📊 Patanjali Foods Limited Q3 FY25 Financial Analysis & Key Insights 🚀

1️⃣ Financial Highlights

📈 Sales Growth

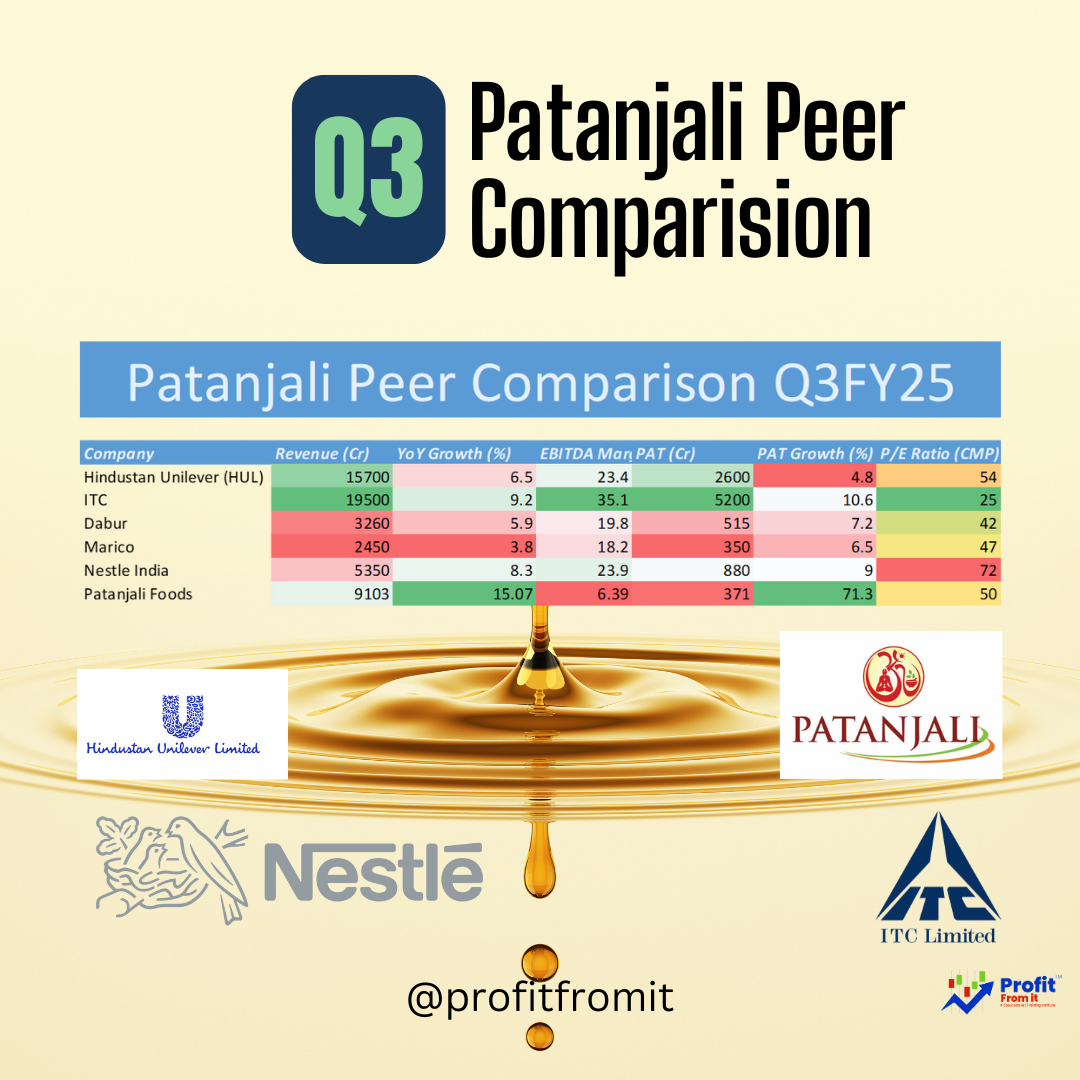

✅ Q3 FY25 Revenue from Operations: ₹9,103.13 Cr vs. Q3 FY24: ₹7,910.70 Cr → 📈 +15.07% YoY Growth

✅ 9M FY25 Revenue: ₹24,430.38 Cr

✅ Segment-wise Performance:

🌻 Edible Oils: ₹6,717.47 Cr (+22.5% YoY Growth ✅)

🥗 Food & FMCG: ₹2,037.61 Cr (📉 Down from ₹2,498.62 Cr in Q3 FY24)

