InfoEdge Q3FY25 Analysis:

🚀 InfoEdge Q3FY25 Results Analysis & Insights 📊

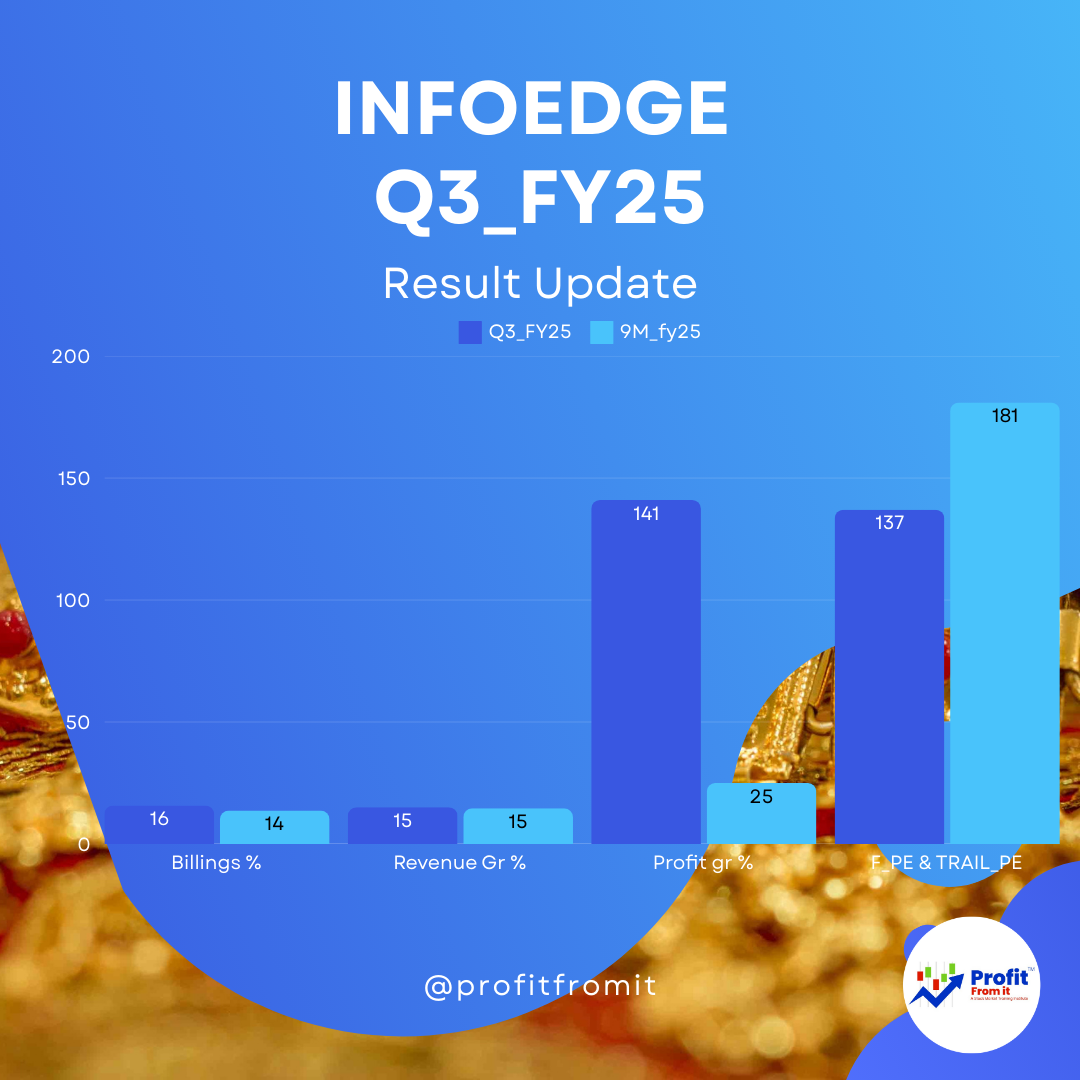

🔥 1. Billing Growth (Q3FY25)

📈 Billing for Q3FY25: ₹668 Cr (+15.8% YoY) 📊 Billing for 9MFY25: ₹1,898 Cr (+13.7% YoY)

