Indigo Airlines' performance for Q3 FY25:

Overview:

🚀 Q3 FY25 Key Changes: Indigo Airlines experienced significant growth across various metrics, including an increase in ASKs (Available Seat Kilometers), RPKs (Revenue Passenger Kilometers), and the number of aircraft and destinations.

Key Financial Highlights:

✈️ ASK and RPK Growth:

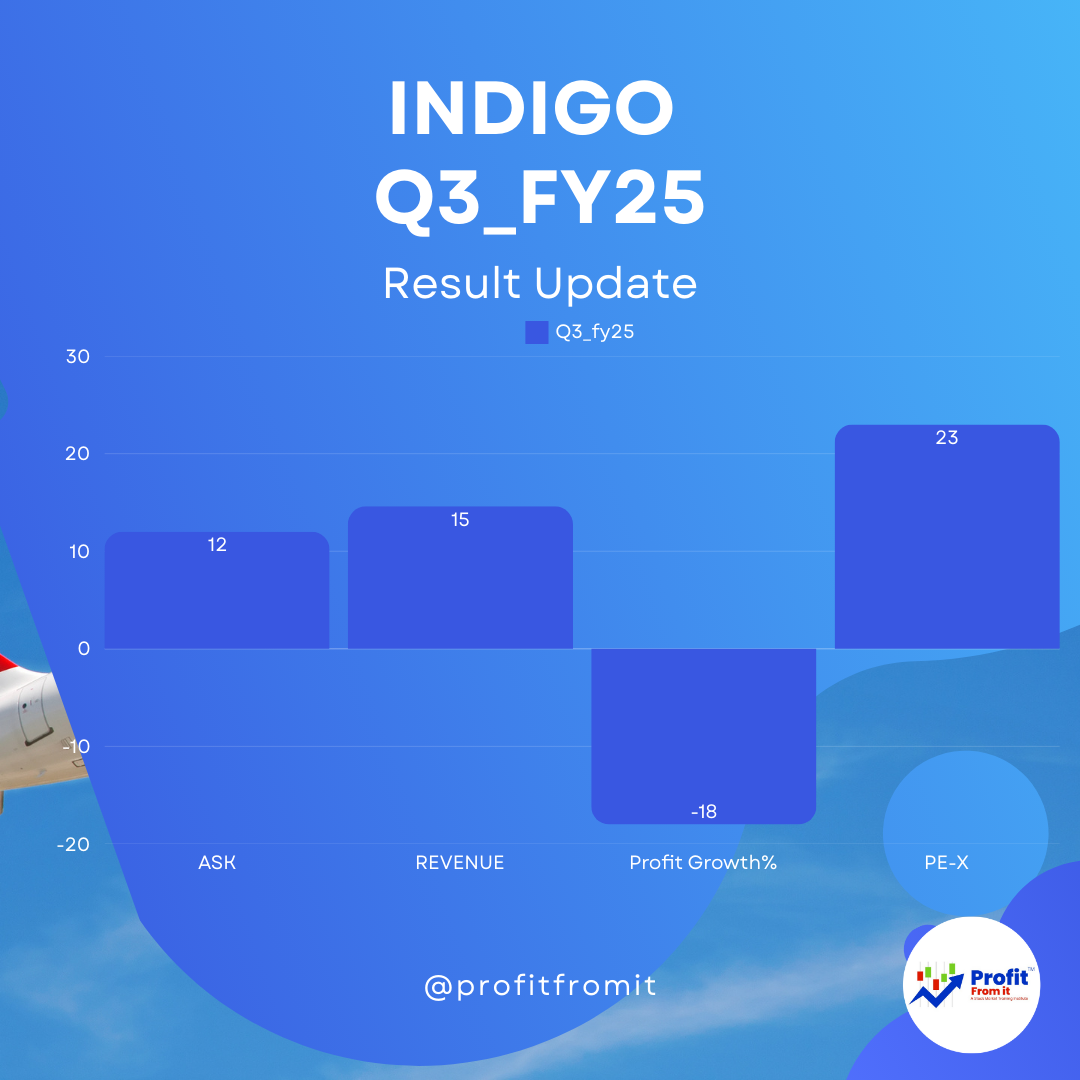

ASKs increased by 12% year-over-year to 40.8 billion.

RPKs grew by 13.5% to 35.5 billion.

This growth indicates effective capacity management and robust demand 📈.

💰 Revenue and Profitability:

Consolidated revenue grew by 14.6% to ₹229,928 million.

Profit after tax (PAT) saw a decrease of 18.3%, amounting to ₹24,488 million, down from ₹29,981 million in Q3 FY24.

PAT margin contracted from 15.4% in Q3 FY24 to 11.1% in Q3 FY25 📉.

📊 Profit Margins:

EBITDAR margin decreased slightly from 28.1% to 27.4%.

🔧 Cost Analysis:

Total expenses were up 19.9%, primarily driven by increases in aircraft and engine rentals, airport fees, and a significant forex loss.

CASK rose by 6.8% to 4.83 INR, impacted by rising operational costs.

💧 Liquidity and Solvency:

Free cash increased significantly by 50.5% to ₹289,035 million.

Total debt rose by 27.3% to ₹651,385 million, reflecting higher capitalized operating lease liabilities.

At Trail EPS of 157.6 the Trail PE comes 23.

Key Performance Indicators (KPIs) for Airline Industry:

📊 Load Factor: Improved by 1.2 points to 86.9%, indicating efficient utilization of increased capacity.

💵 Yield: Slightly decreased to 5.43 INR from 5.48 INR.

📈 RASK: Increased by 1.9% to 5.44 INR, showing enhanced revenue efficiency.

Outlook:

🔍 Near-Term: Challenges remain in terms of cost management, especially with increased lease expenses and forex volatility. The recovery in travel demand continues to support revenue growth.

🌐 Long-Term: Strategic expansion in international routes and modernization of the fleet with more fuel-efficient aircraft can improve profitability and sustainability. Managing operational costs and navigating geopolitical and economic uncertainties will be crucial.

This analysis highlights Indigo's operational success in expanding its network and capacity, despite facing headwinds in profitability due to higher costs and forex impacts. 🌟