Route Mobile's latest financial results for Q3 FY25:

Consolidated Financial Highlights 📊

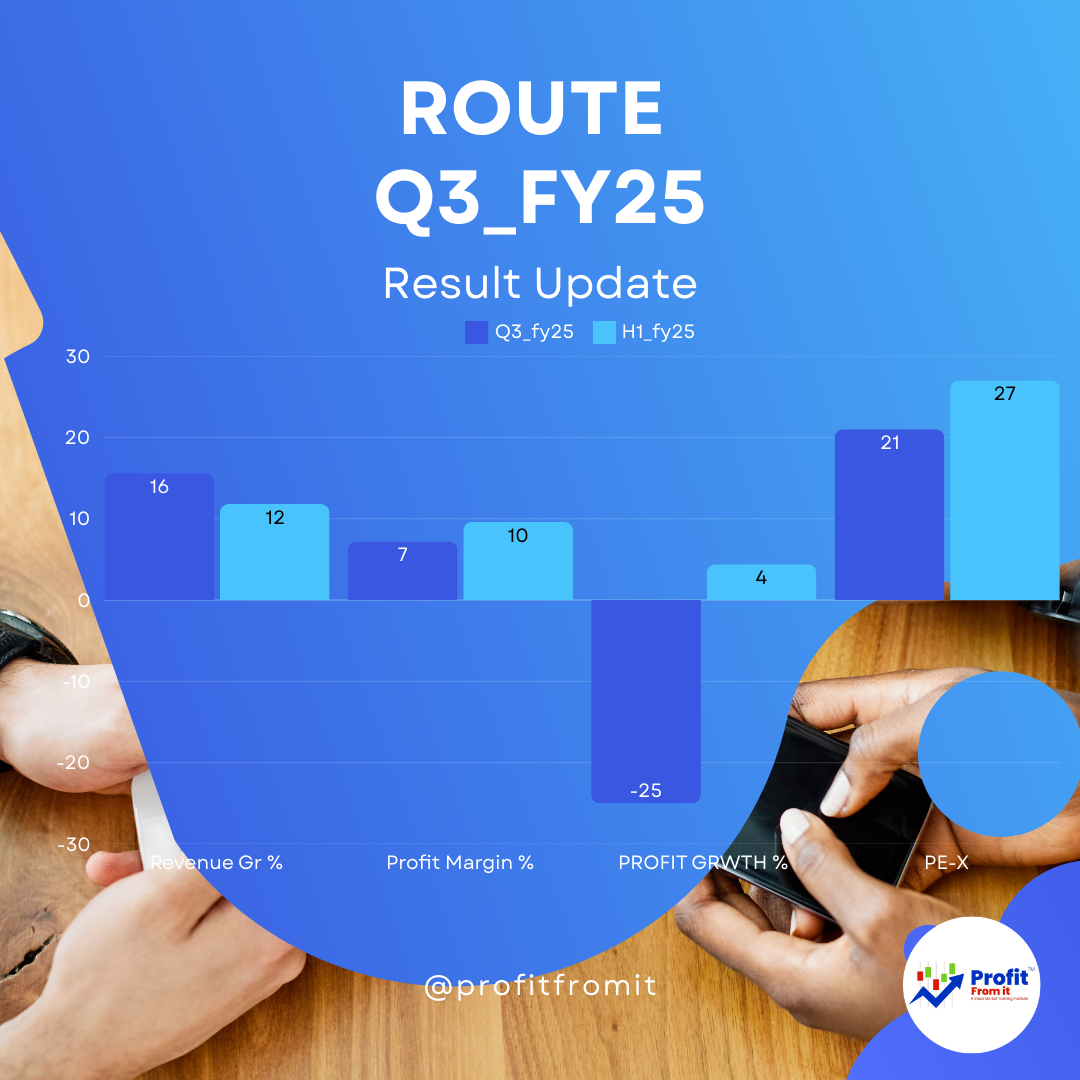

Revenue Growth: Revenue for Q3 FY25 stood at ₹1,183.79 crores, marking a sequential growth of 6.3% from Q2 FY25 and a year-over-year increase of 15.6% from Q3 FY24. 📈

Profit Margins: Profit after tax (PAT) for Q3 FY25 was ₹855 million showing the decline of 25%, with a margin of 7.2%, which is a decrease from 9.6% in Q3 FY24. 📉

EBITDA: The EBITDA for Q3 FY25 was ₹1,382 million, representing an EBITDA margin of 11.7%, slightly down from 12.1% in Q3 FY24. 💸

Segmental and Regional Revenue Growth 🌍

India Revenue: India contributed ₹235.96 crores in Q3 FY25, compared to ₹196.25 crores in Q3 FY24. 🇮🇳

Overseas Revenue: Overseas markets generated ₹1,119.81 crores in Q3 FY25, up from ₹935.43 crores in Q3 FY24. 🌐

Profitability Ratios at CMP of ₹1186 💹

Trail Earnings Per Share (EPS): The Trail EPS was ₹52.8 while F-EPS could be 52.8. 📊

Net Profit Growth: The consolidated net profit for the nine months ending December 2024 showed a year-over-year decline, down to ₹2,674 million from ₹2,786 million in the same period the previous year. 🔻

Liquidity, and Valuation Ratios: Route Mobile reported a net cash position of ₹7,457 million as of December 31, 2024, indicating strong liquidity. The valuation at the current market price reflects a Trail PE ratio of 21 based on annualizing the latest Trail EPS of 52.8, which appears competitive in the industry. 💰

Key Performance Indicators (KPIs) 📑

Billable Transactions: The company processed 117 billion billable transactions in the first nine months of FY25. 🧾

Customer Base: They maintain a diversified customer base, with significant contributions from the social/internet, edtech, and technology sectors. 👥

Outlook 🔮

Near-Term: Continued expansion in product offerings and partnerships, such as the launch of RCS-based services and enhancements in CPaaS capabilities, suggest positive momentum. 🚀

Long-Term: Strategic global expansions and increasing demand for digital communication solutions across various sectors bode well for sustained growth. 🌟

Challenges and Risks ⚠️

Competition: Intense competition in the CPaaS space could pressure margins.

Market Conditions: Fluctuations in foreign exchange rates and macroeconomic conditions could impact profitability.

This analysis reflects a solid performance in revenue growth and expansion activities, although there are challenges in improving profit margins and handling competitive pressures.