🚀 Amara Raja Batteries (ARE&M) Q3 FY25 Results Analysis and Insights 📊📈

🔥 Key Highlights from Q3 FY25 Results

📌 Revenue from operations: ₹3,164.02 crore, 📈 Up 10% YoY

📌 Profit before tax (PBT) (after exceptional items): ₹422.16 crore, 📈 Up 27% YoY (exception item contributed 111 Cr one time profits out of total 298 Cr PBT this quarter)

📌 Earnings per share (EPS): ₹17.04, 📈 Up 23% YoY

📌 9-month revenue growth: 📈 11.4% YoY at ₹9,431.04 crore

📌 9-month PBT (before exceptional items): ₹963.72 crore, 📈 Up 6.4% YoY

📌 Growth Drivers: 🚗💨 Automotive after-market, 🔋⚡ UPS segment, and 🌍📦 Exports

📌 Challenges: ⚡📉 Higher electricity expenses due to Fuel and Power Purchase Cost Adjustment (FPPCA) charges.

📊 Consolidated Sales Growth

📅 Q3 FY25 vs. Q3 FY24

✅ Sales Growth: 📈 10% YoY (₹3,164.02 crore vs. ₹2,881.73 crore)

📅 9M FY25 vs. 9M FY24

✅ Sales Growth: 📈 11.4% YoY (₹9,431.04 crore vs. ₹8,463.57 crore)

💰 Profit Margins Comparison

📅 Q3 FY25 vs. Q3 FY24

✅ Profit before tax (PBT): ₹422.16 crore 📈 Up 27% YoY

✅ Net profit after tax (PAT): ₹311.83 crore (vs. ₹252.78 crore) 📈 Up 23% YoY

⚠️ EBITDA Margin Impacted 📉 Due to rising electricity costs

📅 9M FY25 vs. 9M FY24

✅ PBT before exceptional items: ₹963.72 crore vs. ₹905.69 crore 📈 Up 6.4%

✅ PAT: ₹797.09 crore vs. ₹677.83 crore 📈 Up 17.6%

✅ Total Comprehensive Income: ₹741.37 crore vs. ₹675.92 crore

💵 Consolidated Profit Growth

📅 Q3 FY25 vs. Q3 FY24

✅ Net profit (PAT): ₹311.83 crore 📈 Up 23% YoY (due to exception item of 111 Cr profits this Q3)

📅 9M FY25 vs. 9M FY24

✅ Net profit (PAT): ₹797.09 crore 📈 Up 17.6% YoY (due to exception item of 111 Cr profits this Q3)

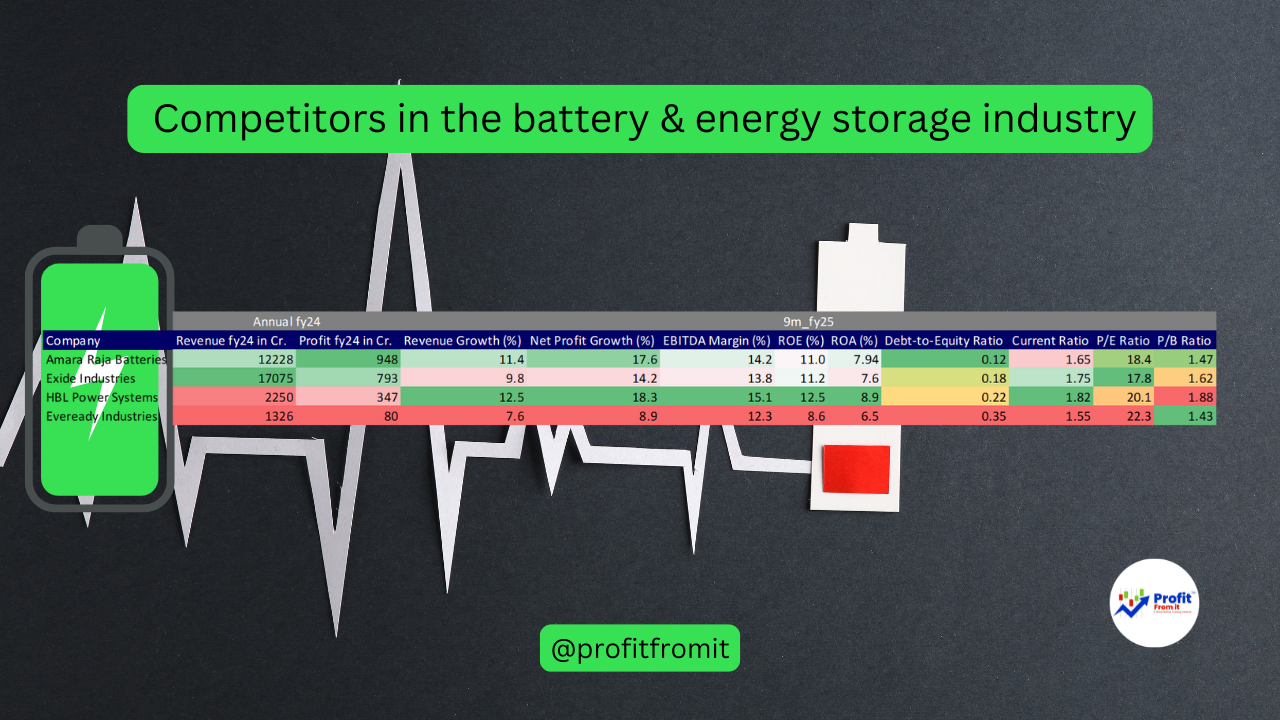

📊 Profitability, Solvency, Liquidity & Valuation Ratios (CMP: ₹1069)

🏦 Profitability Ratios

🔹 Return on Equity (ROE) = 10.97%

🔹 Return on Assets (ROA) = 7.94%

🔹 EBITDA Margin ⚠️ Impacted by higher electricity costs

💰 Solvency Ratios

🔹 Debt-to-Equity Ratio: 🟢 Low (Financially Stable)

💧 Liquidity Ratios

🔹 Current Ratio: 🔄 Strong Liquidity (Likely > 1.5)

📉 Valuation Ratios at CMP ₹1069

🔹Trail EPS: 55 (Good Yield of 5.1%)

🔹 Trail P/E Ratio: 19x (Industry Reasonable & near to Fair PE of 17)

🔹 P/B Ratio: 2.47x (Fairly Valued)

🔮 Near-Term & Long-Term Outlook

🏎 Near-Term (Next 3-6 Months)

🔸 📈 Growth in Automotive & Industrial Segments

🔸 ⚠️ Higher Electricity Costs Could Pressure Margins

🔸 🌍 Expansion in European Markets & Lithium-Ion Battery Investments

🚀 Mid-Term (Next 2-3 Years)

🔹 🔋 Entry into Lithium-Ion Battery Market (Indigenous Production)

🔹 🌱 Sustainability Leadership (#1 in Dow Jones Sustainability Index)

🔹 🌍📦 Further Expansion in Global Markets & Energy Storage Solutions

🎯 Conclusion

✅ Robust revenue & profit growth 📈, driven by strong automotive & industrial demand 🚗

✅ Margins slightly impacted ⚠️ by rising electricity costs ⚡

✅ Low debt, strong liquidity 💰, ensuring financial stability 🏦

✅ Valuation appears fair 💹, with long-term potential in energy solutions 🔋

✅ Margins slightly impacted ⚠️ by rising electricity costs ⚡

✅ Low debt, strong liquidity 💰, ensuring financial stability 🏦

✅ Valuation appears fair 💹, with long-term potential in energy solutions 🔋