UltraTech Cement Limited for the third quarter (Q3) and the first nine months (9MFY) of the financial year 2025:

📊 Q3 FY25 and 9MFY25 Key Financial Performance:

💰 Revenue from Operations:

Q3 FY25: ₹17,193.33 Crores

9MFY25: ₹50,897.62 Crores

There's been a steady increase in revenue compared to the previous quarters and year.

📈 Profit After Tax (PAT):

Q3 FY25: ₹1,473.52 Crores

9MFY25: ₹3,993.92 Crores

The PAT shows a decrease compared to the same quarter last year but has improved over the previous quarter.

🚀 EBITDA:

Q3 FY25: ₹3,131 Crores

This shows an improvement over the previous quarter but a decline YoY.

📏 Volume and Growth:

🔢 Sales Volume:

Domestic sales volume increased by 10.5% YoY and 9% sequentially, indicating a robust demand scenario.

📊 Volume Growth:

Grey Cement - Domestic Q3: 28.10 million tons

This signifies a significant volume growth driven by both urban and rural demand.

💹 Financial Ratios at CMP of ₹11,422:

📈 Profitability Ratios:

ROCE: 40% for RMC segment indicates strong profitability.

EBITDA Margin: EBITDA per ton for domestic operations improved sequentially, suggesting cost efficiency and operational improvement.

💧 Liquidity Ratios:

Current Ratio (as of 31/12/2024): 1.23 times, indicating healthy short-term liquidity.

🏦 Solvency Ratios:

Debt-Equity Ratio: 0.34 times, showing moderate leverage and a strong balance sheet.

🏷️ Valuation Ratios:

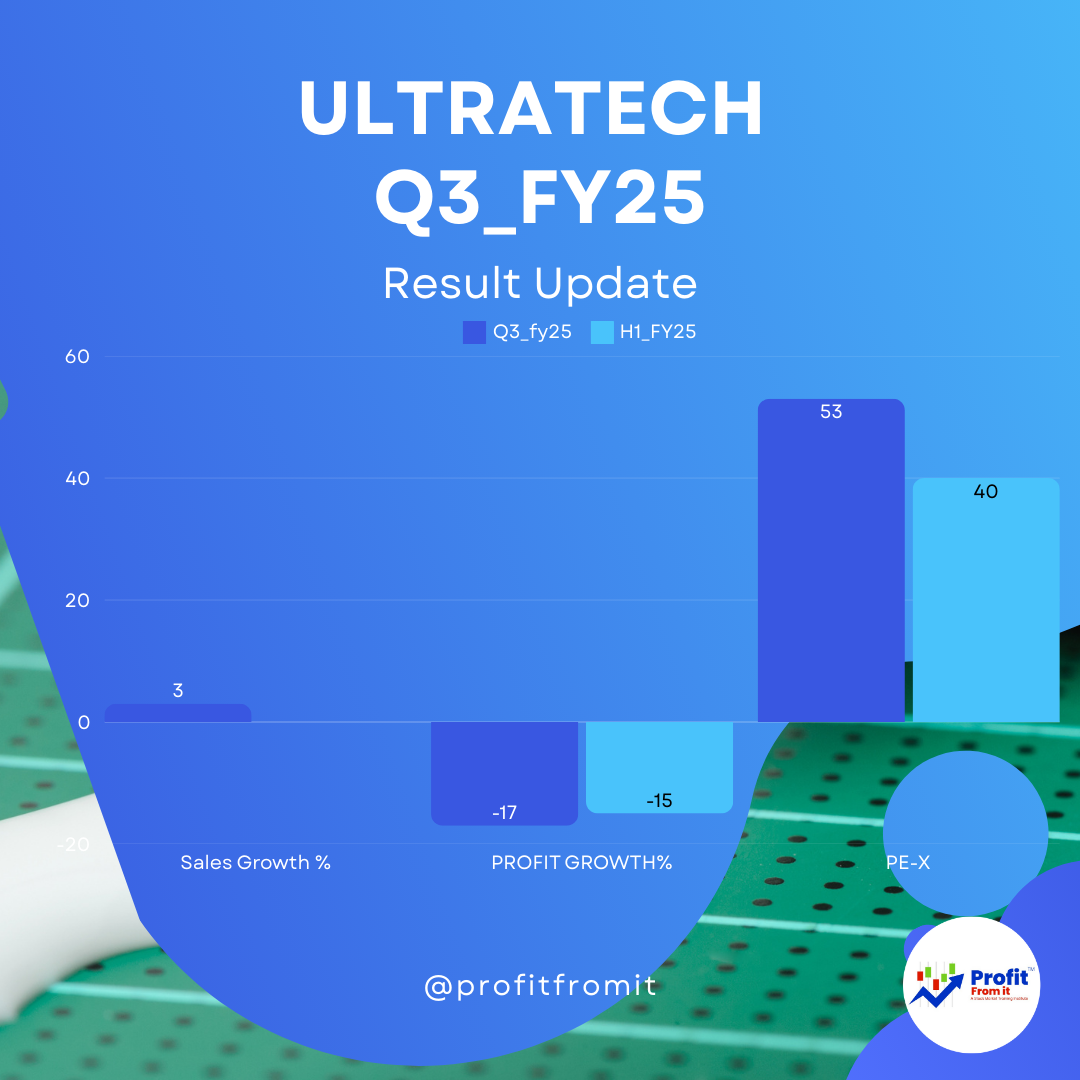

PE Ratio: Trail EPS of 216.6 gives the Trail PE of 53.

📉 Profit Margins:

💸 Profit Margin for Q3 FY25:

Net Profit Margin: 9% (slightly lower due to increased costs).

EBITDA Margin: 18.1% (considering total revenues and EBITDA).

🌟 Near Term and Long Term Outlook:

🔮 Near Term: The company expects continued volume growth and has planned capacity expansions to cater to increasing demand. However, there may be pressure from cost inflations, particularly in power and fuel expenses.

🌍 Long Term: With strategic acquisitions and greenfield projects, UltraTech is positioned to capitalize on infrastructure and housing demand in India. Its focus on sustainability and reducing carbon footprint is expected to enhance its market competitiveness.

✨ Highlights and Insights:

The company has made significant strides in improving its green energy mix and is actively involved in ESG initiatives which could provide long-term benefits in operational cost reductions.

The acquisition of India Cements Limited and other strategic initiatives are expected to strengthen its market position and regional penetration.

This analysis provides a comprehensive view of UltraTech's financial performance and strategic direction, vital for stakeholders and potential investors, enhanced with visuals for a more engaging read.