Hindustan Unilever Q3 FY25 Results 📊

1. Revenue Growth and Profitability in Q3 FY25:

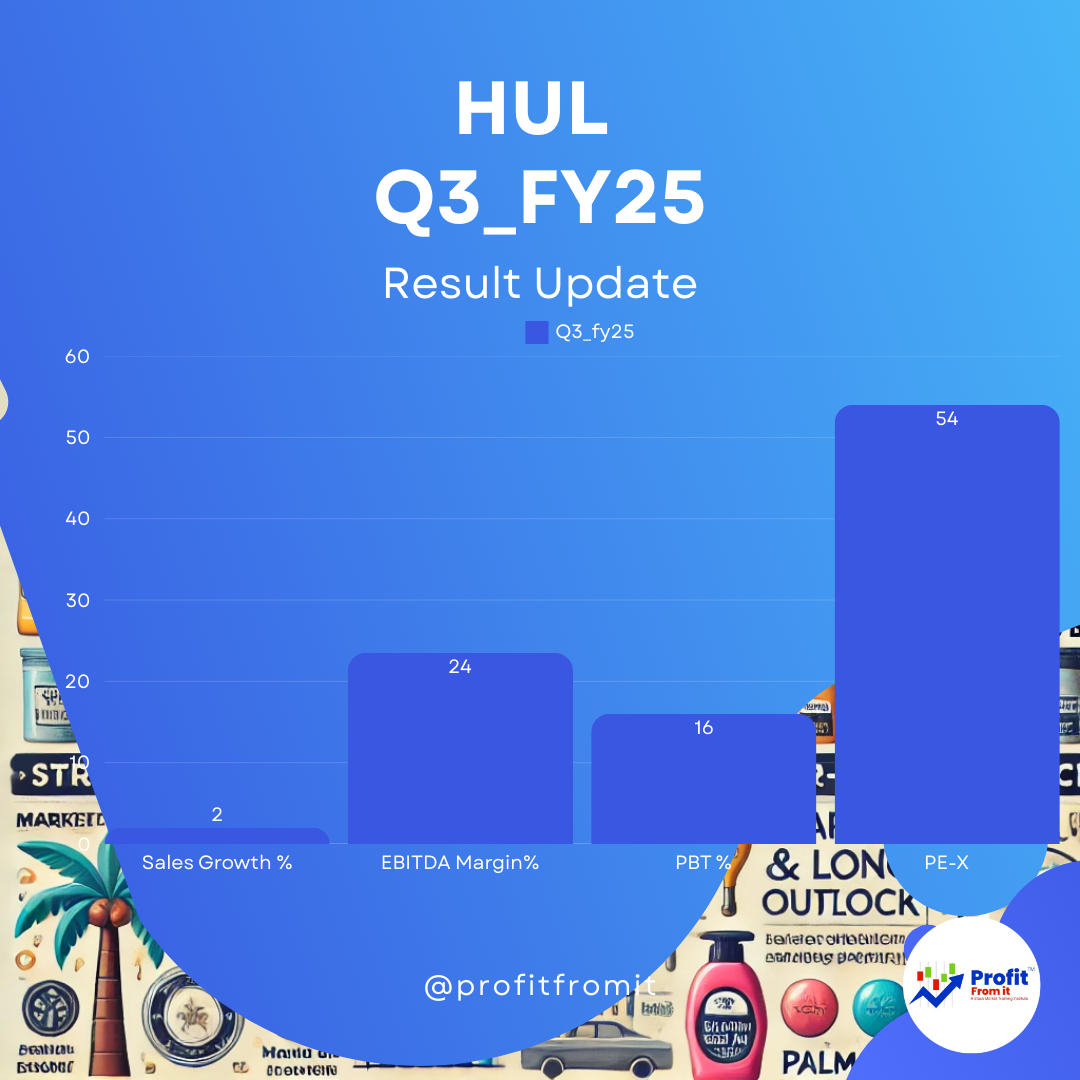

Hindustan Unilever Limited (HUL) reported revenue from operations at ₹15,195 Crores in Q3 FY25, reflecting a slight increase from the previous year's ₹14,928 Crores. The underlying sales growth was 2%, and profit after tax grew by 19% to ₹3,001 Crores, mainly bolstered by the divestment of the ‘Pureit’ business.📈

2. Segmental Growth:

Home Care: Achieved a strong volume-led growth, particularly in fabric wash and household care, contributing significantly to the segment's revenue of ₹5,742 Crores🧼.

Beauty & Wellbeing: Faced a challenging quarter with a muted performance in skin care, impacted by a delayed winter, yet managed revenues of ₹3,438 Crores. Hair care continued to perform robustly💄.

Personal Care: Experienced a decline, particularly in the hygiene segment of skin cleansing, with revenues falling to ₹2,246 Crores🧴.

Foods: Showed stability with modest growth in packaged foods and beverages, maintaining a revenue of ₹3,745 Crores🍽️.

3. Key Initiatives and Strategic Movements:

Acquisition of Minimalist: HUL has signed an agreement to acquire a 90.5% stake in Uprising Science Pvt Ltd, which operates under the brand ‘Minimalist’. This acquisition is aimed at bolstering HUL’s Beauty & Wellbeing portfolio by tapping into the high-growth premium beauty segment🌟.

Demerger of Ice Cream Business: The company is demerging its ice cream business into a new entity, Kwality Wall’s (India) Limited, which is expected to unlock value and allow sharper focus on high-growth segments🍦. Ice Cream is a growing industry in India due to low penetration increasing GDP/Capita.

Palm Oil Localization Strategy: As part of its strategy to secure and localize the supply chain for critical raw materials like palm oil, HUL has acquired a palm oil undertaking Vishwatej Oil Industries in Telangana to support its personal care, beauty, and home care products🌴.

4. Industry KPIs and Market Position:

The company maintains a strong market share, with significant contributions from core segments like Home Care and Beauty & Wellbeing. HUL's strategic initiatives, like the premiumisation of its product portfolio and focus on digital-first brands, are aligned with industry trends of rising consumer demand for premium and bespoke products🏆.

5. Near-Term and Long-Term Outlook:

Near-Term: HUL anticipates continued moderation in consumption trends but expects to maintain competitive growth and profitability with strategic investments in core and high-growth segments⏳.

Long-Term: The company is well-positioned to benefit from its strategic acquisitions and restructuring, aiming for growth in the FMCG sector by enhancing its product offerings and expanding into new markets🌍.

6. Mergers and Acquisitions:

The acquisition of Minimalist and the demerger of the ice cream business are significant steps that reflect HUL’s commitment to refining its portfolio and focusing on more profitable and strategic business units to drive future growth🔄.

These initiatives and financial performances indicate HUL's adaptive strategies in response to market demands and its focus on maintaining a diversified and resilient business model for sustainable growth.

Disclosure: This document is prepared for educational purposes, do not treat this as recommendation or tips, we do not provide tips.