🎨 Asian Paints Q3 FY25 & 9M FY25 Financial Analysis & Insights 📊

🔹 1. Key Highlights 📢 Demand still muted

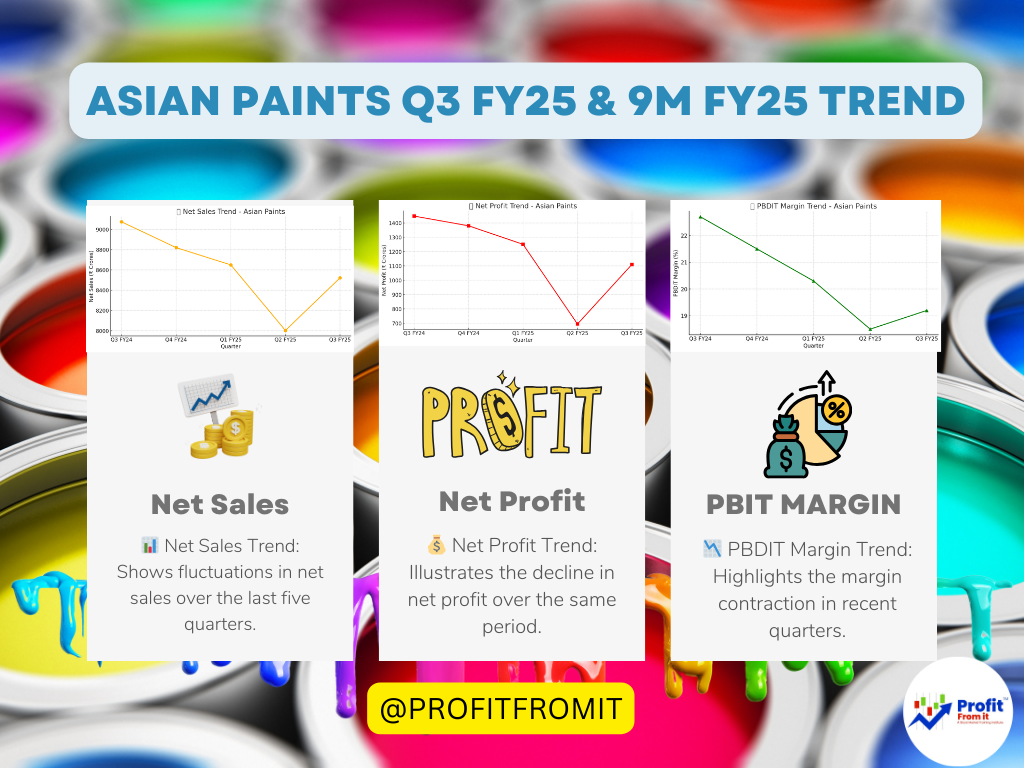

📉 Q3 FY25 Consolidated Net Sales: ₹8,522 crores (⬇ 6.1% YoY)

📉 Q3 FY25 Consolidated PAT: ₹1,110.5 crores (⬇ 23.3% YoY)

📉 9M FY25 Consolidated Net Sales: ₹25,467.8 crores (⬇ 4.5% YoY)

📉 9M FY25 Consolidated PAT: ₹2,975.1 crores (⬇ 29.2% YoY)

📊 Decorative Business (India) Volume Growth: 📈 1.6%

📉 Consolidated PBDIT Margin: 19.2% (⬇ 350 bps YoY)

📦 2. Volume Growth 📊

🔵 Decorative Business (India) Volume Growth: 📈 1.6% YoY

🔵 Growth Challenges: Weak demand, downtrading, weak festive season

🔵 Industrial Business Growth: 📈 3.8% YoY (General Industrial & Refinish segments)

📈 3. Consolidated Sales Growth 💰

📅 Q3 FY25 vs Q3 FY24

Net Sales: ₹8,522 crores (⬇ 6.1% YoY)

Factors: Weak demand in urban centers, seasonal demand slowdown

📅 9M FY25 vs 9M FY24

Net Sales: ₹25,467.8 crores (⬇ 4.5% YoY)

