Bajaj Finance's Q3 FY25:

📊 Executive Summary

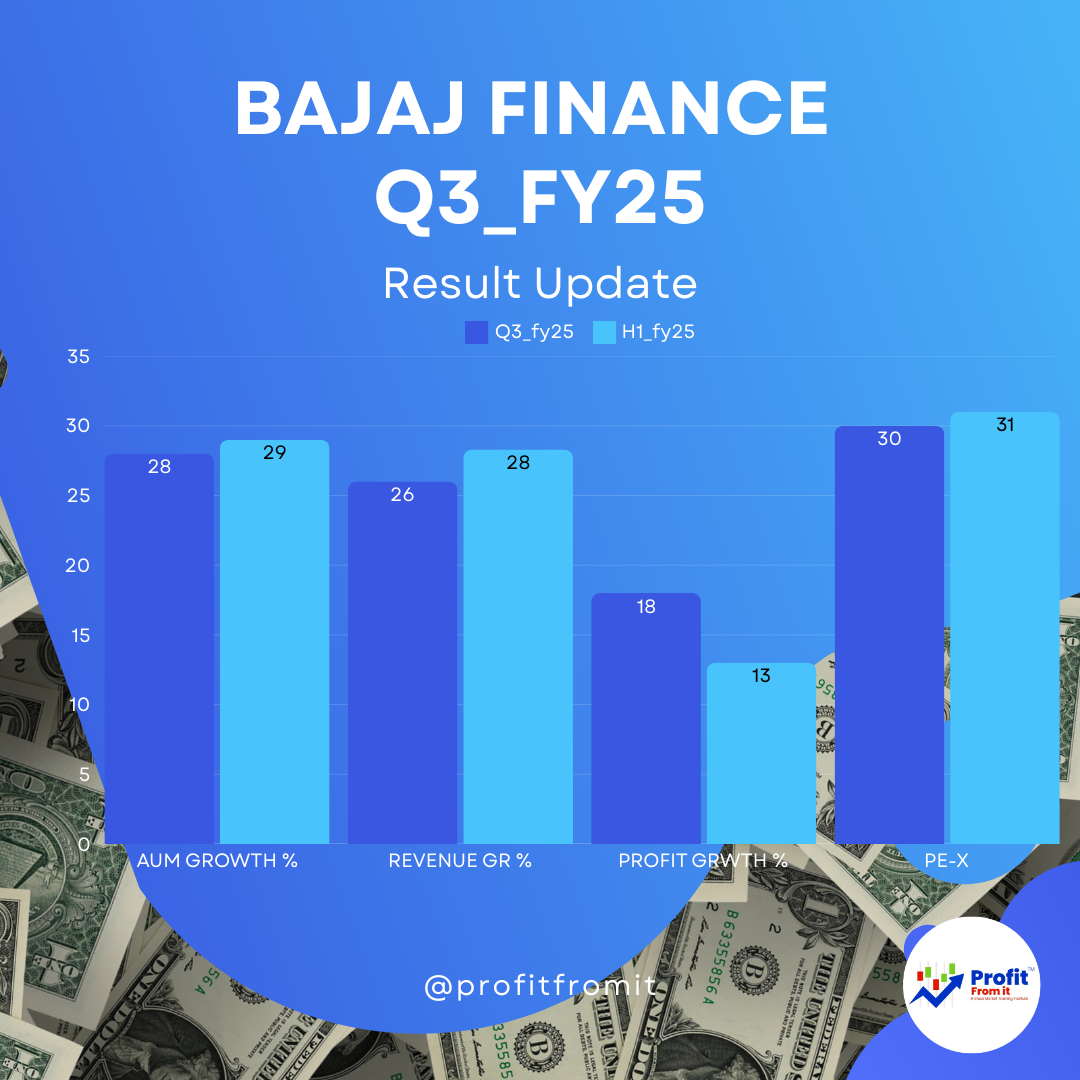

Assets Under Management (AUM) Growth: AUM saw a significant increase of 28% year-over-year, reaching ₹398,043 crore 📈.

Consolidated Revenue Growth: Total net income grew by 26% to ₹11,673 crore 💰.

Segment Share and Growth: The consumer business remains a strong driver, with robust growth in new customer acquisitions and cross-sell strategies 🛍️. Specific segment details were not provided.

Profit Margins:

Profit After Tax (PAT): Increased by 18% to ₹4,308 crore 💸.

Return on Equity (ROE): Declined from 22.0% in Q3 FY24 to 19.1% in Q3 FY25 ⬇️.

Return on Assets (ROA): Slightly decreased to 4.5% from 4.9% the previous year ⬇️.

📉 Key Financial Ratios

Gross NPA and Net NPA:

Gross NPA: Increased from 0.95% in Q3 FY24 to 1.12% in Q3 FY25 🚨.

Net NPA: Rose from 0.37% in Q3 FY24 to 0.48% in Q3 FY25 🚨.

Cost of Funds: Marginally decreased to 7.96% from previous quarters, indicating efficient capital management 📉.

Profitability, Solvency, and Liquidity:

Strong capital adequacy with a ratio of 21.57%, reflecting solid solvency 🏦.

Liquidity buffer stood at ₹13,656 crore, underscoring a robust liquidity position 💧.

Valuation Ratios at Current Market Price (CMP) of 7758:

This would typically involve Trail_EPS which reached 258.5 taking the Trail_PE to 30, while F_EPS is assumed 270 taking F_PE to 29. This is a Fair_PE for high growth companies like BajajFinance. 📊.

🔮 Near Term and Long Term Outlook

Near Term: Given the current economic environment, consumer spending trends, and the company's robust digital and physical presence, Bajaj Finance is well-positioned for sustainable growth, albeit mindful of rising NPAs 🌐.

Long Term: The strategic partnerships, like with Bharti Airtel, and ongoing digital transformations are likely to bolster its market position, diversify revenue streams, and enhance customer engagement 🤝.

This comprehensive financial performance review indicates that Bajaj Finance continues to expand aggressively but faces challenges with slightly increased credit risks, as evident from rising NPA levels. The company's strategic initiatives, especially in digital transformation and partnerships, are expected to strengthen its competitive edge and foster long-term growth.