Reliance Industries' Financial Results for Q3 FY25 📊

Revenue Growth 💹

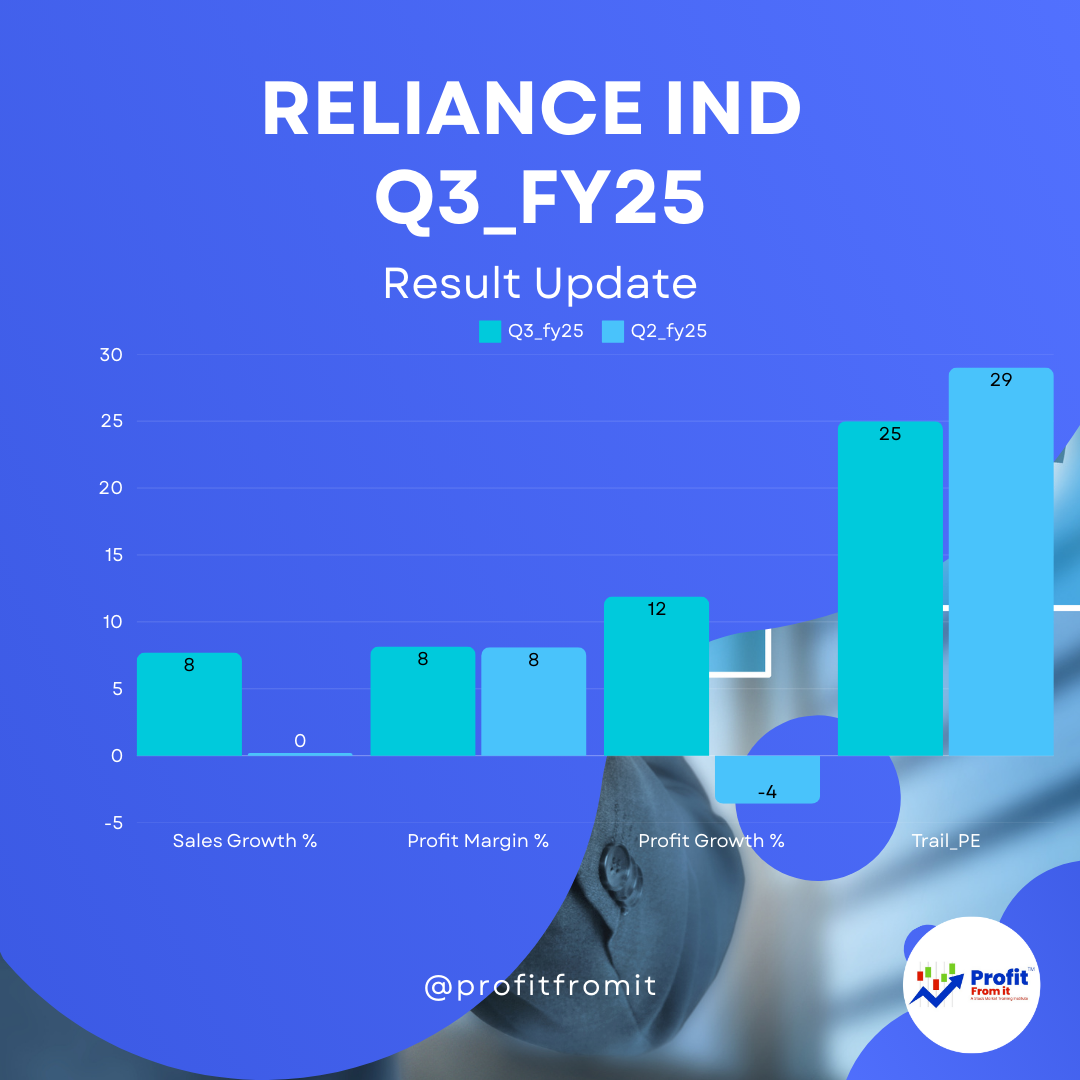

Total Consolidated Revenue: ₹267,186 crore, an increase of 7.7% YoY 📈. Improvement from 0.2% growth seen in Q2.

Digital Services Revenue: 19.2% YoY growth mainly due to tariff hikes and growth in home and digital services 🌐.

Retail Revenue: Increased by 8.8% YoY driven by festive and wedding season buying 🛍️.

Total Consolidated Revenue: ₹267,186 crore, an increase of 7.7% YoY 📈. Improvement from 0.2% growth seen in Q2.

