Voltas' Q3 FY25 financial results:

Consolidated Financial Highlights for Q3 FY25 📊

Total Income:

Q3 FY25: ₹3,164 Crores 💹

Q3 FY24: ₹2,684 Crores

Growth: 18% 📈 (Good Growth)

Profit Before Tax (PBT):

Q3 FY25: ₹191 Crores 🚀

Q3 FY24: ₹24 Crores

Growth: 699% 📈

Profit After Tax (PAT):

Q3 FY25: ₹131 Crores 💰

Q3 FY24: Loss of ₹28 Crores 📉

Recovery to Profitability ✔️

Consolidated Sales Growth:

Revenue increased by 18% year-over-year due to strong performance across all business segments 🌟.

Volume and Market Share:

Unitary Cooling Products: 42% volume growth with a market exit share of 20.5% in the AC market 🏆.

Voltbek Home Appliances: 56% volume growth, surpassing 10% market share in the washing machine category 🔄.

Segmental Performance:

Unitary Cooling Products: Revenue at ₹1,771 Crores for Q3 FY25, a 20% increase from Q3 FY24 📊.

Electro-Mechanical Projects and Services: Revenue at ₹1,190 Crores for Q3 FY25, a substantial improvement from previous losses 🔧.

Engineering Products and Services: Revenue experienced a slight decline from last year 🔽.

Profit Margins Comparison (Q3 FY25 vs. Q3 FY24) 💸

The overall profitability has significantly improved, primarily driven by robust growth in the Unitary Cooling Products and recovery in Electro-Mechanical Projects. There were losses last year Q3 due to provisions from Qatar Projects.

Consolidated Profit Growth 📈

PAT for Q3 FY25 represented a significant recovery compared to a loss in Q3 FY24, highlighting successful cost management and operational efficiency.

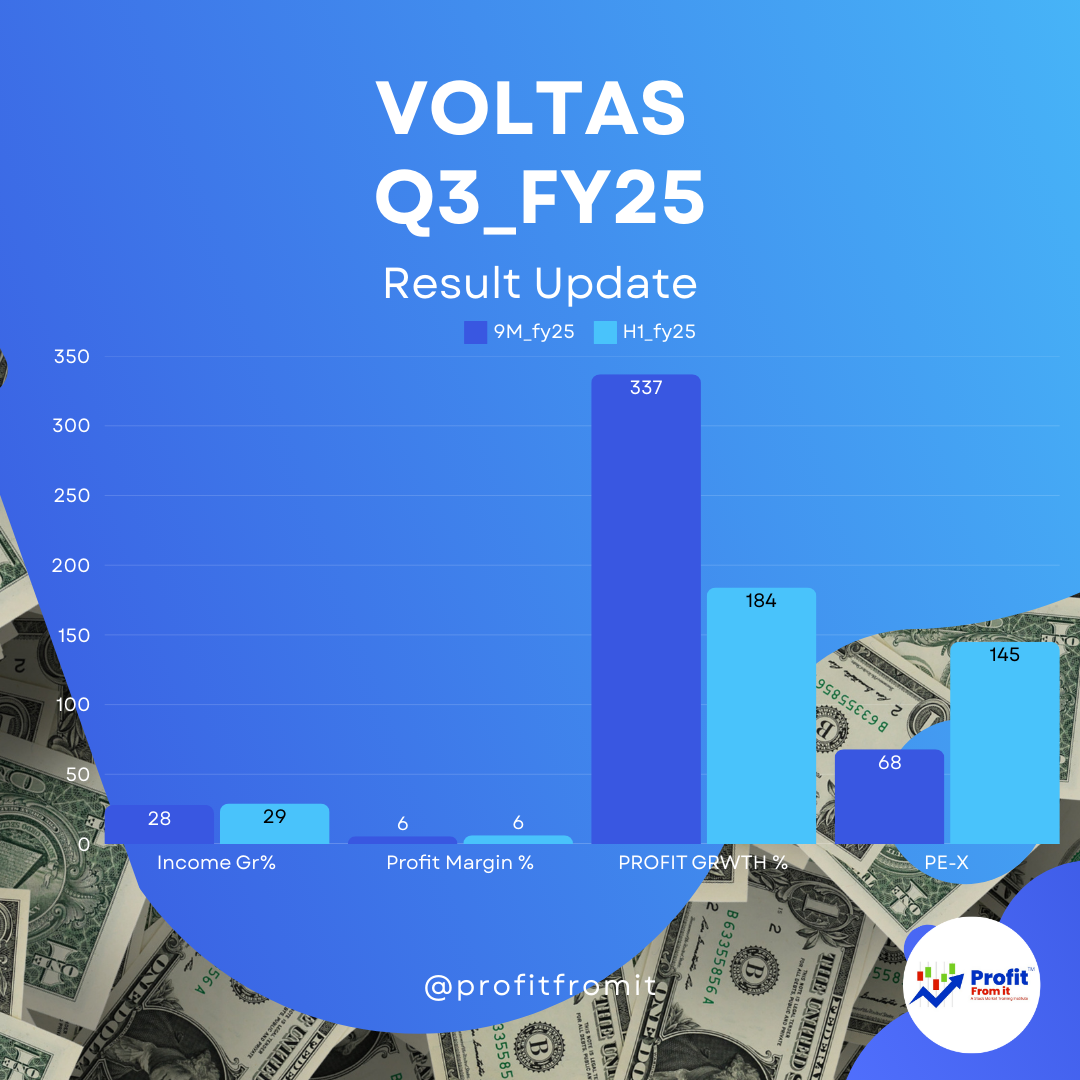

Valuation Ratios at CMP of ₹1,476 🔍

Valuation Ratios: Based on the current market price (CMP) 1476, the improved earnings enhance the attractiveness of the stock, Trail EPS have reached 21.66 from 16.8 earlier dragging the Trail PE from 88 to 68. This could help F_EPS reach 25 and F_PE at 59. The Fair PE of Voltas considering 20%+ plus growth and debt free status should be near to 30.

Near Term and Long Term Outlook 🌐

Near Term: Expected to continue leveraging its market leadership in ACs and expand its presence in home appliances.

Long Term: Focused on expanding its product portfolio and geographical reach, along with investments in technology to sustain growth and profitability.

Leadership Transition 🔄

Leadership Change: Mr. Pradeep Bakshi, the current Managing Director & CEO, will not seek reappointment post-August 2025. Mr. Mukundan Menon will take over as Managing Director starting September 2025, which might bring fresh strategic directions to the company.

Voltas exhibits strong performance and recovery in Q3 FY25, positioning it well for sustainable growth amid leadership transitions and market expansion strategies. 🚀🌟