IREDA's Q3 FY25:

Highlights and Insights

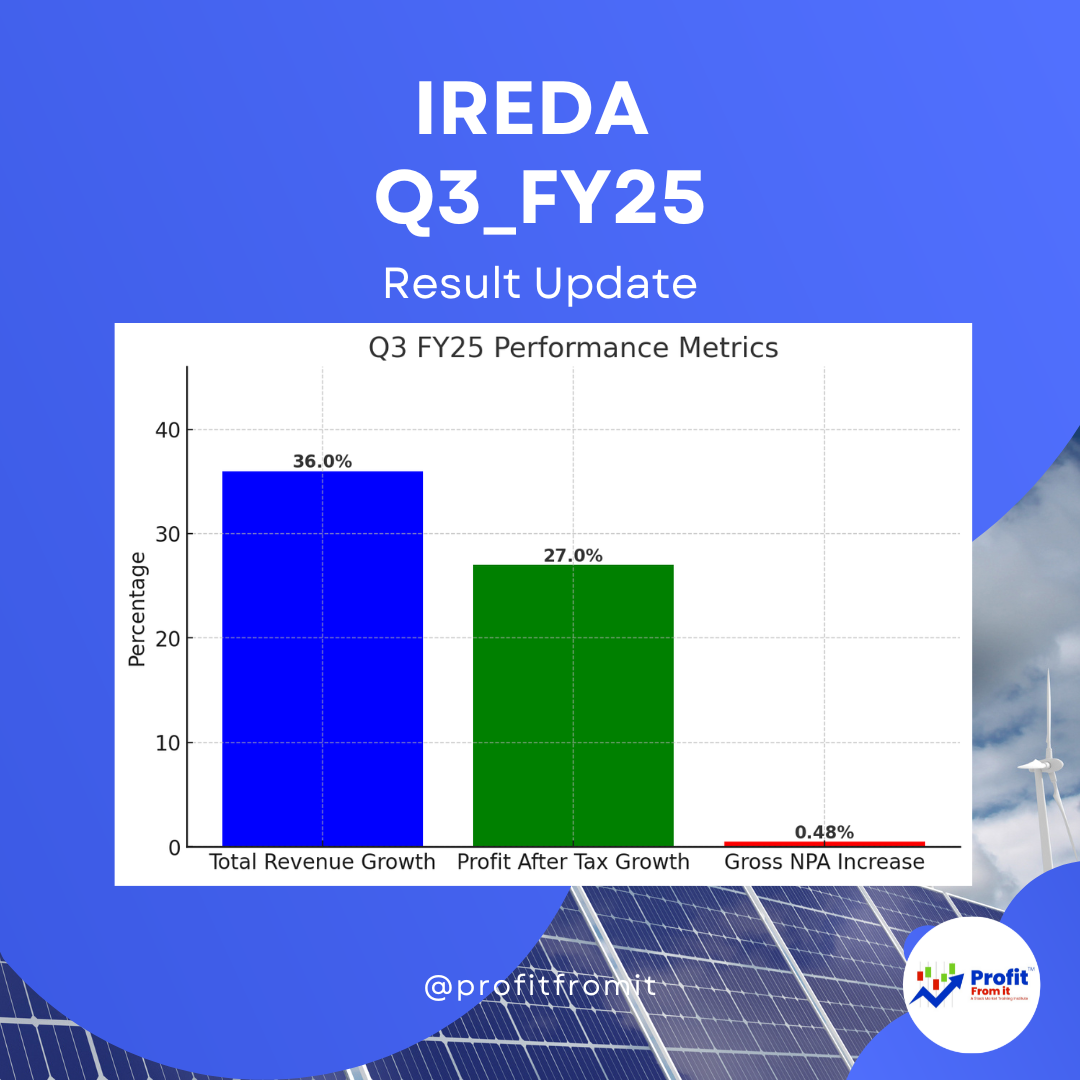

Revenue Growth: Total revenue from operations increased by 36% compared to Q3 FY24, showing growth in line and as assumed.

Profit Margin Expansion: Profit after tax for Q3 grew by 27% year-over-year. The net profit margin for the nine months ended December 2024 is 24.73%, slightly below the previous year's 25.60%, indicating a slight contraction in margin due to increased cost of Fund.

Operational Efficiency: Operating profit increased by 51% compared to the previous quarter, signaling improved operational efficiency.

Key Financial Metrics

Gross NPA (Non-Performing Assets): There's an increase in GNPA from 2.20% in the previous Quarter to 2.68% in Q3 FY25, increasing GNPA can reduce profitability.

Earnings Per Share (EPS): Increased from ₹5.16 during the year end in FY_25 to current trail EPS at 5.7 & Forwards EPS is assumed at 6.8.

Advances and Loan Book Growth

The outstanding loan book showed significant growth of 36% year-over-year, indicating aggressive lending and potentially higher interest income in future quarters.

Solvency and Liquidity Ratios

Debt-Equity Ratio: Increased from 5.13 to 5.89, suggesting higher leverage but still within a manageable range.

Capital Adequacy Ratio (CRAR): Stands at 19.63%, down from 23.88% last year, yet remains healthy above regulatory requirements, ensuring solvency.

Valuation at Current Price (₹201)

Considering the earnings growth and operational metrics, Forward EPS is 6.8 and F_PE should be 31. The stock appears to be trading at a reasonable valuation, especially when the future growth prospects of the renewable energy sector are considered. Concern should be NPA which should be watchful in near term.

Short-Term and Long-Term Outlook

Short-Term: The company is expected to maintain robust growth in revenue and profitability due to increased demand for renewable energy financing and government support.

Long-Term: Long-term prospects appear promising with continued government focus on renewable energy, although increasing leverage and any potential rise in NPAs should be monitored.

This analysis provides a thorough insight into IREDA's financial health and performance, with positive indicators for both short and long-term investment perspectives.