Digital Services Revenue: 19.2% YoY growth mainly due to tariff hikes and growth in home and digital services 🌐.

Retail Revenue: Increased by 8.8% YoY driven by festive and wedding season buying 🛍️.

Profitability 💸

Consolidated Profit After Tax (PAT): ₹21,930 crore, up by 11.7% YoY 📊. Improvement from -3.6% growth seen during Q2 results.

Digital Services PAT: ₹6,857 crore, up by 25.9% YoY 📱.

Retail PAT: ₹3,485 crore, up by 10.1% YoY 🏪.

Consolidated Profit After Tax (PAT): ₹21,930 crore, up by 11.7% YoY 📊. Improvement from -3.6% growth seen during Q2 results.

Digital Services PAT: ₹6,857 crore, up by 25.9% YoY 📱.

Retail PAT: ₹3,485 crore, up by 10.1% YoY 🏪.

EBITDA Performance 📈

Consolidated EBITDA: ₹48,003 crore, a 7.8% increase YoY.

Digital Services EBITDA: Increased by 18.8% YoY.

Retail EBITDA: Up by 9.5% YoY.

Consolidated EBITDA: ₹48,003 crore, a 7.8% increase YoY.

Digital Services EBITDA: Increased by 18.8% YoY.

Retail EBITDA: Up by 9.5% YoY.

Segmental Insights 🧩

Oil to Chemicals (O2C): Revenue up by 6% YoY due to higher volumes and domestic product placements 🛢️.

Oil and Gas: Revenue down by 5.2% due to lower volumes and price realisations ⛽.

Oil to Chemicals (O2C): Revenue up by 6% YoY due to higher volumes and domestic product placements 🛢️.

Oil and Gas: Revenue down by 5.2% due to lower volumes and price realisations ⛽.

Financial Ratios and Debt Metrics 📉

Net Debt to EBITDA Ratio: Improved to 0.60 from 0.67 last year, demonstrating better debt management 💰.

Finance Costs: Rose by 6.7% YoY to ₹6,179 crore, indicating an increase in the cost of borrowing despite a largely flat net debt due to increased Interest Rates and appreciated USD💳.

Net Debt to EBITDA Ratio: Improved to 0.60 from 0.67 last year, demonstrating better debt management 💰.

Finance Costs: Rose by 6.7% YoY to ₹6,179 crore, indicating an increase in the cost of borrowing despite a largely flat net debt due to increased Interest Rates and appreciated USD💳.

Strategic and Operational Highlights 🔍

Digital Services: Sustained subscriber growth with a significant increase in ARPU (Average Revenue Per User) to ₹203.3, attributed to tariff hikes and a favorable subscriber mix 📞.

Retail: Significant growth in footfalls and transactions due to strong consumer demand and strategic store expansions 🛒.

O2C: Stability in performance, supported by feedstock optimisation and a rebound in refining margins 🏭.

Oil and Gas: Slight decrease in EBITDA due to reduced production volumes, partially offset by higher price realizations 📉.

Digital Services: Sustained subscriber growth with a significant increase in ARPU (Average Revenue Per User) to ₹203.3, attributed to tariff hikes and a favorable subscriber mix 📞.

Retail: Significant growth in footfalls and transactions due to strong consumer demand and strategic store expansions 🛒.

O2C: Stability in performance, supported by feedstock optimisation and a rebound in refining margins 🏭.

Oil and Gas: Slight decrease in EBITDA due to reduced production volumes, partially offset by higher price realizations 📉.

Long-Term and Near-Term Outlook 🌐🔮

Near-Term: Expect continued growth in digital and retail segments, leveraging recent tariff revisions and expanding service networks 🚀.

Long-Term: Strategic investments in technology and energy sectors, such as the acquisition of Reliance New Energy Battery Limited, are expected to foster growth in new business areas and enhance Reliance's market position in renewable and digital services 🔌🌿.

This comprehensive financial performance overview reflects a robust growth trajectory for Reliance Industries, driven by both its traditional and new age business segments.

Near-Term: Expect continued growth in digital and retail segments, leveraging recent tariff revisions and expanding service networks 🚀.

Long-Term: Strategic investments in technology and energy sectors, such as the acquisition of Reliance New Energy Battery Limited, are expected to foster growth in new business areas and enhance Reliance's market position in renewable and digital services 🔌🌿.