Havells Q3 FY25 Analysis 📊

Financial Performance Highlights 📈

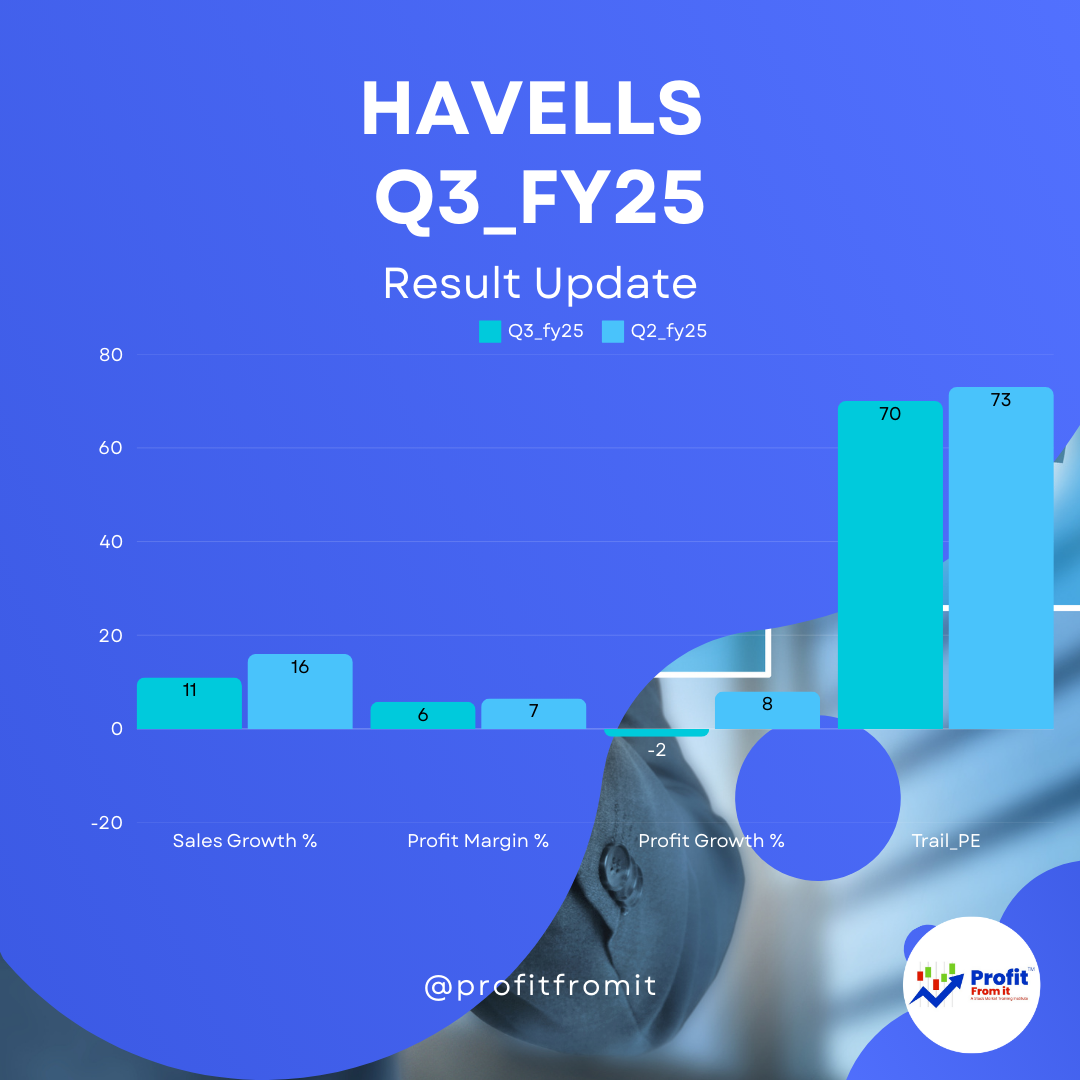

Revenue Growth: Havells reported an 11% year-over-year (YoY) increase in revenue from operations for Q3 FY25, reaching ₹4,882.5 crore. Growth was 16% during Q2_fy25.

Profit and Margins: Profit for the period was ₹282.81 crore, a slight decline compared to ₹287.87 crore in Q3 FY24. The profit before tax was ₹382.19 crore, down slightly from ₹390.69 crore YoY. Earnings per share (EPS) stood at ₹4.51.

Dividend 💸: The Board of Directors declared an interim dividend of ₹4.00 per equity share.

Segmental Performance 📝

Switchgears ⚡: Revenue from the switchgears segment increased by 10.8% YoY to ₹576.88 crore.

Cables 🧶: Cable segment revenue saw a 7.3% increase YoY to ₹1,687.87 crore.

Lighting & Fixtures 💡: This segment grew by 2.5% YoY, generating ₹440.90 crore in revenue.

Electrical Consumer Durables 🏠: Revenue increased by 14.9% YoY to ₹1,104.28 crore.

Lloyd Consumer 📺: Notably improved, with revenue up by 14.7% YoY to ₹741.76 crore.

Profitability, Liquidity, and Solvency Ratios at Current Market Price (CMP) of ₹1557 📉

Profit Margins 💹: Q3 FY25 profit margin was slightly reduced to 5.8% of net revenue compared to 6.5% in Q3 FY24.

Operating Profit Margin (OPM) 📊: Stood at 8.8%, down from 9.8% YoY.

Return on Equity (ROE) 🚀 and Return on Capital Employed (ROCE) 🔄: ROE was 18.4%, and ROCE was 25.3%, indicating solid returns.

Trail EPS 🚀 and F_PE 🔄: Trail EPS comes at 70 & F_PE comes at 81 which are high in relation to earning growth.

Near Term and Long Term Outlook 🌐

Near Term 🔍: Havells is likely to benefit from the continued robust demand in infrastructure and industrial sectors. However, commodity price fluctuations and increased competition might pose challenges.

Long Term 🌟: With strategic expansions like the Tumkur plant and consistent growth in major segments, Havells is well-positioned to leverage market opportunities. Continual product innovation and expansion in consumer durables indicate a promising long-term growth trajectory.

Summary 📝

Havells has demonstrated Cooled off in revenue growth and decreased profitability due to decreased margin. The company continues to strengthen its market presence across various segments, which should bode well for its future financial performance.