✅ Growth Driver: Strong momentum in Recruitment & Real Estate 📂🏡

📊 2. Consolidated Revenue Growth (Q3FY25 & 9MFY25)

💰 Q3FY25 Revenue: ₹722 Cr (+15.1% YoY) 💰 9MFY25 Revenue: ₹2,055 Cr (+14.6% YoY)

🔹 Key Contributors: Recruitment 🏢 | Real Estate 🏡 | Matrimony 💑 | Education 🎓

📌 3. Segmental Growth & Market Share

📝 Recruitment (Naukri.com)

💰 Q3FY25 Billings: ₹494 Cr (+15.2% YoY) 📊 Q3FY25 Revenue: ₹505 Cr (+12% YoY) 📈 Operating Profit Margin: 58.9% (vs. 57.6% in Q3FY24)

🚀 Growth Driver: IT, BFSI, Healthcare, Infra Hiring Surge

🏡 99Acres (Real Estate)

💰 Q3FY25 Billings: ₹103 Cr (+16% YoY) 📊 Q3FY25 Revenue: ₹104 Cr (+14.5% YoY) 🟢 Operating Losses Down by 67%

🏗 Increased Developer & Broker Engagement

💑 Jeevansathi (Matrimony)

💰 Q3FY25 Billings: ₹28 Cr (+36% YoY) 📊 Q3FY25 Revenue: ₹27 Cr (+30.3% YoY) 💵 Cash Losses Down by 89% YoY 🚀

🎓 Shiksha (Education)

💰 Q3FY25 Billings: ₹44 Cr (+12% YoY) 📊 Q3FY25 Revenue: ₹35 Cr (+3.3% YoY)

🎯 Focus on Study-Abroad Expansion & Higher Student Engagement

💰 4. Strategic & Financial Investments

📈 Strategic Investments

📊 ₹367 Cr invested in: 🔹 Zwayam Digital (100%) 🏢

🔹 Aisle Network (94.38%) 💑

🔹 Sunrise Mentors (Coding Ninjas - 54.64%) 🎓

💹 Financial Investments

✅ Listed Holdings: 📊 Zomato (12.43%) - ₹722.3 Cr 🍽

📊 PB Fintech (12.52%) - ₹635.2 Cr 💰

📈 Private Investments in 21 Startups (Consumer Tech, AI, Deep-Tech)

📊 5. Profit Margin Comparison

📈 Q3FY25 Operating Margin: 39.2% (vs. 36.7% in Q3FY24)

📈 9MFY25 Operating Margin: 37.7% (vs. 36.5% in 9MFY24)

🟢 Cost Optimization & Higher Realization per Client = Improved Profitability

📈 Q3FY25 Consolidated Profit Growth

🔹 Revenue from Operations: ₹722 Cr (vs ₹627 Cr in Q3FY24) 📈 +15.1% YoY

🔹 Profit Before Tax (Excluding Exceptional Items): ₹417 Cr (vs ₹185 Cr in Q3FY24) 🚀 +125.4% YoY

🔹 Total Comprehensive Income: ₹3,182 Cr (vs ₹2,624 Cr in Q3FY24) 📈 +21.2% YoY

✅ Key Drivers: ✔ Recruitment business (Naukri) momentum - Hiring activity in BFSI, Healthcare, Infrastructure, and IT sector

✔ Operational cost optimization - Better digital marketing & ad spend efficiency

✔ Real estate (99Acres) & Matrimony (Jeevansathi) showing revenue recovery

📊 9MFY25 Consolidated Profit Growth

🔹 Revenue from Operations: ₹2,055 Cr (vs ₹1,793 Cr in 9MFY24) 📈 +14.6% YoY

🔹 Profit Before Tax (Excluding Exceptional Items): ₹1,073 Cr (vs ₹682 Cr in 9MFY24) 🚀 +57.3% YoY

🔹 Total Comprehensive Income: ₹9,525 Cr (vs ₹7,856 Cr in 9MFY24) 📈 +21.2% YoY

✅ Key Growth Areas: ✔ Higher customer adoption in Naukri & 99Acres platforms

✔ Improved monetization in Jeevansathi & Shiksha

✔ Strategic cost reduction leading to better margins

📌 Profitability Outlook:

With continued expansion in core segments and investments in high-growth verticals, InfoEdge is expected to maintain a strong double-digit profit growth trajectory in the coming quarters.

