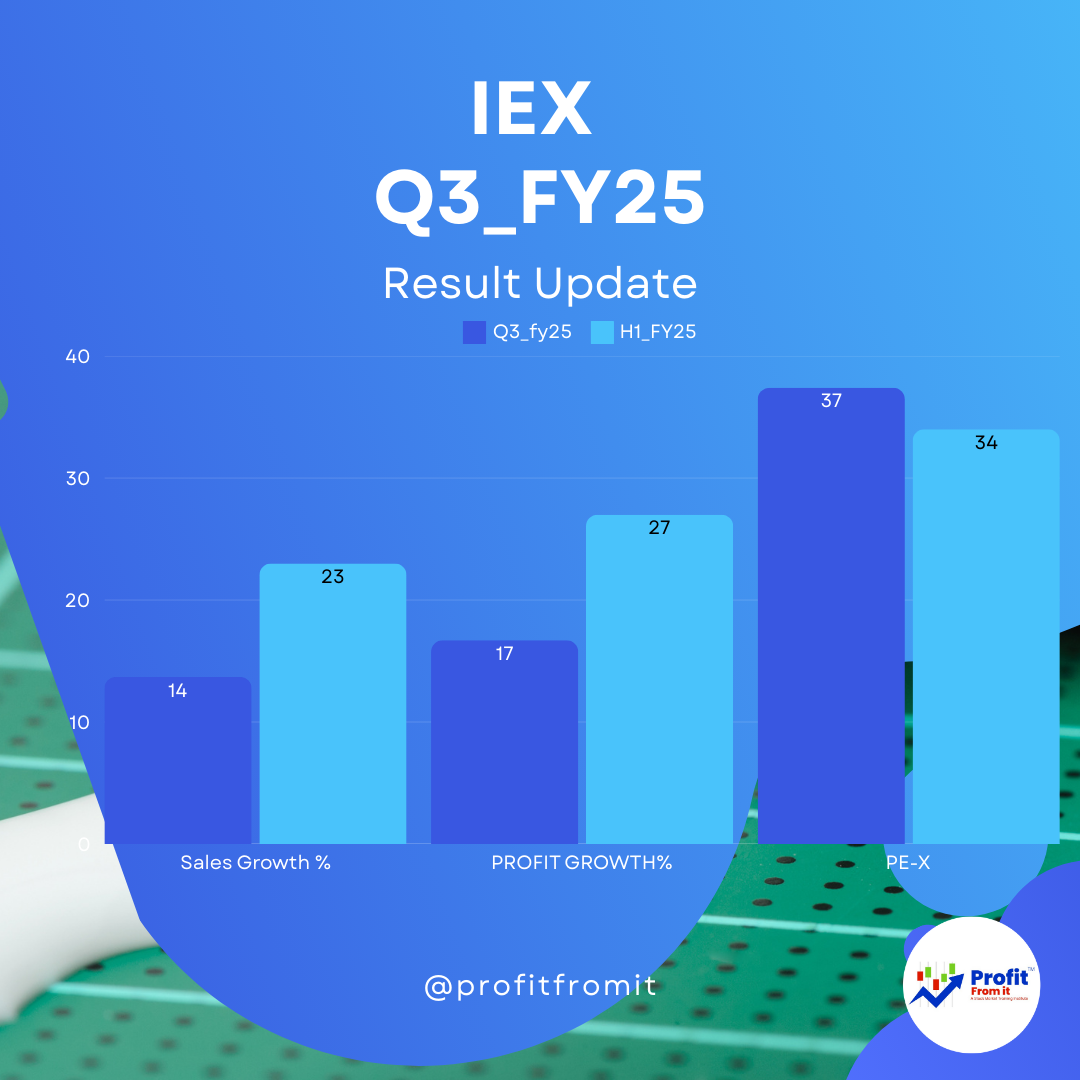

Year-over-Year (YoY) Revenue Growth: 13.7% increase from Q3 FY24 which had a revenue of ₹141.2 crores. 📊

Quarter-over-Quarter Revenue Growth: Compared to Q2 FY25, revenue decreased slightly from ₹167.8 crores, indicating a 4.4% reduction. ⬇️

Segmental Analysis 🌐

Electricity Volume: IEX reported a 15.9% YoY increase in electricity volume, totaling 30.5 BU for Q3 FY25. ⚡

Renewable Energy Certificates (RECs): IEX traded 26.52 lakh RECs in Q3 FY25, reflecting a 31% increase YoY. 🌿

Gas Market: The Indian Gas Exchange (IGX) traded a total volume of 162 lakh MMBtu for Q3 FY25, showing a significant growth of 93% YoY. 🔥

Profit Margins 💰

Profit After Tax (PAT): ₹107.3 crores in Q3 FY25, representing a 16.9% YoY increase from ₹91.8 crores in Q3 FY24.

Quarter-over-Quarter PAT Growth: There's an increase from ₹108.3 crores in Q2 FY25, up by 1.2%. 📉

Profit Margins: PAT margin improved from 64.95% in Q3 FY24 to 66.85% in Q3 FY25, indicating better profitability. 📈

Valuation Ratios 📊

Earnings Per Share (EPS): Increased from ₹1.00 in Q3 FY24 to ₹1.21 in Q3 FY25 taking the trail EPS to 4.6, Trail PE is 37.4. 📈

Key Performance Indicators (KPIs) and Industry Outlook 🔑

Market Share: IEX maintains an 85% market share in the electricity exchange market as of 9M FY25. 🏆

Capacity and Growth: Investing in renewable and gas exchange markets, aligning with national energy transition goals. 🌍

Long-Term Outlook: Positive, with expansions into renewable certificates and energy efficiency projects. 🌱

Near-Term and Long-Term Outlook 🔮

Near-Term: Focus on expanding renewable energy capacities and transitioning towards green energy provides a favorable outlook. 📈

Long-Term: Strategic initiatives like new market models and diversification into the gas market position IEX well for sustained growth. 🚀

Overall, IEX shows robust financial health and growth prospects, particularly with the focus on renewables and energy certificates, aligned with national goals for clean energy.