🧴 Home & Personal Care (HPC): ₹420.36 Cr (📢 Newly Integrated)

🌍 Exports: ₹67.27 Cr (Sales in 29 Countries)

💰 Profit Margins & Growth

✅ Q3 FY25 EBITDA: ₹581.24 Cr (6.39% Margin) vs. ₹390.63 Cr in Q3 FY24 (🚀 +48.79% YoY Growth)

✅ 9M FY25 EBITDA: ₹1,510.17 Cr (6.18% Margin)

✅ Q3 FY25 PAT: ₹370.93 Cr (4.06% Margin) vs. ₹216.54 Cr in Q3 FY24 (🔥 +71.30% YoY Growth)

✅ 9M FY25 PAT: ₹937.78 Cr (3.84% Margin)

2️⃣ Profitability, Solvency, Liquidity & Valuation 📊

📊 Profitability Ratios

✔ Gross Profit (GP) Margin: Increased from ₹1,051.44 Cr to ₹1,482.00 Cr YoY 📈 (Strong edible oil margins 💪)

✔ EBITDA Margin: 6.39% (Q3 FY25) vs. 4.9% (Q3 FY24) 🚀

✔ PAT Margin: 4.06% (Q3 FY25) vs. 2.72% (Q3 FY24) 🔥

🏦 Solvency & Liquidity

📌 The company maintains a stable balance sheet ✅

📉 Valuation Ratios at CMP ₹1,853

Trail Earnings Per Share (EPS): ₹31.8 🏆

Trail Price-to-Earnings (Trail P/E) Ratio: ~58.3x 📈 (Premium Valuation ⚠)

Forward Earnings Per Share (FEPS): ₹37 🏆

Forward Price-to-Earnings (F_P/E) Ratio: ~50x 📈 (Premium Valuation but decreasing due to increased earnings ⚠)

Industry Comparison: Higher than traditional FMCG but in line with premium consumer brands 🤔

3️⃣ Key Business Highlights 🚀

🔥 Edible Oil Business

✔ Strong profitability: EBITDA of ₹364.24 Cr (vs. ₹107.67 Cr YoY 📈).

✔ Branded edible oils contribute 75% of total edible oil sales.

✔ Nutrela Oils growth 🚀: +41.9% YoY 🎯.

🍽️ Food & FMCG Performance

⚠ Sales Decline: Revenue down 📉 from ₹2,498.62 Cr (Q3 FY24) to ₹2,037.61 Cr (Q3 FY25) due to:

Commodity Price Pressure ⛔

Overall Weak Demand 💸

✔ Biscuits & Confectionery: ₹395.37 Cr (+1.64% YoY Growth 🍪).

✔ Honey sales doubled 📈 to ₹146.87 Cr.

✔ Ghee sales stable at ₹355.71 Cr 🧈.

✔ Nutraceuticals Revenue: ₹15.09 Cr (+6.88% YoY Growth 💊).

✔ Nutrela recognized as "Most Preferred Brand for 2024-25" 🏆.

🧼 Home & Personal Care (HPC) Integration

📌 Added ₹420.36 Cr in revenue post acquisition in Nov 2024.

📢 Marquee Products: Dant Kanti 🦷, Saundarya 💆♀️, Herbal Wash 🌿, Kesh Kanti 🧴.

📌 Advertising spend increased to 2.50% of revenue 📢.

🌴 Oil Palm Plantation Expansion

✔ Total area under plantation: 87,109 hectares 🌿 (46.3% mature).

✔ 6,157 hectares added in Q3 FY25 🌱.

✔ New Oil Mills in Arunachal Pradesh & Mizoram 🏭.

📢 Marketing & Branding

✔ Celebrity Endorsements 🎤:

MS Dhoni 🏏 (Mahakosh & Sunrich).

Shilpa Shetty 🧘♀️ (Wellness).

Shahid Kapoor 🎬 (Nutrela).

Khesari Lal Yadav 🎤 (Regional Outreach).

4️⃣ Near-Term & Long-Term Outlook 🔮

📉 Near-Term (1-2 Quarters)

⚠ Challenges:

❌ Weak FMCG Demand (Urban consumption slowdown) 💸.

❌ Commodity Price Volatility (Edible oils, wheat, sugar) 📉.

❌ Higher Marketing & Advertising Spend (May impact short-term profitability) 📢.

✅ Opportunities:

✔ Edible Oils remain a strong driver 💪.

✔ HPC integration can improve margins 💰.

✔ Increased market penetration via celebrity branding 📢.

