HDFC Asset Management Company's financial results for Q3 FY25:

Q3 FY25 Performance:

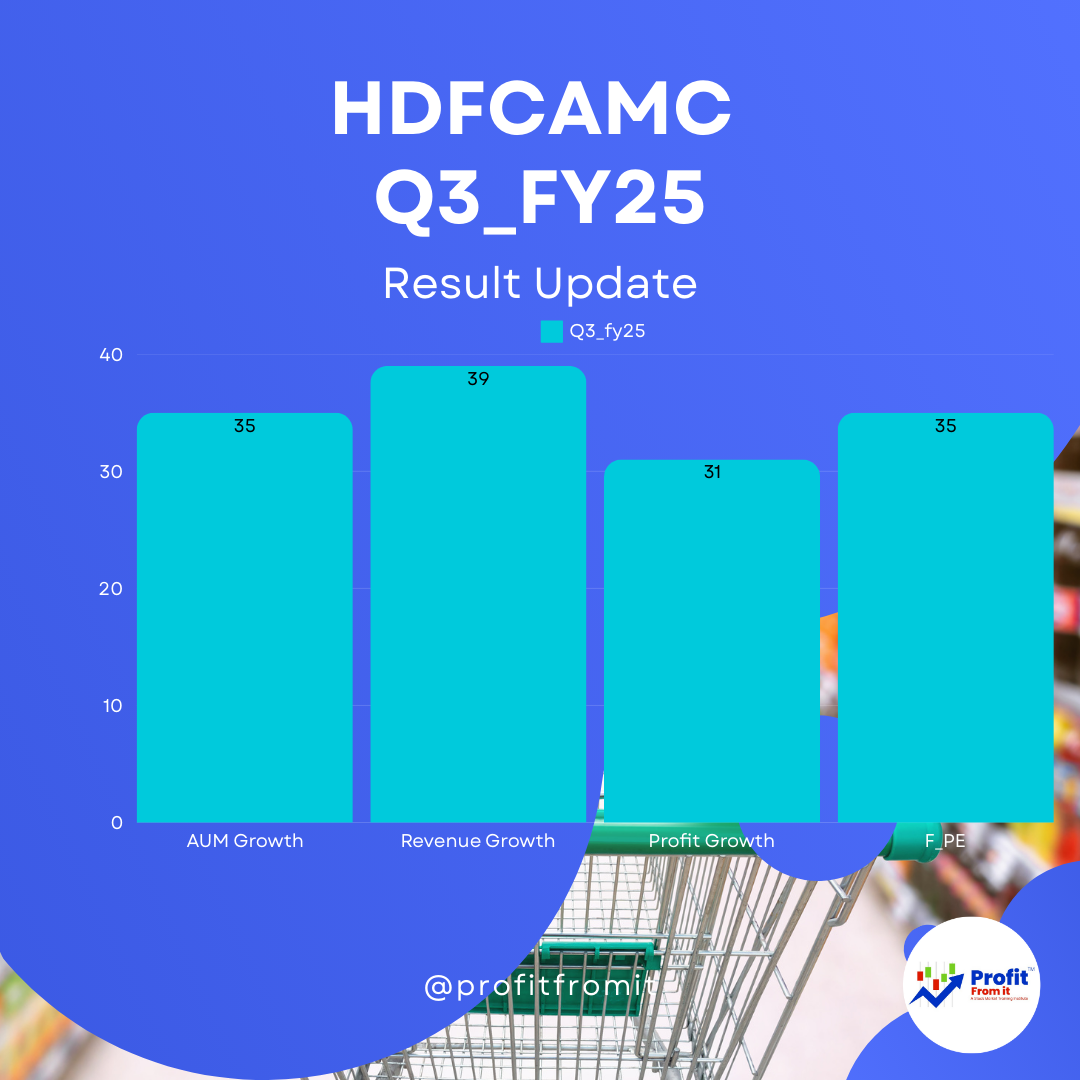

Revenue from Operations: ₹934.36 crore, a 39% increase YoY.

Profit After Tax (PAT): ₹6,415 million, up by 31% YoY, indicating robust growth and operational efficiency.

AUM and Market Share:

Total AUM: ₹7.76 trillion, a notable increase from the previous year.

Equity-Oriented AUM: ₹5.12 trillion, with a significant portion being actively managed.

Market Share: HDFC AMC holds a market share of 12.8% in actively managed equity-oriented funds, marking it as a leader in this segment.

Growth Metrics:

AUM Growth: Yearly AUM growth stood at 35%, highlighting strong inflows and market performance.

Revenue Growth: Total income for Q3 increased by 26% YoY, driven by higher AUM and effective fund management.

Profitability & Valuation Ratios:

Operating Margin: Increased to 37 basis points in Q3 FY25, up from 36 in Q2 FY25, reflecting improved efficiency.

ROE (Return on Equity): Consistently strong, showing efficient use of equity.

T_PE (Trail PE): Trail EPS stands at 110.6 Providing Trail PE at 35, Near to Fair Valuations.

KPIs & Industry Comparison:

HDFC AMC leads with innovative products and a large distribution network, which includes more than 95,000 empaneled partners.

SIP Contributions: Continued to increase, indicating a strong retail participation and trust in HDFC AMC's fund management.

Short-Term and Long-Term Outlook

Short-Term: HDFC AMC is well-positioned to benefit from market volatility due to its strong liquidity management and diversified asset base.

Long-Term: With strategic expansions and a focus on increasing its B-30 (beyond top 30 cities) penetration, which stands at 19.3% of its total AUM, HDFC AMC is expected to grow its customer base and deepen market penetration.

Conclusion

HDFC Asset Management Company's Q3 FY25 results demonstrate strong performance and strategic positioning in the asset management industry. Its focus on equity-oriented assets, systematic investment plans, and expanding geographic footprint are likely to drive continued growth and profitability. The company's operational efficiency and robust financial health are reflected in its improved profit margins and consistent market share gains, making it a noteworthy entity in the asset management sector.