📊 Apollo Hospitals Q3FY25 & 9MFY25 Financial and Operational Analysis

1️⃣ Consolidated Sales Growth for Q3FY25 & 9MFY25 📈

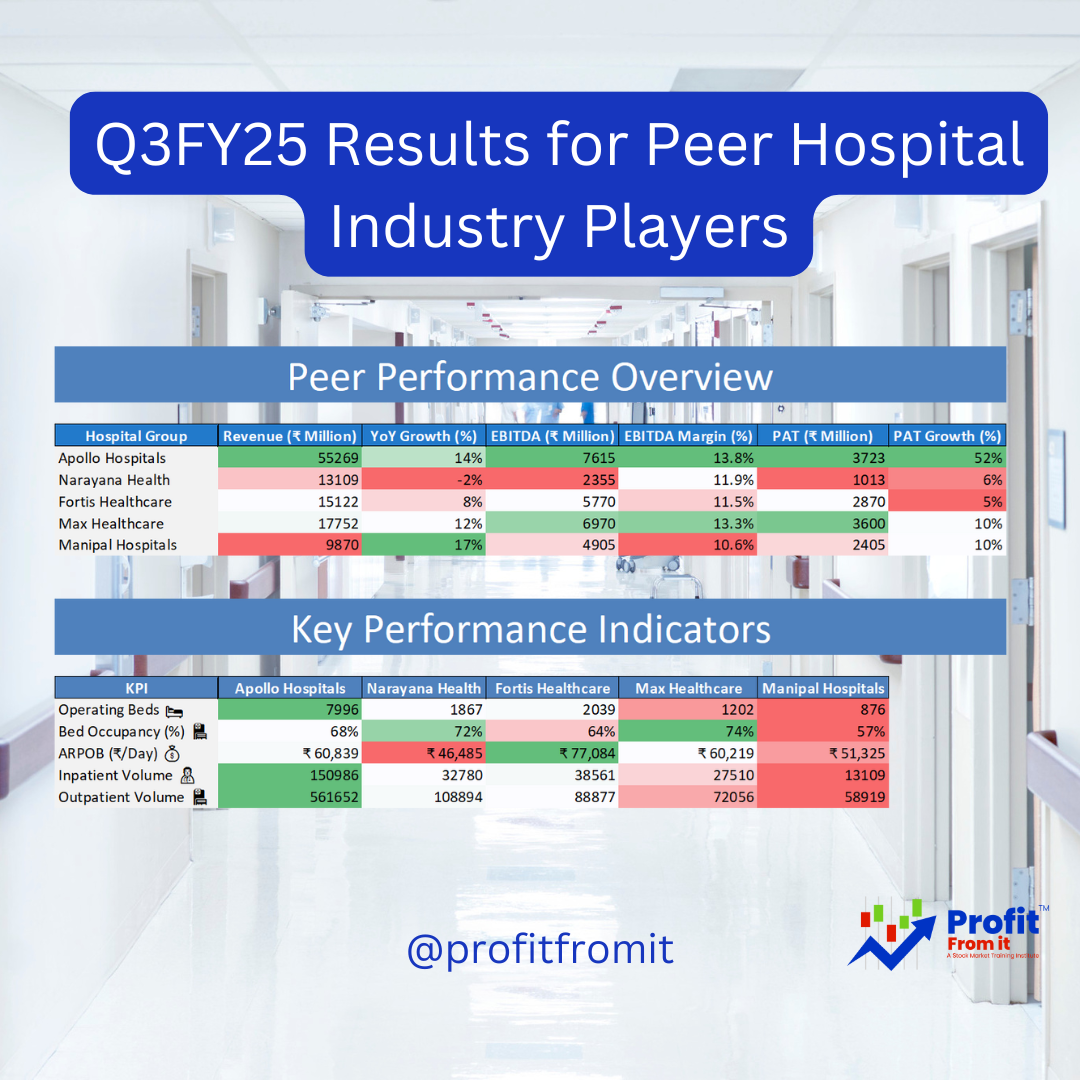

Q3FY25: Consolidated revenue stood at ₹55,269 million 📊, reflecting a 14% YoY growth 📊 compared to ₹48,506 million in Q3FY24.

9MFY25: Consolidated revenue for the nine months ended December 2024 reached ₹162,018 million 💰, marking a 15% YoY growth 📊 from ₹141,153 million in 9MFY24.