🚀 Long-Term (1-3 Years)

📌 Growth Drivers:

✔ Transition into a full-scale FMCG giant 🏭.

✔ Oil palm plantations offer long-term cost benefits 🌱.

✔ E-commerce & modern trade expansion 📦.

✔ Export market expansion 🌍.

⚠ Risks & Challenges:

❌ Heavy dependence on Edible Oil (~75% of revenue) 🏭.

❌ Regulatory risks in FMCG (Food Safety, Ad Bans, etc.) 🚫.

❌ High Competition from FMCG giants (HUL, ITC, Dabur, Nestlé) ⚔.

🎯 Final Verdict

✅ Short-term: Strong profit growth 🔥 led by Edible Oils, but weak FMCG demand ⛔ remains a concern.

✅ Long-term: Transitioning into a pure-play FMCG player 🎯 with brand investments, HPC integration, & oil palm expansion 🌿.

✅ Valuation Check: At ₹1,853, the stock is trading at ~58x P/E. Expensive vs. peers, but high growth potential 🌟.

📢 Disclaimer & Disclosure Statement

Important Investor Advisory Notice

This research analysis is for informational purposes only and should not be considered as financial, investment, or legal advice. The information provided herein is based on publicly available financial reports, market data, and our analysis. Investors are advised to exercise caution and discretion before making any investment decisions.

Class Sessions

1- IREDA’s latest quarterly results

2- Patanjali's Q2 FY25 financials

3- United Breweries Limited - Detailed Q2 FY25 Consolidated Financial Analysis

4- HDFC LIFE Q1 FY 2025

5- DMart Q1 FY 2025

6- HDFC LIFE Q1 FY 2025

7- Bajaj Auto Q1 FY24 Analysis

8- IREDA Q1 FY 2024

9- TCS Q1 FY 2025

10- HDFC Asset Management Company (HDFC AMC) Q1 FY25 Analysis

11- BAJAJ FINANCE | BEL | VOLTAS | LT | MARUTI SUZUKI Q3 Result Update 2024

12- How do you Analyse NBFC companies?

13- Which company is best for home appliances?

14- Who is No 1 construction company in India?

15- Aerospace & Defense Industry

16- Passenger Vehicle Market Share

17- Which is the No 1 small finance bank in India?

18- What is the position of steel market in India?

19- Tyres & Rubber Products INDUSTRY

20- Computers-Software & Consulting_q3_fy24

21- Which is the best stock in Consumer Food? Watch Now

22- Auto Sector Vehicle January Data

23- Telecom Industry in India: Sector Overview

24- Comparision: Reliance Retail | Dmart | ShoppersStop | Spencer | Vmart

25- ICICI GI, Supreme Industry, Asian Paint & Ultratech Cement | Q3 FY2024 Result Update

26- TCS, Dmart, HDFC AMC & HDFC LIFE Q3 FY2024 Result Update

27- LTTS, MAPMYINDIA, HDFC BANK Q3 FY2024 Result Update

28- Hospital Industry Analysis

29- Industry Update

30- Tata Consultancy Services Ltd Q4 Result Update 2023

31- Ultratech Cement Latest News | Q4 Result 2023

32- Q4 Result 2023

33- Q3 Result Update 2023

34- Q3 2021-22 RESULT UPDATE Video Updated

35- Q3 2021-22 RESULT UPDATE Video Updated - Part 2

36- Q2 2021-22 RESULT UPDATE Video Updated

37- Q2 2021-22 RESULT UPDATE Video Updated Part 2

38- Result Updated Video

39- Student Page Video

40- Live Query Sessions Video Updated

41- TCS's Q3 FY25: (Leading Company from Computers - Software & Consulting Industry)

42- TATAELXSI's Q3 FY25:

43- IREDA's Q3 FY25:

44- Avenue Supermarts Limited's (DMart) financial results for the third quarter ended December 31, 2024:

45- HDFC Asset Management Company's financial results for Q3 FY25:

46- HDFC Life Q3 FY25 Analysis 📊

47- L&T Technology Services Q3 FY25

48- Havells Q3 FY25 Analysis 📊

49- Reliance Industries' Financial Results for Q3 FY25 📊

50- ICICI Lombard's performance for Q3 FY25”

51- Q3 FY25 Supreme Industries Ltd. 📊

52- Indian Railway Finance Corporation Limited (IRFC) for Q3 FY25:

53- Zomato's Q3 FY25 financial results:

54- Dixon Technologies (India) Ltd. Q3 FY25 Results 📊

55- HDFC BANK Q3 FY25 Results 📊

56- Hindustan Unilever Q3 FY25 Results 📊

57- Pidilite Industries Limited's Q3 FY25:

58- UltraTech Cement Limited for the third quarter (Q3) and the first nine months (9MFY) of the financial year 2025:

59- Indian Energy Exchange (IEX) Q3 FY25:

60- AU Small Finance Bank Limited's Q3 FY25:

61- Indigo Airlines' performance for Q3 FY25: Overview: 🚀

62- Balkrishna Industries Q3 FY25 Performance Analysis 📊

63- CDSL's financial results for Q3 FY25: Key Insights and Highlights

64- EMS Limited's financial results for Q3 FY25:

65- JSW Steel's Q3 FY25 financial performance:

66- Wonderla Holidays Limited Q3 FY25 Analysis 📊

67- Bajaj Housing Finance's latest results for Q3 FY25;

68- Route Mobile's latest financial results for Q3 FY25:

69- Bajaj Auto Q3 FY25 Consolidated Financial Analysis:

70- Maruti Suzuki India Limited (MSIL) - Q3 FY25 Financial Highlights and Analysis 📊

71- Q3 FY25 results for C.E. Info Systems Limited (MapMyIndia)

72- Bajaj Finance's Q3 FY25: 📊

73- Voltas' Q3 FY25 financial results:

74- 📢 BEL Q3 FY25 Results – Key Insights & Analysis 🚀

75- 📊 Waaree Energies Q3 FY25 and 9M FY25 Performance Analysis 🚀

76- 📊 Dr Lal PathLabs - Q3 FY25 & 9M FY25 Financial Analysis & Insights 🚀

77- Larsen & Toubro Q3 FY 25: 🚀📊📈

78- 📊 Analysis of Tata Consumer Products Q3 FY25 & 9M FY25 Results 📈

79- 📊 Manyavar (Vedant Fashions Ltd.) Q3 FY25 Earnings

80- Nestlé India Q3 FY25 results:

81- 📢 Divis Laboratories Q3 FY25 & 9M FY25 Results - 📊💡

82- 🎨 Asian Paints Q3 FY25 & 9M FY25 Financial Analysis & Insights 📊

83- 📊 Godrej Properties Q3 FY25 Analysis 🏗️

84- 📊 Kajaria Ceramics Q3 FY25 Analysis 📊

85- 📊 Titan Q3 FY25 & 9M FY25 Performance Analysis 🔥🚀

86- 🚀 InfoEdge Q3FY25 Results Analysis & Insights 📊

87- 📊 Page Industries Q3 FY25 Analysis & Investment Insights 🏭📈

88- 📢 SBI Q3FY25 Earnings Analysis & Insights 📊🏦

89- 📊 PI Industries Q3 FY25 Results - Analysis & Insights 🔍

90- 🚀 Amara Raja Batteries (ARE&M) Q3 FY25 Results Analysis and Insights 📊

91- 📊 Affle (India) Limited Q3 & 9M FY2025 Earnings Analysis & Insights 🚀

92- 📊 Patanjali Foods Limited Q3 FY25 Financial Analysis & Key Insights 🚀

93- 📊 Apollo Hospitals Q3FY25 & 9MFY25 Financial and Operational Analysis

94- 🚄 IRCTC Q3FY25 Earnings Analysis & Insights 📊💡

95- 🎯 Jubilant FoodWorks Q3FY25 & 9MFY25 Key Highlights 🚀🔥

96- 📊 UBL Q3 FY25 & 9M FY25 Performance Analysis – Investor Insights 💹

97- 🚢 Mazagon Dock Shipbuilders: Q3FY25 & 9MFY25 Analysis

98- 📈 TCS FY25 Results: Muted CC Growth, Hence Low Sales & Profit Growth in Headwind Environment, but valuations near to favourable.

99- 🔋 IREDA Q4FY25 Results: Powered by Growth, Poised for the Future

100- 📊 ICICI Lombard General Insurance – FY25 & Q4 FY25 Results Update

101- 🔍 HDFC AMC Q4FY25 & FY25 Results: Strong Performance, Robust Growth & Healthy Margins

102- 📈 HDFC Life FY25 Results: Strong Growth, Steady Profits & Enhanced Market Position

103- 📊 Tata Elxsi Q4FY25 & FY25 Review: Growth Foundations Amidst Headwinds

104- 🔍 HDFC Bank – FY25 & Q4FY25 Results Highlights

105- 📊 Havells FY25 Results Analysis: Robust Growth with Strategic Resilience

106- Waaree Energies Ltd. (WAAREEENER) FY25 Results Update & Investor Insights

107- 📊 AU Small Finance Bank Q4 & FY25 Results – Growth Anchored by Profitability & Prudent Risk Management

