Nestlé India Q3 FY25 results:

📢 Nestlé India Q3 FY25 Results - Key Highlights

🔹 Total Sales: ₹4,762.1 crore

🔹 Sales Growth: 3.9% YoY

🔹 Domestic Sales Growth: 3.3% YoY

🔹 Net Profit: ₹696.1 crore

🔹 Earnings Per Share (EPS): ₹7.22

🔹 Profit from Operations Margin: 20.3% of sales

📊 Volume & Sales Growth

✅ Volume Growth: Positive in key segments

✅ MAGGI noodles: Returned to credible volume growth

✅ NESCAFÉ: Added 3.7 million households to the coffee category

✅ E-commerce & Quick Commerce: Boosted sales significantly

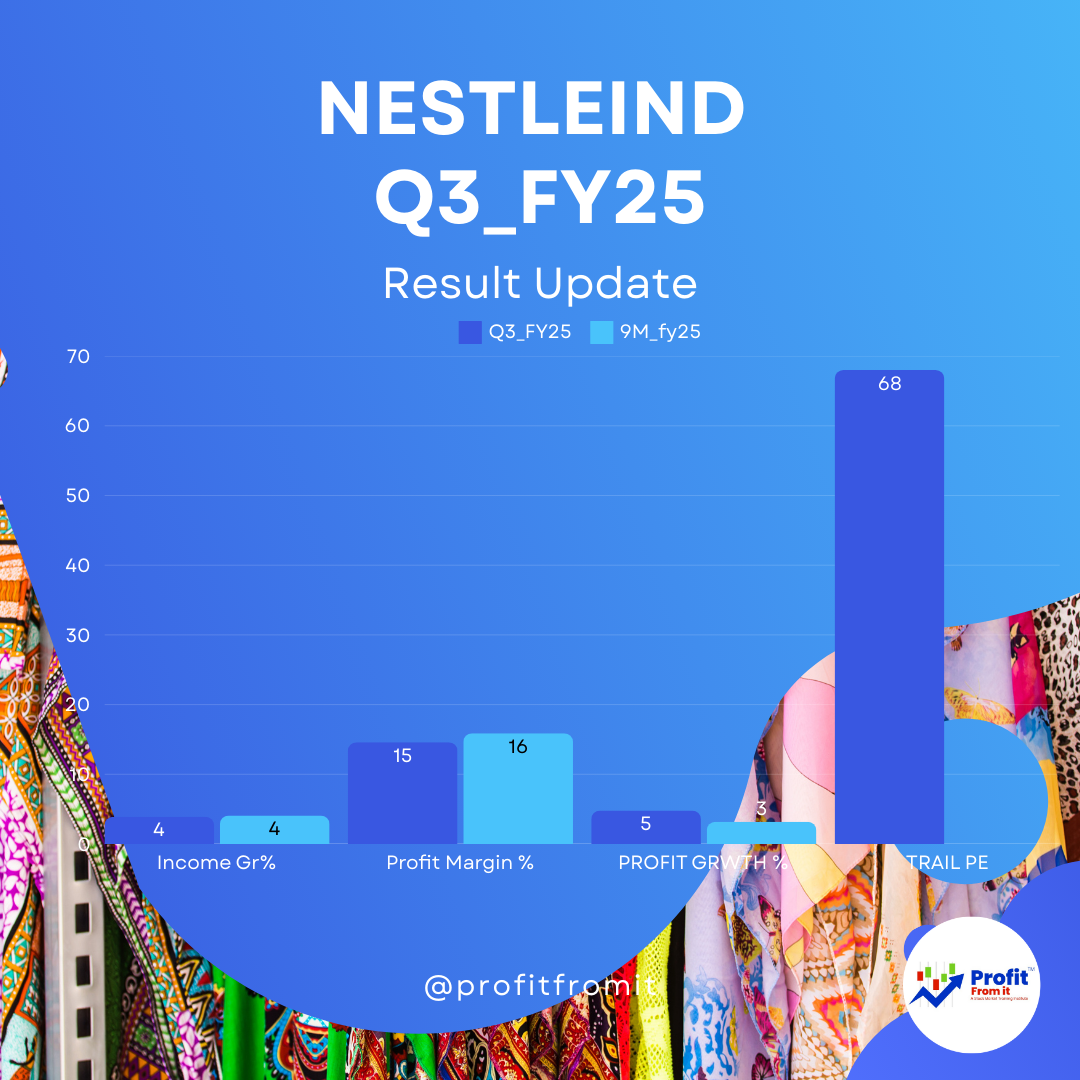

🔹 Q3 FY25 Sales Growth: 3.9% YoY

🔹 9M FY25 Sales Growth: 4.1% YoY

💼 Segment-Wise Performance

📌 Product-Wise Sales Growth

✅ Prepared Dishes & Cooking Aids: High single-digit growth 📈 (Led by MAGGI noodles)

