📊 Godrej Properties Q3 FY25 Analysis 🏗️

1️⃣ Area Sold & Booking Value 📏💰

📐 Area Sold:

Q3 FY25: 4.07 million sq. ft.

9M FY25: The area sold was 18.21 million sq. ft., reflecting 📈 54% YoY growth.

💰 Booking Value:

Q3 FY25: ₹5,446 Cr

Q3 FY24: ₹5,733 Cr

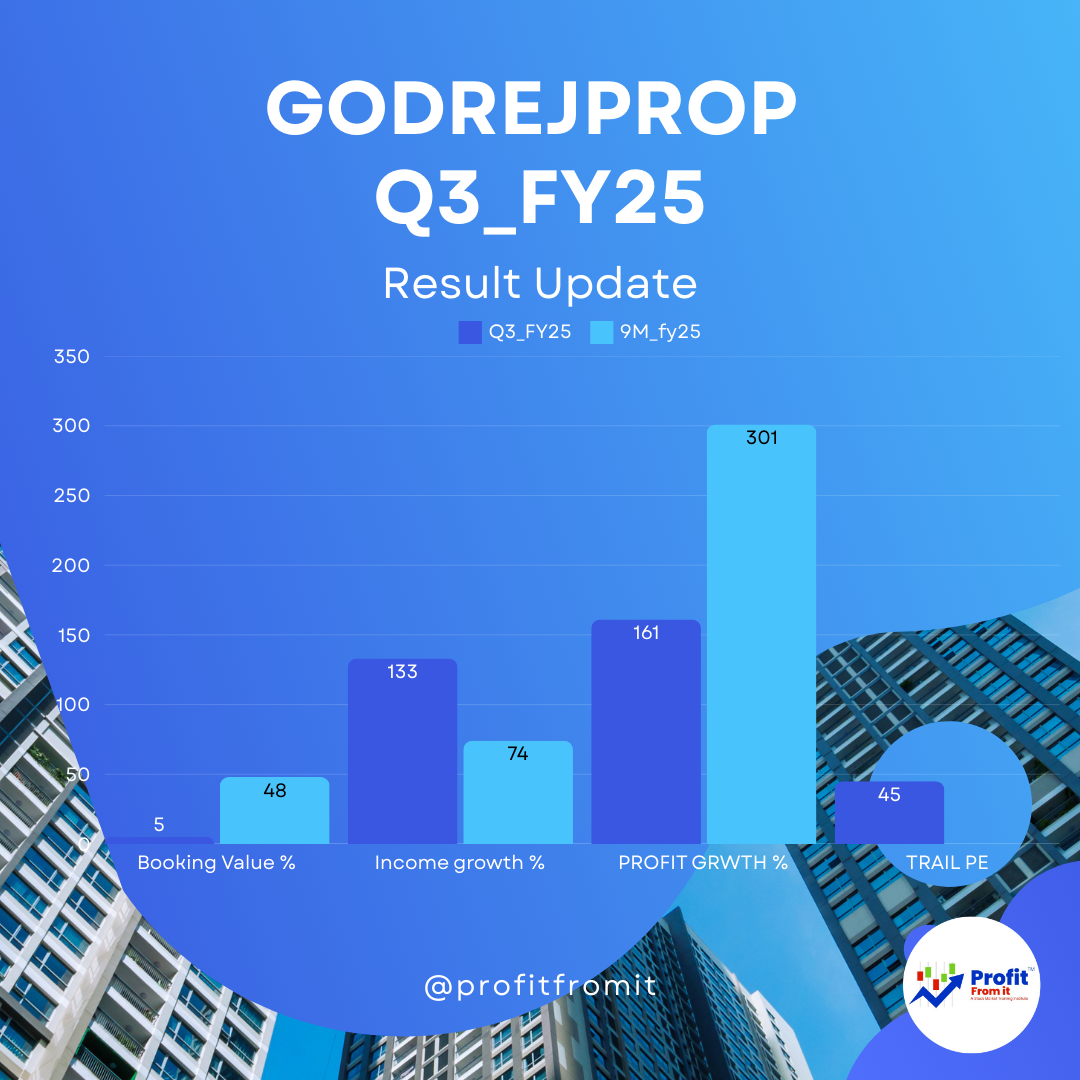

📉 5% YoY decline, but 📈 5% QoQ growth.

