ICICI Lombard's performance for Q3 FY25”

1. Key Financial Highlights (Q3 FY25 vs. Q3 FY24)

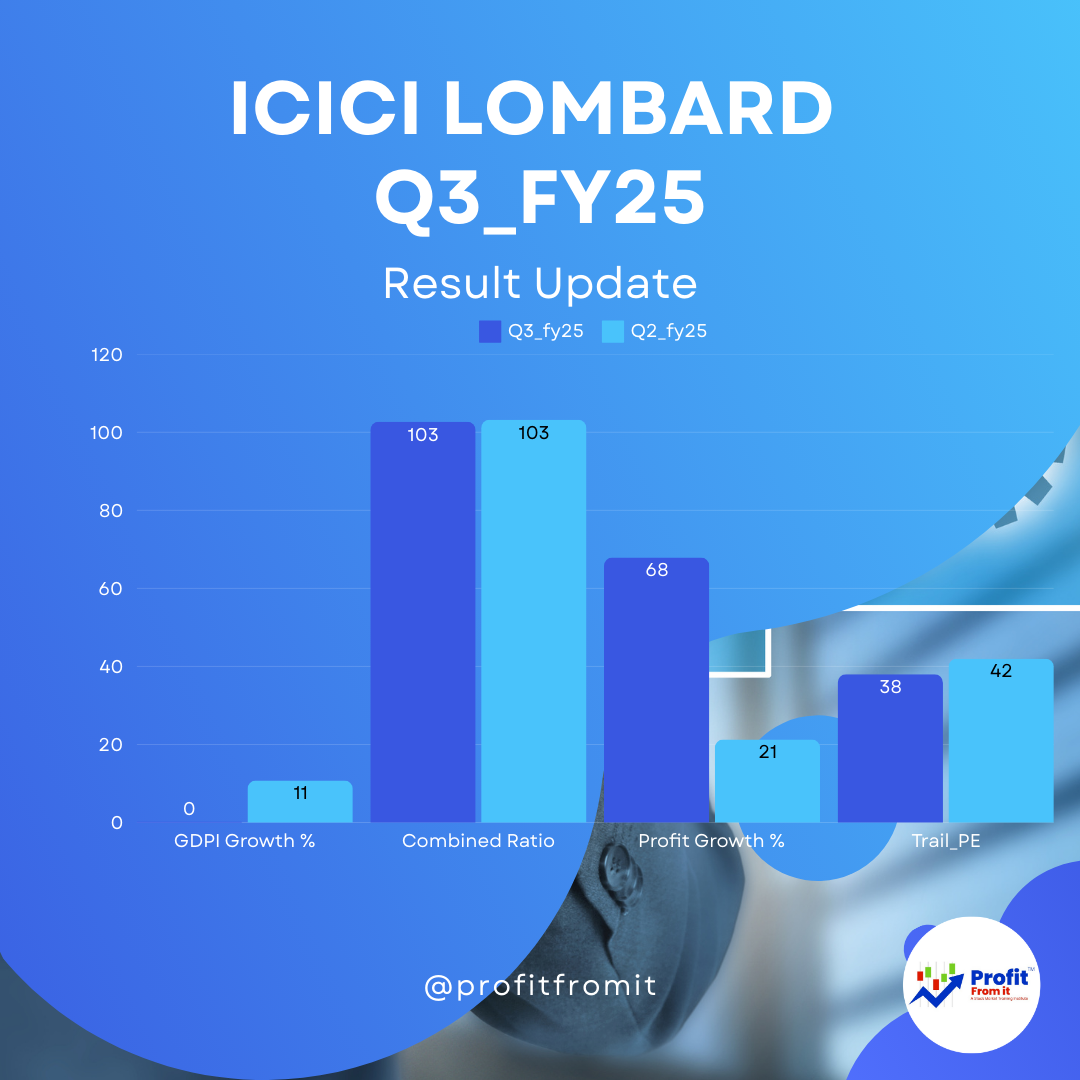

Gross Direct Premium Income (GDPI): It saw a slight decrease of 0.3% in Q3 FY25 with ₹62.14 billion compared to ₹62.30 billion in Q3 FY24. This contrasts with the industry growth of 9.5%, showing underperformance relative to the sector. However, when excluding the impact of accounting changes, GDPI grew by 4.8%.

Combined Ratio: Improved to 102.7% in Q3 FY25 from 103.6% in Q3 FY24, suggesting a more efficient expense management this quarter.

Profit Before Tax (PBT): Significantly increased by 67.3%, reaching ₹9.60 billion in Q3 FY25 up from ₹5.74 billion in Q3 FY24.

Profit After Tax (PAT): Also grew robustly by 67.9%, with a jump from ₹4.31 billion in Q3 FY24 to ₹7.24 billion in Q3 FY25.

Return on Average Equity (ROAE): Improved substantially from 15.3% in Q3 FY24 to 21.5% in Q3 FY25.

2. Valuation Ratio

The current market price (CMP) is ₹1947. Given the strong growth in profit and improving combined ratio, the improved efficiency and profitability could justify this valuation. Trail EPS is 51 and Trail PE comes 38.

3. Long-term and Near-term Outlook

Near-Term: The near-term outlook appears muted growth in Premium but positive given the strong quarterly performance, particularly in profitability metrics. The insurance industry's growth, coupled with ICICI Lombard's initiatives to leverage technology and improve operational efficiency, suggests continued robust performance.

Long-Term: For long-term investors, the company's consistent focus on expanding its product portfolio, enhancing digital capabilities, and maintaining a strong solvency ratio (2.36x as at the end of December 2024) position it well in a growing insurance market. However, monitoring regulatory changes and market competition will be crucial.

4. General Insurance Industry KPIs

Key Performance Indicators (KPIs) for the general insurance industry that are relevant to analyzing ICICI Lombard include GDPI growth, combined ratio, solvency ratio, and ROAE. The company's performance in these areas except Premium Growth is in line with industry standards, with particular strength in profitability improvement as evidenced by the high growth in PBT and PAT.

This detailed review shows that ICICI Lombard is managing its resources efficiently despite slight challenges in GDPI growth. The robust increase in profitability and the strong solvency ratio highlight its solid market positioning and operational success, making it an attractive option for long-term investors.