✅ Confectionery: Strong growth 🍫 (KITKAT double-digit growth)

✅ Beverages (NESCAFÉ): High double-digit growth ☕ (₹2,000+ crore annual revenue)

✅ Milk Products & Nutrition: 📦 Festive demand boosted MILKMAID sales

✅ Petcare: 🐶 Highest-ever growth (Led by Friskies & Felix)

🔹 Market Share Gains:

NESCAFÉ strengthened leadership 🚀

MAGGI noodles expanded regional presence 🍜

KITKAT drove premium growth 🥇

💰 Profit Margins - Q3 FY25 vs. Q3 FY24

🔻 Gross Profit Margin: Declined (Higher input costs 📈 - coffee, cocoa, cereals)

🔹 EBITDA Margin: 20.3% (Stable, but cost pressures exist)

🔹 Net Profit Margin: 14.6% (Slight decline due to inflation)

📈 Consolidated Profit Growth (Q3 & 9M FY25)

🔹 Q3 FY25 Net Profit: ₹696.1 crore

🔹 9M FY25 Net Profit: ₹2,342.8 crore

🔻 YoY Decline in Profitability due to higher input costs 📊

📊 Financial Ratios (Profitability, Solvency, Liquidity & Valuation)

🟢 Profitability Ratios

✅ EBITDA Margin: 20.3%

✅ Net Profit Margin: 14.6%

✅ ROE (Return on Equity): ~70%+ 🚀 (Very strong)

✅ ROCE (Return on Capital Employed): ~95%

🟡 Solvency Ratios

✅ Debt-to-Equity Ratio: 0.02x (Minimal debt 💪)

✅ Interest Coverage Ratio: ~25x (Strong)

🟢 Liquidity Ratios

✅ Current Ratio: ~1.6x (Healthy liquidity 💧)

✅ Quick Ratio: ~1.2x (Comfortable)

🔴 Valuation Ratios at CMP ₹2,316

❌ Trail EPS: 33.9

❌ P/E Ratio: ~68.4x (Expensive compared to FMCG peers)

❌ EV/EBITDA: ~40x (High valuation, premium pricing)

📉 Challenges & Risks

❌ Input Cost Inflation 🛑 (Coffee, Cocoa, Cereals impacting margins)

❌ Slower Rural Demand Recovery 🚜

❌ High Valuation (P/E 68x) 📊 Expensive compared to peers

📈 Outlook - Near-Term & Long-Term

📍 Near-Term Outlook (6-12 Months)

✅ Premiumization trend in NESCAFÉ, KITKAT ☕🍫

✅ E-commerce & Quick Commerce expansion 🚀

✅ Strong brand loyalty & pricing power

❌ Food inflation pressure remains high 📊

❌ Rural demand yet to fully recover 🚜

📍 Long-Term Outlook (2-5 Years)

✅ Tier-2, Tier-3 expansion 🚀

✅ Sustainable growth through premium & health segments 🏋️♂️

✅ ₹5,800 crore Capex expansion for manufacturing 🏭

✅ Sustainability push (Methane reduction, eco-friendly sourcing) 🌱

📌 Final Verdict

✅ Positives:

✔️ Market Leadership in Coffee, Confectionery, Instant Foods ☕🍫🍜

✔️ Strong Brand Loyalty and Pricing Power

✔️ Expanding into Premium & Health Categories

✔️ Debt-Free Balance Sheet & Strong ROE/ROCE

❌ Risks:

⚠️ High Valuation (P/E 68x) - Expensive Stock 📊

⚠️ Input Cost Inflation Pressuring Margins 📈

⚠️ Rural Consumption Slower Than Expected 🚜

📊 Investment Perspective

📌 Short-Term (6-12 months): 🚨 Moderate Upside, Valuation Risk High

📌 Long-Term (2-5 years): ✅ Strong Growth Potential with Premiumization

📢 Disclaimer & Disclosure Statement

Important Investor Advisory Notice

This research analysis is for informational purposes only and should not be considered as financial, investment, or legal advice. The information provided herein is based on publicly available financial reports, market data, and our analysis. Investors are advised to exercise caution and discretion before making any investment decisions.