Q3 FY25 results for C.E. Info Systems Limited

1. Consolidated Income Growth for Q3 FY25:

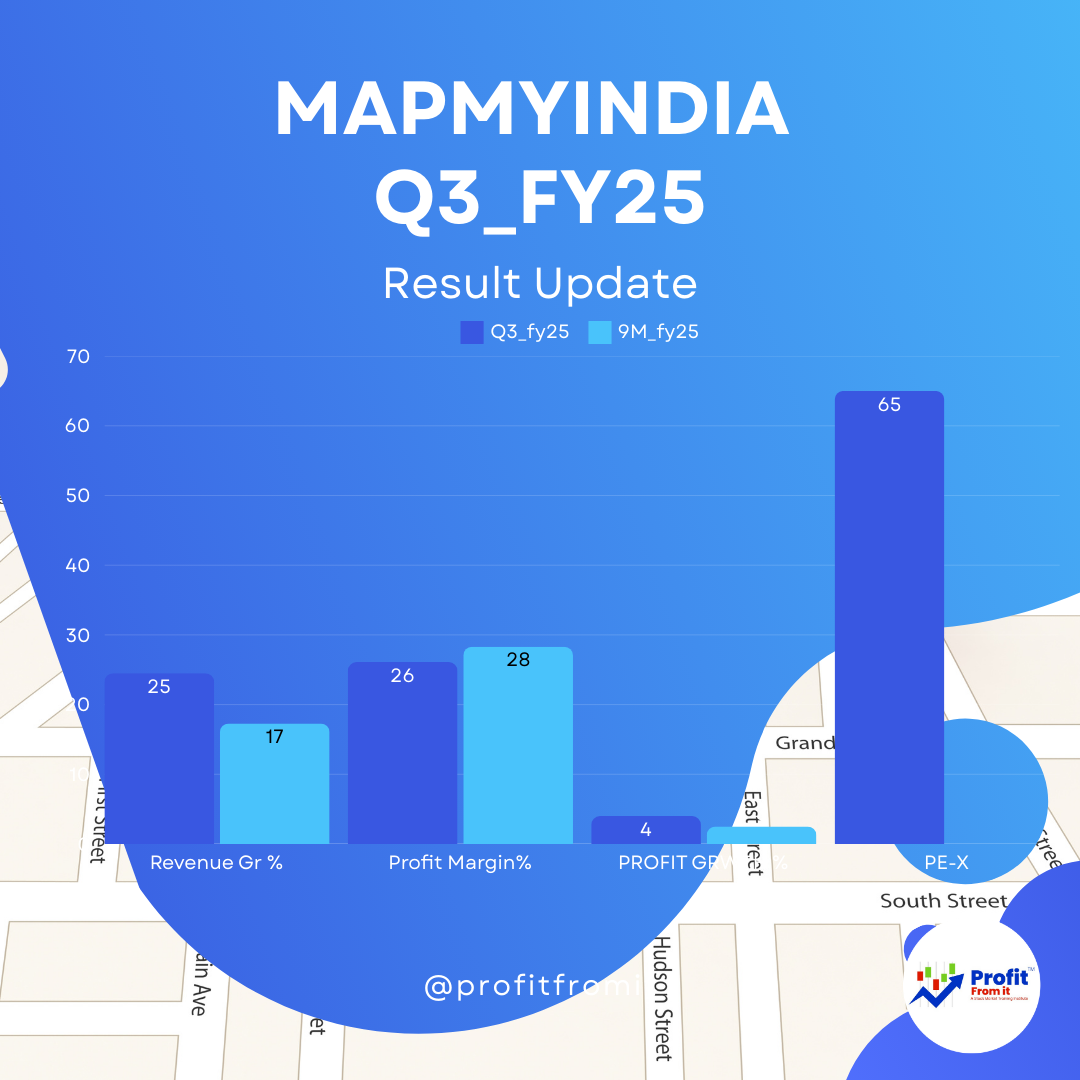

Revenue from Operations: 💹 Increased to ₹114.5 crores in Q3 FY25 from ₹92.0 crores in Q3 FY24, reflecting a growth of 24.5%.

Total Income: 📈 Increased to ₹123.9 crores in Q3 FY25 from ₹103.6 crores in Q3 FY24, marking a 19.6% growth.

2. Product or Segment-Wise Share and Growth:

Automotive & Mobility Tech (A&M) 🚗: Revenue grew by 9% to ₹49 crores.

Consumer Tech & Enterprise Digital Transformation (C&E) 💻: Revenue surged by 39% to ₹65 crores.

Map-led and IoT-led Segments: 🗺️🤖

Map-led: Grew by 33% to ₹87 crores in Q3 FY25.

IoT-led: Grew by 4% in Q3 FY25.

3. Profit Margin for Q3 FY25 vs Q3 FY24:

EBITDA Margin: 📉 Decreased to 36.4% in Q3 FY25 from 39.0% in Q3 FY24.

PAT Margin: 🔻 Decreased to 26.1% in Q3 FY25 from 30.0% in Q3 FY24, reflecting higher costs relative to income.

4. Consolidated Profit Growth for Q3 FY25:

Profit After Tax (PAT) 💸: Increased modestly to ₹32.3 crores in Q3 FY25 from ₹31.1 crores in Q3 FY24, a growth of 4%.

5. Profitability, Solvency, Liquidity, and Valuation Ratios at CMP of ₹1650:

EBITDA/PAT Margins: 📊 As noted, there's a compression in margins due to higher operational costs.

Valuation Ratios: 🔢 Given the current market price (CMP) of 1651 and Trail_EPS at 25.3 the Trail PE should be 65 which high in relation with the earning growth. Even considering F-EPS at 23 the F-PE reaches to 7 which is high.

6. Other Key Performance Indicators for this Industry:

Market Segment Performance: 🏆 Strong growth in the C&E segment, driven by new business acquisitions and expansions in digital services.

Innovation and Expansion: 🌍 Continued development in map-led technologies and expansion into international markets such as the joint venture in Indonesia.

7. Near Term and Long Term Outlook:

Near Term: 🔍 The company may continue to experience growth driven by expansion in digital and IoT solutions, although margin pressures could persist due to rising costs.

Long Term: 🚀 Potential for significant growth through further international expansion, deepening IoT integration, and new product developments, especially in automotive and mobility technologies.

These results showcase a robust growth trajectory in terms of revenue, although profit margins are under pressure, potentially from increased costs associated with expansion and product development. The company's strategic focus on tech and digital transformation sectors positions it well for future growth, aligning with industry trends towards digitalization and connected technologies.