TATAELXSI's Q3 FY25:

1. Revenue and Profit Growth 📈

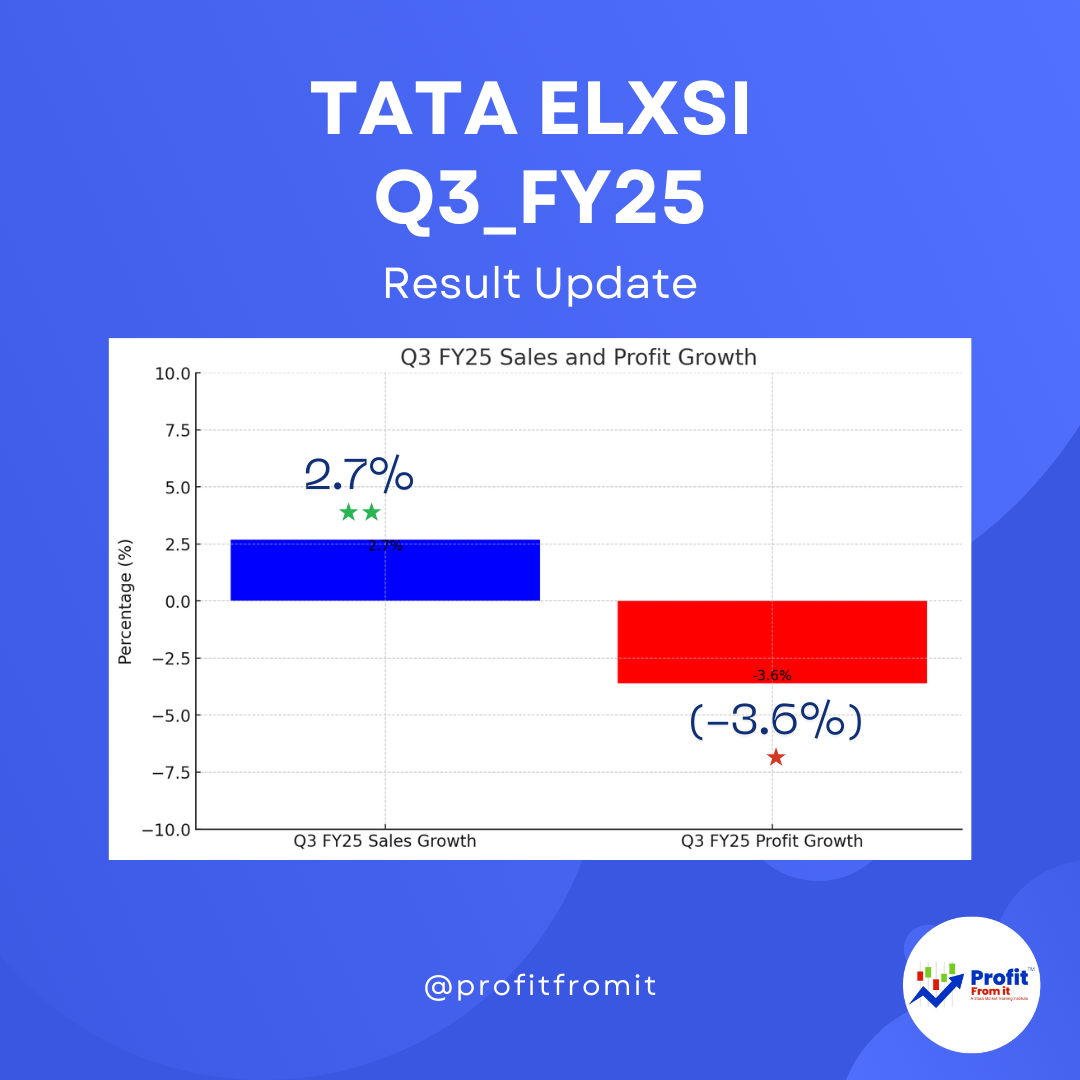

Q3 FY25 Sales and Profit Growth vs Last Year: The revenue from operations for Q3 FY25 was ₹939.2 Cr, representing a year-on-year increase of 2.7% from ₹914.2 Cr in Q3 FY24. During H1_fy25 the growth was 8.7%. Q3 came with weak growth.

Profit Margins: The Profit After Tax (PAT) margin for Q3 FY25 was 20.3%, down from 21.7% in Q3 FY24. Compared to Q2 FY25, the PAT margin also decreased from 22.5% to 20.3%.

2. Segmental and Regional Growth 🌍

Media & Communications and Healthcare: Both segments reported constant currency (CC) QoQ growth, with Media & Communications growing at 0.4% and Healthcare at 1.1% QoQ.

Geographical Performance: Revenue growth from India was notable at 21.9% YoY, while Japan and emerging markets grew significantly by 66.8% YoY.

3. Employee Metrics 👥

Employee Addition and Attrition Ratio: The headcount at the end of Q3 FY25 was 12,878, while it was 12,793 in Q2 FY25. The attrition rate was stable around 12.4%.

4. Important KPIs in Respect to Industry 📊

EBITDA Margin: The Operating EBITDA margin for the quarter stood at 26.3%, a slight decrease from the previous quarter's 27.9%.

5. Profitability and Valuation Ratios 💸

Valuation at Price of ₹5998: Considering the low growth F-EPS for Fy_25 seems to be ₹134 for Q3 FY25, the Price-to-Earnings (P/E) ratio at the current price would be approximately 45, suggesting a premium valuation likely due to Low growth.

6. Short Term and Long Term Outlook 🔮

Short Term: The company is navigating challenges in the automotive industry, especially in the US and Europe, but has secured significant deals that could stabilize revenue streams in the coming quarters.

Long Term: Strategic initiatives like the AVENIR SDV software suite and partnerships for cloud-native and hybrid platforms are likely to bolster Tata Elxsi's position in digital and software domains, supporting long-term growth.

This analysis highlights robust growth in strategic markets, though pressures on profit margins are evident. The company's focus on emerging technologies and geographical expansion are positive signs for future resilience and growth.