2️⃣ Segment Share & Sales Growth 📊

📌 Healthcare Services 🏥

Q3FY25 revenue: ₹27,850 million (+13% YoY 🔼)

9MFY25 revenue: ₹83,255 million (+14% YoY 🔼)

📌 Apollo Health & Lifestyle Ltd (AHLL - Diagnostics & Retail Health) 🏪

Q3FY25 revenue: ₹3,895 million (+15% YoY 🔼)

9MFY25 revenue: ₹11,596 million (+15% YoY 🔼)

📌 Apollo HealthCo (Pharmacy Distribution & Digital Health) 💊

Q3FY25 revenue: ₹23,524 million (+15% YoY 🔼)

9MFY25 revenue: ₹67,167 million (+16% YoY 🔼)

3️⃣ Profit Margins 📊 (Q3FY25 vs. Q3FY24 & 9MFY25 vs. 9MFY24)

📌 EBITDA Margins 🏦

Q3FY25: 13.8% 📈 vs 12.7% in Q3FY24.

9MFY25: 13.9% 📈 vs 12.4% in 9MFY24.

📌 PAT Margins 💰

Q3FY25: 12.5% 📊 vs 11.7% in Q3FY24.

9MFY25: 12.5% 📊 vs 11.8% in 9MFY24.

4️⃣ Consolidated Profit Growth 🚀

💡 Q3FY25: PAT stood at ₹3,723 million 🏦, a 52% YoY growth 🚀 from ₹2,453 million in Q3FY24.

💡 9MFY25: PAT rose to ₹10,563 million 🏦, marking a 64% YoY growth 🚀 from ₹6,448 million in 9MFY24.

5️⃣ Key Performance Indicators for Hospital Industry 🏥

📌 Operational Metrics 📊

🏥 Total operational beds: 7,996 🛏️, up 1.1% YoY 🔼.

📈 Bed Occupancy: 68% in Q3FY25 🛌, improved from 66% in Q3FY24.

👨⚕️ Inpatient Volume: 150,986 patients in Q3FY25, a 5.4% YoY increase 🏥.

🏥 Outpatient Volume: 561,652 in Q3FY25, growing 22.8% YoY 🏥.

📌 Revenue per Patient 💰

ARPOB (Average Revenue Per Occupied Bed): ₹60,839/day in Q3FY25, up 8% YoY 🔼.

Average Revenue Per Inpatient: ₹162,957 in Q3FY25, up 7% YoY 🔼.

6️⃣ Profitability, Solvency, Liquidity & Valuation Ratios 📊

📌 ROCE (Return on Capital Employed) 💰

29% in Q3FY25 📈.

📌 Debt Position 💵

Gross Debt: ₹27,455 million.

Net Debt: ₹1,374 million (after cash & cash equivalents of ₹23,785 million 💰).

📌 Earnings Per Share (EPS) 📉

Trail_EPS: ₹91.6 per share 📊

Trail_PE: ₹69X 📊. (High Valuations)

7️⃣ Near-Term & Long-Term Outlook 🔮

📌 Near-Term 🌟

✅ Strong revenue growth expected, driven by price and case mix improvements 📊.

✅ Expansion in digital health, pharmacy, and retail diagnostics 💊.

✅ Continuing cost optimization efforts, leading to margin expansion 📈.

📌 Long-Term 🚀

✅ Bed capacity expansion: 3,512 additional beds planned over the next 3-4 years 🏥.

✅ Strategic acquisitions and investments in AI-driven healthcare solutions 🤖.

✅ Focus on specialty care growth, particularly in oncology, cardiology, and transplant services 🩺.

🔍 Final Takeaway 🎯

Apollo Hospitals continues its strong growth trajectory, with double-digit revenue growth, margin improvements, and expanding patient volumes 📈. The planned capacity expansion 🏥 and digital transformation initiatives position it well for long-term growth 🚀.

📍 At CMP ₹6,354, valuation remains dependent on continued execution of growth strategies and cost efficiencies but still we should say they are high 💰.

🔥 A strong outlook for long-term investors! 🚀

📢 Disclaimer & Disclosure Statement

Important Investor Advisory Notice

This research analysis is for informational purposes only and should not be considered as financial, investment, or legal advice. The information provided herein is based on publicly available financial reports, market data, and our analysis. Investors are advised to exercise caution and discretion before making any investment decisions.

---------------------------------------------------------