Maruti Suzuki India Limited (MSIL) - Q3 FY25 Financial Highlights and Analysis 📊

Q3 FY25 Volumes and Sales Growth 📈

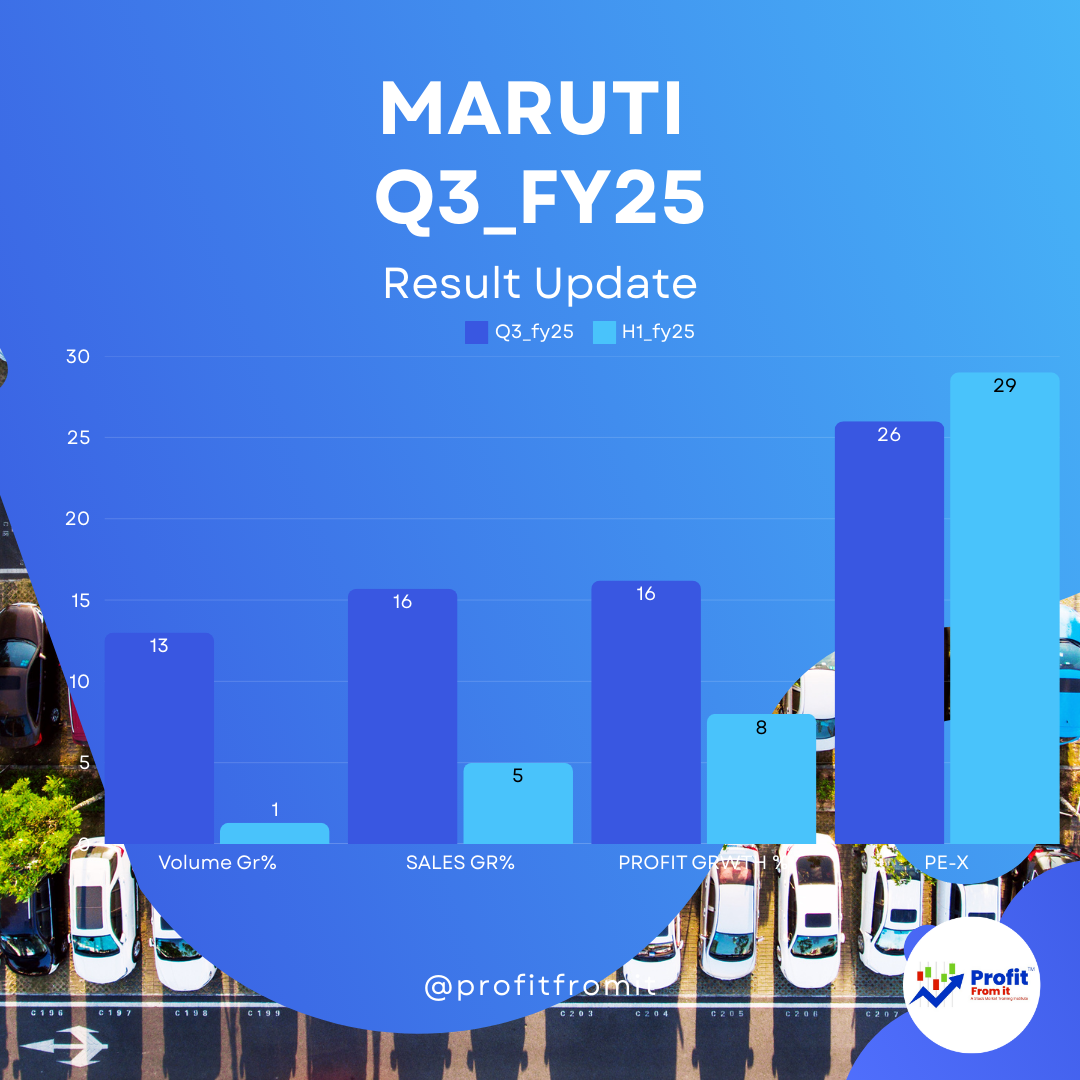

Sales Volume: MSIL experienced a significant increase in sales volume, reporting 566,213 units in Q3 FY25 compared to 501,207 units in Q3 FY24, marking a growth of 13.0% 🚗.

Consolidated Sales Growth: Net sales rose from INR 3,87,643 million in Q3 FY24 to INR 335128 million in Q3 FY25, a growth of 15.7% 💹.

Profitability Metrics Q3 FY25 vs. Q3 FY24 💸

Operating EBIT: Grew by 16.1%, from INR 31,562 million to INR 36,653 million 💰.

Profit Before Tax (PBT): Increased by 13.5%, from INR 40,538 million to INR 46,019 million 📊.

Profit After Tax (PAT): Increased by 16.2%, from INR 32,068 million to INR 37,269 million 📈.

Key Financial Ratios 🔍

Material Cost: Slightly increased as a percentage of net sales from 74% to 74.7% 📉.

Employee Cost: Stable at 4.2% 👥.

Depreciation: Slightly decreased from 2.4% to 2.2% 🛠️.

Operating EBIT Margin: Improved slightly by 10 basis points to 10% 📈.

Profit Before Tax Margin (PBT): Decreased slightly by 20 basis points to 12.5% 📉.

Profit After Tax Margin (PAT): Also saw a slight decrease of 20 basis points, settling at 9.6% 📉.

Valuation Ratios (at CMP of INR 11,989) 📏

Price to Earnings Ratio (P/E): Trail EPS upgraded to 462.5 from 446 precious which helped Maruti value Trail PE to 26 down from previously 29. F_EPS could reach 493 with F_PE at 24. 🧮.

Near-term and Long-term Outlook 🌐

Near-term: Given the solid growth in sales volumes and revenue, along with steady profitability improvements, the near-term outlook for MSIL appears positive 🌟. However, the slight increases in material costs could pressure margins if not offset by further operational efficiencies 🔍.

Long-term: The strategic merger with Suzuki Motor Gujarat Private Limited indicates a long-term strategy aimed at consolidating manufacturing operations, which should yield operational efficiencies and cost savings 🔄. This alignment and simplification of business structure are expected to enhance MSIL’s competitive position in the automotive industry, driving long-term growth and shareholder value 📈.

Additional Information 📝

MSIL's strategy includes leveraging non-operating income and maintaining a disciplined cost structure to support profitability 💼. The company's approach to enhancing operational leverage and reducing administrative expenses by merging with Suzuki Motor Gujarat Private Limited could serve as significant catalysts for future financial performance enhancements 🚀.