📍 6. Industry Key Performance Indicators (KPIs)

✅ 📄 Recruitment (Naukri.com) 📂 104M+ Resumes 🧑💼

📊 19.5K New Resumes/Day

📈 Growing Engagement in JobHai & AmbitionBox 🚀

✅ 🏡 Real Estate (99Acres) 📊 828K+ Active Listings

🚀 +9% Growth in New Projects

✅ 💑 Matrimony (Jeevansathi) 📊 +90% Growth in App Engagement 📱

✅ 🎓 Education (Shiksha) 📊 5.24 Lakh Course Listings | 9M+ Visits Annually

💸 7. Financial Ratios at CMP ₹7,863

📈 Profitability Ratios ✔ Operating Profit Margin (Q3FY25): 39.2%

✔ Net Profit Margin: Improving YoY 📊

💰 Liquidity Ratios ✔ Cash Balance (Standalone, Dec 31, 2024): ₹4,290 Cr

✔ Cash from Operations (Q3FY25): ₹346 Cr (+26.9% YoY)

🛡 Solvency Ratios ✔ Debt-Free Company = Strong Financial Health 🟢

📊 Valuation at CMP ₹7,863: Trail_EPS: 43.26

✔ Trail P/E Ratio: 182x (Premium Growth Stock) 🚀

🔮 8. Near-term & Long-term Outlook

📆 Near-Term (1 Year)

✅ Recruitment & Real Estate to Drive Growth

✅ Higher Profitability via Cost Control

✅ Investment Monetization (Zomato, PB Fintech)

✅ Valuations high (182X PE)

⚠ Risk: Global Slowdown & IT Hiring Pressure

🚀 Long-Term (3-5 Years)

✅ Market Leader in Digital Recruitment 🏆

✅ Expanding Monetization in New Verticals

✅ Tech & AI Investments Boosting Future Growth

⚠ Challenge: Competition in Real Estate & Matrimony 📉

📌 Stock Split Announcement

📆 Date Approved: February 5, 2025

📢 Board Approval: The board has approved a stock split to enhance liquidity and make shares more affordable.

🔹 Existing Face Value: ₹10 per share

🔹 New Face Value: ₹2 per share (Split in 5:1 ratio)

🗓 Record Date: To be announced post shareholder approval

⚡ Impact: More affordable shares, increased retail participation.

🔄 Scheme of Amalgamation & Restructuring

📌 Companies Involved in Amalgamation:

✅ Info Edge (India) Limited (Transferee)

✅ Axilly Labs Pvt. Ltd.

✅ Diphda Internet Services Ltd.

✅ Zwayam Digital Pvt. Ltd.

✅ Allcheckdeals India Pvt. Ltd. (Recently included)

📢 Objective of the Merger:

🔹 Simplification of Corporate Structure 🏢

🔹 Reduction of Administrative & Compliance Costs 📉

🔹 Pooling of Financial & Operational Resources 💰

🔹 Enhanced Cash Flow Management 💵

🔹 Greater Management Focus on Core Business Growth 📈

📍 Status: The scheme is subject to approval from NCLT, SEBI, Stock Exchanges, and Shareholders.

📢 Key Takeaways

✅ InfoEdge posts strong revenue & profit growth in Q3FY25 🚀

✅ Recruitment & Real Estate continue to lead 📈

✅ Higher engagement in Matrimony & Education platforms 📊

✅ Valuations remain high at CMP ₹7,863 – A long-term digital play!

📍 Follow for more financial insights & stock updates! 🔔

🔗 #StockMarket #Investing #InfoEdge #EarningsUpdate #BusinessGrowth

📢 Disclaimer & Disclosure Statement

Important Investor Advisory Notice

This research analysis is for informational purposes only and should not be considered as financial, investment, or legal advice. The information provided herein is based on publicly available financial reports, market data, and our analysis. Investors are advised to exercise caution and discretion before making any investment decisions.