TCS's Q3 FY25:

1. Revenue and Growth 📈

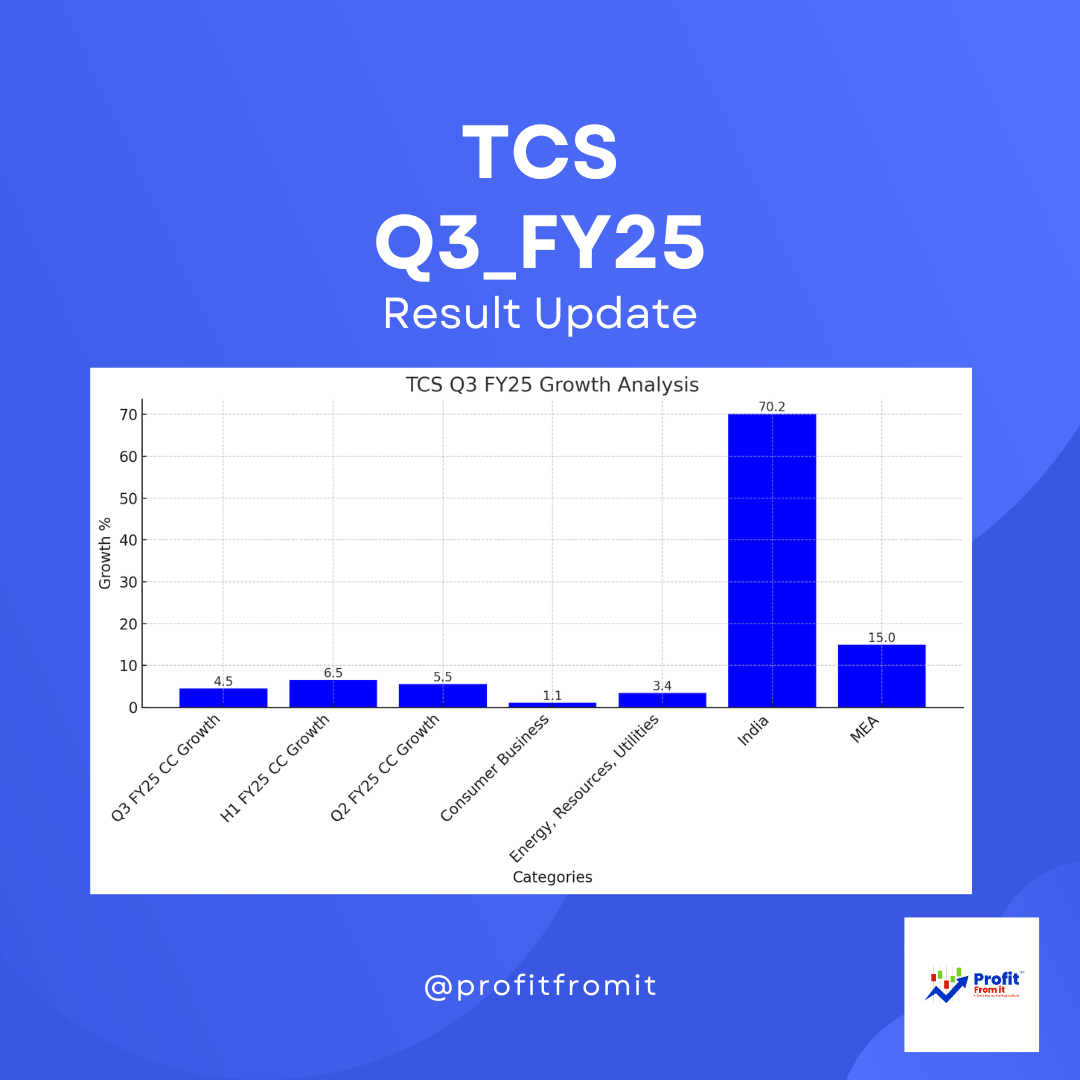

Constant Currency (CC) Growth: TCS reported a revenue of ₹63,973 crore, marking a 5.6% year-over-year (YoY) growth v/s 6.5% growth we saw during H1_fy25 and a 4.5% growth in constant currency terms again which was 5.5% during Q2. Weakness Continues in Q3 with good promise for Fy_26.

Segment and Regional Performance: Notable growth in consumer business (+1.1% CC), energy, resources, and utilities (+3.4% CC), with significant regional growth in India (+70.2% CC) and the Middle East & Africa (+15.0% CC). India Outshines in continuity.

2. Profitability 💰

Net Income and Margins: TCS achieved a net income of ₹12,380 crore, a 5.5% increase YoY. Operating margin stood at 24.5%, showing a sequential improvement of 40 basis points, though there was a decline of 50 basis points YoY.

Profit Margins Comparison: Q3 FY25's net margin was reported at 19.4%, illustrating stable profitability across the quarters.

3. Employee Metrics 👥

Workforce Strength: Total employee count reached 607,354 with a last twelve months (LTM) IT services attrition rate of 13.0%. 5370 Jobs have been cut.

Diversity and Inclusion: Women constituted 35.3% of the workforce, encompassing 152 nationalities, indicating TCS's commitment to a diverse and inclusive workplace.

4. Order Book and TCV 📚

Total Contract Value (TCV): Strong TCV recorded at US$10.2 billion with a book-to-bill ratio of 1.4, positioning TCS well for sustained long-term growth.

5. Key Performance Indicators (KPIs) and Industry Comparison 📊

Client Initiatives: Emphasis on technology modernization and business transformation. Sectors like Cyber Security, AI.Cloud, and TCS Interactive led the growth.

Market Performance: TCS maintained a leadership position in multiple industry assessments, reflecting its strong market presence and client trust.

6. Financial Ratios and Valuation 💹

Profitability Ratios: Consistent net income growth and stable profit margins highlight effective cost management and operational efficiency.

Valuation at Price 4037: Given the solid financial performance and strategic investments in talent and technology, the current valuation suggests a stable investment outlook. However, detailed financial ratios such as P/E stands at 30 which is high in comparison to growth, ROE stands strong at 49% due to high profitability in relation to Equity.

7. Outlook 🔮

Short-Term: The solid TCV and robust client engagements across diverse industries provide positive momentum heading into the next quarters.

Long-Term: TCS’s ongoing investments in AI, digital transformations, and global expansion, particularly in high-growth markets like India and the Middle East, align well with long-term growth prospects.

Summary 🌟

The Q3 FY25 results for TCS show the continuity in slowdown performance across key financial metrics, a strong order book but it needs more growth, and workforce which has decreased by 5370 even in Q3 is not a good sign. The company's strategic focus on digital and cloud services, along with significant investments in AI, positions it well for future growth both in the short and long term.