International Business: 📈 5% growth in INR terms (📈 17.1% constant currency)

🌎 4. Segmental & Regional Performance 🌏

🏠 Domestic Decorative Business 🖌️

✔ Q3 FY25 Volume Growth: 📈 1.6%

✔ Revenue Decline: 📉 7.8%

✔ Weak festive demand & downtrading impacted sales

🏭 Industrial Business 🏗️

✔ Overall Growth: 📈 3.8%

✔ General Industrial & Refinish segments drove growth

🌍 International Business 📊

✔ Revenue Growth: 📈 5% in INR terms, 📈 17.1% constant currency basis

✔ Best performing regions: 🏝️ Middle East, 🇱🇰 Sri Lanka, 🇧🇩 Bangladesh, 🇳🇵 Nepal

✔ Challenges: 📉 Currency devaluation in 🇪🇹 Ethiopia & 🇪🇬 Egypt

🏡 Home Décor Business 🛋️

✔ Q3 FY25 Sales:

🛀 Bath Fittings: ₹87.6 crores (📈 2.6%)

🍽️ Kitchen Business: ₹102.7 crores (📈 2.7%)

🔥 White Teak: ₹26.0 crores (📉 -22.8%)

🏠 Weatherseal: ₹11.8 crores (📉 -14.1%)

📊 5. Profit Margins Analysis 💹

📅 Q3 FY25 vs Q3 FY24

Consolidated PBDIT Margin: 📉 19.2% vs 22.7% (-350 bps)

Net Profit Margin: 📉 13.0% vs 15.9%

📅 9M FY25 vs 9M FY24

Consolidated PBDIT Margin: 📉 17.9% vs 22.1% (-420 bps)

🚨 Margin Pressures:

📉 Higher sales & distribution expenses

📉 Adverse product mix

📉 Weak domestic demand

📈 6. Consolidated Profit Growth 💰

📅 Q3 FY25 vs Q3 FY24

Profit Before Tax (PBT): ₹1,518.2 crores (📉 22.8% YoY)

Net Profit (PAT): ₹1,110.5 crores (📉 23.3% YoY)

📅 9M FY25 vs 9M FY24

PBT: ₹4,261.0 crores (📉 25.6% YoY)

Net Profit (PAT): ₹2,975.1 crores (📉 29.2% YoY)

📊 7. Profitability, Solvency, Liquidity & Valuation 💹

✅ Profitability Ratios at CMP ₹2345

📊 Return on Equity (ROE) (TTM): 📈 ~22-24%

📊 Return on Capital Employed (ROCE): 📈 ~25-27%

📊 EBITDA Margin: 📈 ~18-20%

📊 Net Profit Margin: 📈 ~12-14%

💰 Solvency & Liquidity

✔ Debt-to-Equity Ratio: 🔹 0.02-0.05x (Low debt, strong balance sheet)

✔ Current Ratio: 🔹 ~1.6-1.8x (Good liquidity)

✔ Interest Coverage Ratio: 🔹 >10x (Strong financial health)

📈 Valuation Ratios at CMP ₹2345

💰 PE Ratio (TTM): 📈 ~50-55x (Premium valuation)

💰 EV/EBITDA: 📈 ~30-32x (Expensive vs historical levels)

💰 Price-to-Book Value (P/B): 📈 ~12-14x (High valuation)

🚀 8. Near-term & Long-term Outlook 🔮

📆 Near-Term (6-12 months)

📉 Muted demand recovery expected in urban markets

📉 Margin pressures due to competition & inflation

📉 High valuation limits upside potential

📈 Potential rural & Tier 2-3 city demand growth

📈 Long-Term (2-5 years)

🏆 Strong market leadership & pricing power

🏭 Expansion in Industrial Coatings & International Business

🏡 Home Décor segment poised for long-term growth

📊 Strategic acquisitions & innovation will boost profitability

🎯 Final Takeaway 🎯

💡 Short-Term: 📉 Weak demand, lower margins, expensive valuation

💡 Long-Term: 📈 Strong fundamentals, market leader, high growth potential