Bajaj Auto Q3 FY25 Consolidated Financial Analysis:

1. Financial Highlights:

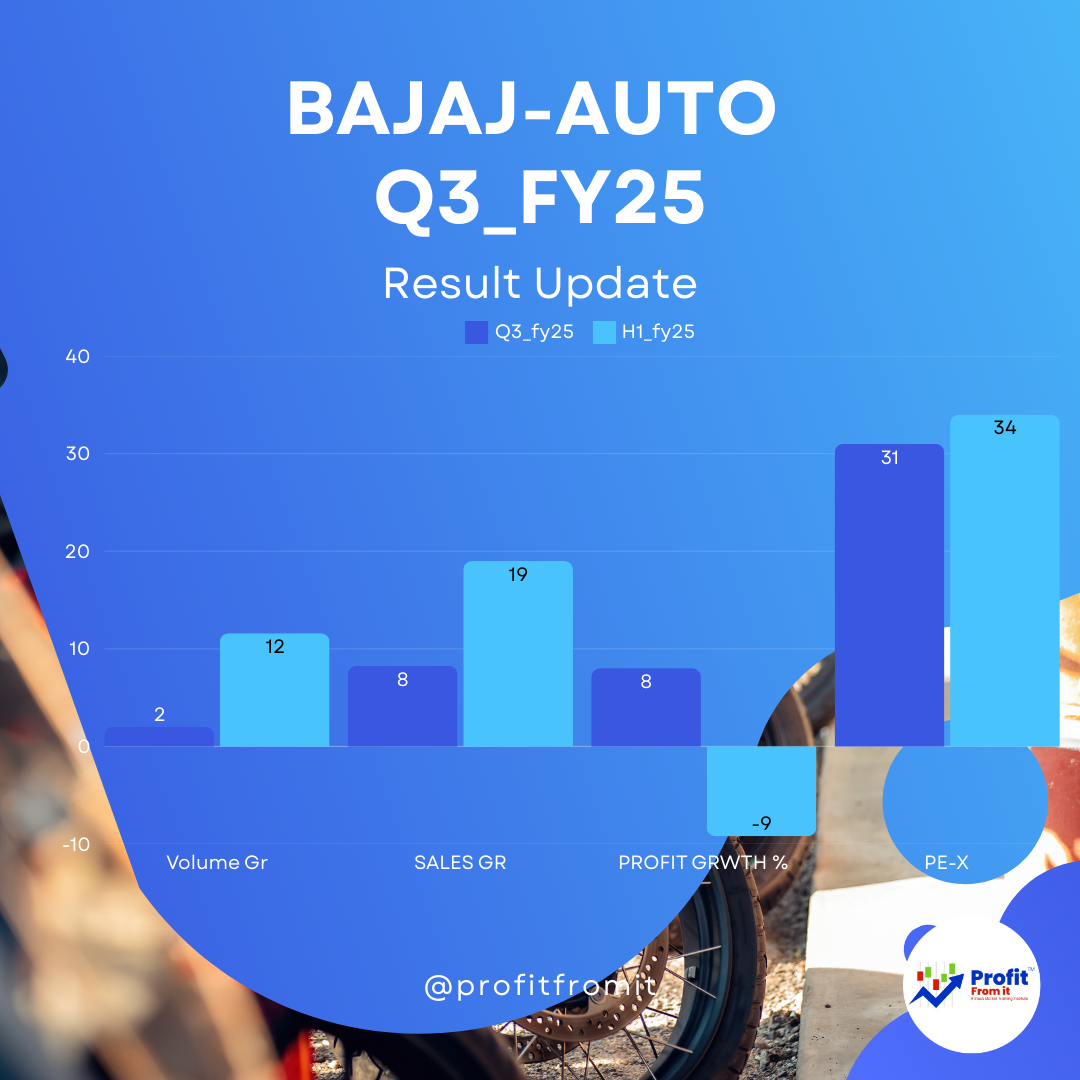

Revenue Growth: 📈 Consolidated revenue from operations increased to ₹13,168.88 crore in Q3 FY25, up from ₹12,165.33 crore in Q3 FY24, representing a growth of 8.2% year-over-year. This will help Bajaj-Auto trigger the benchmark revenue sales of 50k cr for the 1st time in the history.

Profit Margins: 💹 The Profit Before Tax (PBT) for Q3 FY25 stood at ₹2,876.43 crore compared to ₹2,666.22 crore in Q3 FY24, indicating an increase of 7.9% year-over-year. Profit margins remained relatively stable despite varied costs.

Net Profit: 💸 Profit After Tax (PAT) increased slightly from ₹2,032.62 crore in Q3 FY24 to ₹2,195.65 crore in Q3 FY25, showing a growth of 8.0%.

2. Segment Performance:

Automotive Segment: 🚗 The automotive segment continues to be the primary revenue driver, posting ₹12,837.06 crore in revenue for Q3 FY25 against ₹12,181.78 crore in the same quarter the previous year, up by 5.4%.

Investments and Financing: 🏦 These segments also showed positive revenue, contributing ₹342.73 crore and ₹336.62 crore, respectively, for Q3 FY25.

3. Regional Insights:

🌍 Revenue was up on strong exports, a buoyant domestic Green Energy portfolio and another record on Spares.

🌍 Exports saw a broad-based recovery that led to the return of >5 Lakh units after 9 quarters.

Domestic business was led by Green Energy portfolio that now contributes ~45% of revenues (LY: 30%) as focused strategy is put to action.

Significant strides made on the electric vehicles portfolio as it delivered another quarter of ~1 lakh units and in doing so, nearing leadership by doubling share in e2Ws / trebling share in e3Ws over last year.

Electric three-wheeler volumes surged 5x YoY, with market share expanding to a new quarter high (3x YoY), supported by an extended network from 600 to over 850 touchpoints.

Chetak maintained strong momentum while steadily gaining customer preference; volumes ~2.5x YoY and exit market share 25%, +1100bps.

4. Solvency, and Liquidity:

Liquidity: 💰 Continued emphasis on cash conversion/generation saw - ~:3,000 crores of free cash flow being added in 9M FY25.

Solvency: 🛡️ Robust Balance Sheet with surplus funds of < 15,001 crores after having infused capital of nearly <1 ,600 crores in financing subsidiary (Bajaj Auto Credit Ltd.), executing capex of-~450 crores in the year to date and paying out over <2,200 crores as dividend to shareholders

5. Valuation Ratios:

Valuation at CMP of ₹8393: 📊 The current market price reflects robust industry KPIs, including growth in revenue and profits. The company’s strategic initiatives, particularly in electric vehicles, have begun to contribute significantly to the bottom line.

Valuation Ratios: 🔍 With the given CMP, Bajaj Auto’s Trail-EPS increases to 269.2 from previously 262.4 taking the Trail Price-to-Earnings (P/E) ratio to 31 from previously 32. F-EPS could be 289 with the F-PE taking it to a better valuation lower 29. Yet, the fair PE should be 20.

6. Near Term and Long Term Outlook:

Near Term: ⏳ The company is likely to continue benefiting from its diversified product range and focus on electric vehicles, which are gaining market share rapidly.

Long Term: 🚀 Bajaj Auto’s investments in technology and expansion in international markets are expected to drive long-term growth, although competition and regulatory changes remain key risks.

Overall, Bajaj Auto’s Q3 FY25 results depict a company that is adapting well to market demands, particularly in the sustainable vehicle sector, and maintaining a strong financial standing in a competitive industry.