HDFC Life Q3 FY25 Analysis 📊

Strong Growth in APE: HDFC Life reported a robust 24% growth in individual Annualized Premium Equivalent (APE), indicating strong sales performance, particularly in retail protection, where APE saw a growth of 28%.

Improved Market Share: The company increased its overall market share by 70 basis points to 10.8%, with the private sector market share reaching 15.3%.

Solvency and Persistency: The Solvency Ratio remained robust at 188%, comfortably above the regulatory requirement. The persistency ratios for the 13th and 61st months showed significant improvements, which indicates effective customer retention and policy renewal strategies.

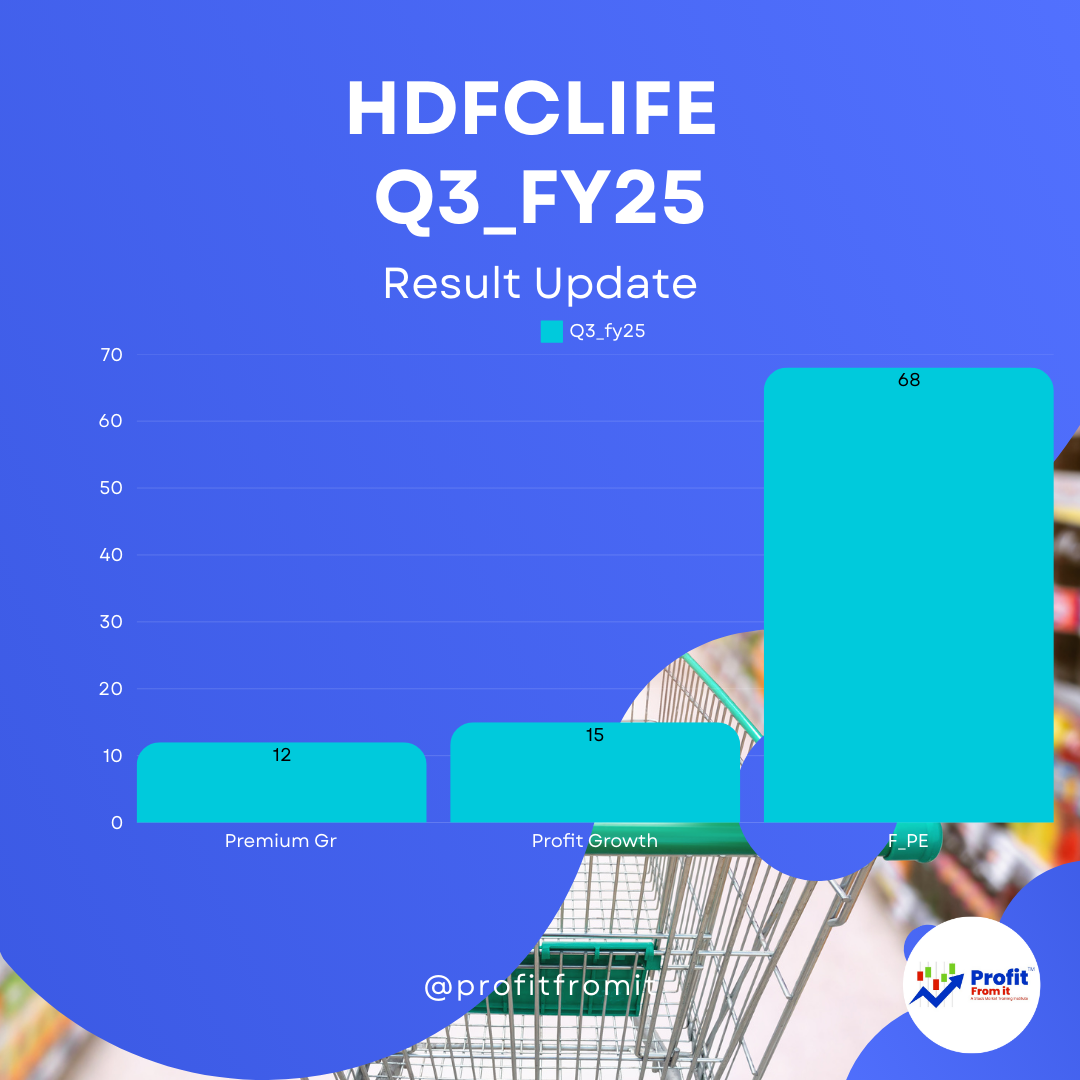

Profitability: Profit After Tax (PAT) rose by 15% year-on-year, supported by an 18% increase in back book profit emergence.

Premium Income Growth:

First Year Premium: ₹296.9 crore for the quarter ended December 2024, compared to ₹267.9 crore for the same period in 2023, reflecting a growth that supports the increase in APE.

Renewal Premium: Increased to ₹937.6 crore for the quarter, up from ₹839.6 crore in the previous year, demonstrating strong retention and ongoing policyholder commitment.

Profit Growth and Margins:

PAT for Q3 FY25: Reached ₹1,326 crore, marking a 15% growth from the previous year, largely driven by higher premium income and efficient capital management.

Profit Margins: The margins have been solid, with New Business Margins at 25.1%, although slightly down from 26.5% in the previous year, possibly due to shifts in product mix or market conditions.

Important KPIs and Ratios for the Life Insurance Industry:

Persistency Ratio: 87% for the 13th month and 61% for the 61st month, reflecting high levels of customer retention over the short and medium term.

Solvency Ratio: Maintained well above the regulatory requirement, indicating strong financial health and risk management.

Expenses of Management Ratio: At 20.2%, which is within industry norms, showing controlled operational expenses relative to premiums.

Other Important Ratios:

Annualized Premium Equivalent (APE): Shows growth and is a critical measure of new business acquisition efficiency.

Value of New Business (VNB): Increased by 14%, indicating profitable new business capture and good control over acquisition costs.

Outlook (Short and Long Term):

Short-Term: The company appears well-positioned to capitalize on market opportunities with strong growth in APE and improvements in profitability metrics. Ongoing investments in technology and distribution are likely to support operational efficiency and customer acquisition.

Long-Term: With a strong base in profitable growth segments and a sustained focus on expanding market share and distribution networks, HDFC Life is likely to maintain a leading position in the industry. The consistent focus on long-term value creation for stakeholders and robust financial health supports a positive long-term outlook.

The stock's current price (₹694) at Trail_EPS of 8.12 & F_EPS of 8.7 give the Trail PE of 78 & F_PE of 68. This suggests a market response to these ongoing growth and profitability trends, with expectations of sustained performance based on fundamental health and industry positioning.