Avenue Supermarts Limited's (DMart) financial results for the third quarter ended December 31, 2024:

Sales and Store Growth 📈

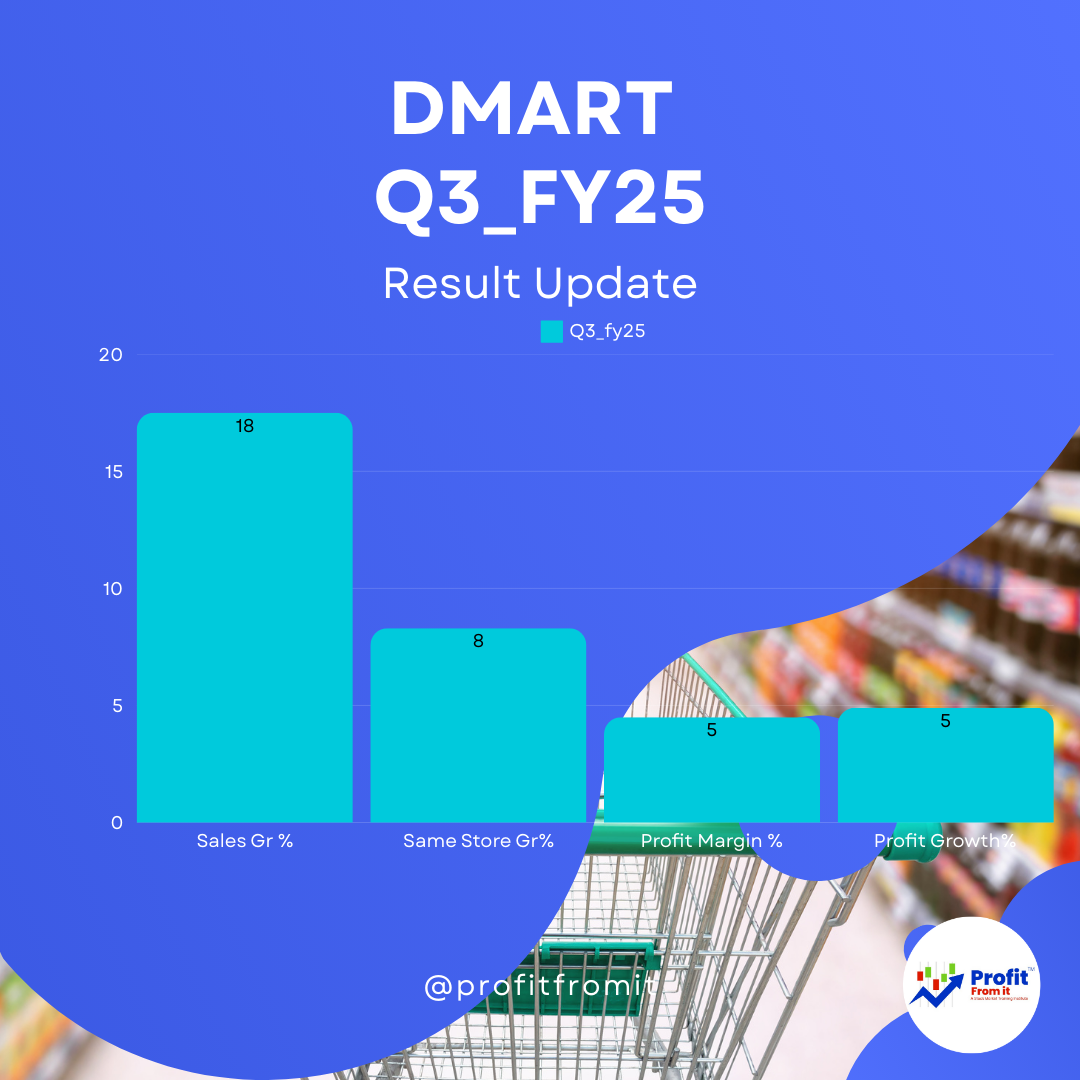

Total Revenue: Consolidated revenue stood at ₹15,973 crore, marking a growth of 17.5% year-over-year (YoY) 📊 from ₹13,572 crore in the previous year which was 16% till H2, improvements seen.

Store Expansion: DMart added 10 stores during Q3 FY25, bringing the total to 387 stores. The company continues to expand significantly in major states like Maharashtra, Karnataka, and Gujarat. This helped Dmart reach 387 Stores adding 22 New stores this year.

Financial Performance 💰

EBITDA: Consolidated EBITDA for Q3 was ₹1,217 crore, slightly up from ₹1,120 crore in the previous year. However, the EBITDA margin decreased from 8.3% to 7.6% YoY, indicating higher operating costs or less effective cost management relative to sales growth.

Net Profit: Consolidated net profit was ₹724 crore, up from ₹690 crore, a growth of 4.9% YoY. Profit After Tax (PAT) margin decreased from 5.1% to 4.5%, reflecting the margin pressures despite revenue growth.

EPS: Earnings Per Share (EPS) increased to ₹11.12 from ₹10.62, taking Trail EPS to 41.8 & even F_EPS to 42.5 reflecting the modest growth in profitability relative to the number of shares.

Key Performance Indicators (KPIs) 📊

Like-for-Like Growth: Reported at 8.3% for Q3, indicating healthy same-store sales growth, a critical indicator of retail health. This was bad for the last 2 Years, in fact it was (-3%) till H1.

Sales per Square Foot: This metric improved, demonstrating effective asset utilization and sales efficiency in existing store space. It reached 9317 Rs/Sqft from mere 8582 Rs/Sqft.

Profitability, Liquidity, Solvency, and Valuation Ratios 🔍

Profitability Ratios: The decrease in EBITDA and PAT margins suggests a tightening of profitability, possibly due to increased competition or higher cost pressures.

Solvency Ratios: DMart operates with a low level of debt, which is a good indicator of solvency and financial health.

Valuation at CMP of ₹3702: Given the Trail EPS to 41.8, the Price-to-Earnings (P/E) ratio is approximately 89, which suggests a premium valuation typical for high-growth retail companies.

Outlook 🌐

Near Term: The market may continue to pressure margins, especially with competitive discounting in key categories like FMCG. However, revenue growth is robust, supported by store expansions and an increase in sales density.

Long Term: Strategic initiatives like DMart Ready for e-commerce and continuous geographic expansion provide a strong growth trajectory. DMart Ready grew by 21.5% in 9 months FY 2025. In the rapidly evolving dynamics of the grocery ecommerce market, this segment is seeing significantly more demand for home delivery compared to pick-up point and hence they continue to align their business to that extent. Dmart home delivery business now far exceeds their pick-up point sales contribution. We will continue to provide both channels of delivery as an option to our shoppers in select towns. In several towns we now only operate ‘Home Delivery’ as a delivery channel. The leadership transition with Anshul Asawa taking over as CEO might bring fresh strategies and maintain the growth momentum.

Additional Insights 👥

Leadership Transition: Neville Noronha, the CEO, will step down in January 2026, and Anshul Asawa will take over. This transition is critical as leadership plays a pivotal role in retail strategies and execution.

This comprehensive analysis should provide investors with a deep understanding of DMart's current financial health, strategic positioning, and future outlook, aiding in informed investment decisions.