2️⃣ Consolidated Sales Growth 🚀📈

📊 Q3 FY25 vs Q3 FY24:

🏢 Total Income: ₹1,222 Cr (+133% YoY, from ₹524 Cr)

💵 EBITDA: ₹280 Cr (+85% YoY, from ₹152 Cr)

🏦 Net Profit: ₹163 Cr (+161% YoY, from ₹62 Cr).

📊 9M FY25 vs 9M FY24:

🏢 Total Income: ₹4,203 Cr (+74% YoY, from ₹2,410 Cr)

💵 EBITDA: ₹1,336 Cr (+144% YoY, from ₹548 Cr)

🏦 Net Profit: ₹1,018 Cr (+301% YoY, from ₹254 Cr).

3️⃣ Segmental & Geographical Performance 🌎📌

📍 Geographical Booking Value (9M FY25):

📍 Mumbai Metropolitan Region (MMR): ₹5,155 Cr (+104% YoY)

📍 Bengaluru: ₹4,807 Cr (+145% YoY).

🏗️ Segmental Performance (Q3 FY25 vs Q3 FY24):

🏠 Real Estate: PBT ₹216.02 Cr (vs ₹98.72 Cr) ✅

🏨 Hospitality: PBT ₹4.24 Cr (vs 📉 Loss ₹4.06 Cr).

4️⃣ Profit Margins & Profit Growth 💹💰

📊 Q3 FY25 vs Q3 FY24:

📈 Net Profit Margin: 12.95% (vs 24.85% last year)

📉 Operating Margin: 5.76% (vs 7.24%)

✅ Adjusted EBITDA Margin: 25.26% (vs 24.52%).

📊 9M FY25 vs 9M FY24:

💰 Net Profit Growth: +301% YoY to ₹1,018 Cr

📈 EPS Growth: ₹36.29 (vs ₹9.14, a 4x increase).

5️⃣ Profitability, Solvency, Liquidity & Valuation Ratios 🏦📊

📍 At CMP ₹2,390:

📉 P/E Ratio: With Trail EPS ₹53.4, the Trail P/E Ratio ≈ 44x, showing a little bit premium valuation but considering strong growth this earnings further can make company more cheaper.

📊 Key Financial Ratios:

📉 Debt-Equity Ratio (Gross): 0.88 (down from 1.25 in Q3 FY24)

📉 Debt-Equity Ratio (Net): 0.23 (down from 0.70)

✅ Current Ratio: 1.52 (vs 1.40 last year) – Improved Liquidity

📉 Total Debt to Assets: 0.28 (vs 0.32) – Lower Leverage.

6️⃣ Key KPIs for the Real Estate Industry 🏗️📈

✅ 📊 Bookings & Area Sold

✅ 💰 Cash Flow from Operations

✅ 🏦 Debt Levels & Interest Coverage

✅ 🏠 Project Pipeline & New Launches

✅ 📈 Pricing Power & ASP Growth

✅ 📊 Customer Advance & Pre-sales

7️⃣ Near & Long-Term Outlook 🌍🚀

🟢 Near-term: Strong demand, robust cash flow, and aggressive project launches will support steady growth.

🔵 Long-term: Sector tailwinds (urbanization, infrastructure push, rising disposable incomes) are favorable for sustained growth.

🎯 Final Verdict 📌

✅ Strong topline growth 📈

✅ Record-breaking bookings 🏢

✅ Improving profitability & lower leverage 🏦

🔶 Short-term concern: Slight decline in Q3 booking value YoY 📉

🟢 Long-term potential remains solid with expansion into key markets 🌏

📌 Godrej Properties remains a high-growth real estate player with strong fundamentals & a promising future! 🚀💰