108- Bajaj Housing Finance Ltd. – FY25 Financial Performance Highlights and Analysis

109- Tata Consumer FY25 & Q4FY25 Summary: Strong Growth with Margin Recovery on the Horizon

110- L&T Technology Services (LTTS) Q4 FY25 & FY25 Results Analysis

111- Hindustan Unilever Limited (HUL) FY25 & Q4FY25 Results Update

112- 📊 Nestlé India Limited – FY25 & Q4FY25 Results Analysis

113- 📊 IEX FY25 and Q4FY25 Results Analysis

114- Supreme Industries Limited – FY25 Financial Results Update

115- Maruti Suzuki FY25 Results Update: Key Insights and Strategic Highlights

116- Reliance Industries Limited – FY25 Results Update

117- UltraTech Cement FY25 Results Update: Driving Consolidated Growth Amidst Strategic Expansions

118- Bajaj Finance Limited – Q4FY25 and FY25 Financial Results Update

119- 📊 Eternal Limited – Q4FY25 & FY25 Financial and Strategic Performance Update

120- 🏢 Godrej Properties Q4 & FY25 Result Analysis: Booking Boom & Financial Resilience

121- 🧾 DMart Q4 FY25 & FY25 Result Highlights – Resilient Growth Amid Operational Pressures

122- 📊 CDSL Q4 & FY25 Result Analysis

123- 📊 Kajaria Ceramics Q4 FY25 Results Analysis 📈

124- Manyavar (Vedant Fashions Limited) Q4 FY25 Financial Analysis

125- Wonderla Holidays Q4FY25 & FY25 Financial Analysis: Strong Footfalls Despite Market Headwinds

126- 📊 Voltas Q4 FY25 Financial Analysis: Detailed Investor Insights

127- 📊 Route Mobile Q4 FY25 & FY25 Financial Analysis

128- United Breweries Limited (UBL) Q4 FY25 Financial Analysis

129- Asian Paints Q4 FY25 Financial Analysis: Detailed Investor Insights

130- Pidilite Industries Q4 FY25 Financial Analysis

131- Larsen & Toubro (L&T) Q4 FY25 & FY25 Financial Analysis

132- 📊 Titan Company Ltd. Q4 FY25 & FY25 Financial Performance Analysis

133- Affle 3I Q4 & FY25 Results: Strong Growth

134- Divi's Laboratories Q4 & FY25 Results: ₹2,209 Cr Profit, ₹30 Dividend, CMP ₹6,539 | Long-Term Outlook & Valuation

135- ITC Hotels Q4 & FY25 Results: 73% Profit Growth | ₹202 CMP Valuation & Expansion Outlook

136- Patanjali Foods Q4 FY25 Results: 70% PAT Growth | Highest Ever Revenue Achieved

137- Jubilant FoodWorks Q4 & FY25 Results: Delivery Growth, Store Expansion & Financial Insights

138- 🚗 MapmyIndia Q4 FY25 & FY25 Results: Strong Momentum in Tech & Mobility

139- 🧾 Page Industries Q4 & FY25 Result Update Brand:

140- 🇮🇳 Bharat Electronics Ltd – Q4 & FY25 Financial Results & Investor Insights 🔍

141- 🔬 PI Industries Ltd – Q4 & FY25 Results Review | Growth, Margins, and Outlook

142- 📊 Dixon Technologies (India) Ltd – Q4 FY25 & FY25 Financial Results Analysis

143- 🧬 Dr. Lal PathLabs Q4 & FY25 Results: Strategic Growth Beyond Metro Markets

144- 🛫 IndiGo Q4 FY25 Results: Record Profits, Rising Passengers & Strong Outlook

145- 🚜 Balkrishna Industries Ltd – Q4 & FY25 Results Update: Strong Long-Term Strategy Despite Soft Q4

146- Info Edge (India) Ltd. Q4 FY25 & FY25 Results Analysis: Detailed Investor Insights

147- 📊 Bajaj Auto Q4 FY25 & FY25 Financial Highlights: Growth, Resilience, & Green Momentum

148- IRCTC Q4 & FY25 Results: Insights for Investors

149- 🚢 Mazagon Dock Q4 & FY25 Results:

150- 🏥 Apollo Hospitals FY25 Results: Strong Performance Backed by Expansion Plans

151- United Breweries Ltd (UBL) Q4 & FY25 Results Analysis: Brewing Growth with Consistency