EMS Limited – Q1 FY26 Results & Long-Term Investment Outlook

1. Company Overview

EMS Limited, founded in 2010, works on water and sewage treatment projects for Indian government bodies. Its business includes:

Sewage Treatment Plants (STPs) and Water Supply Systems

Wastewater recycling for agriculture, industry, and urban use

Electrical transmission & distribution (Small Portion)

Road and building projects

Recently, EMS also expanded into flex sheets and paper products via acquisition, and into real estate development through EMS Realtech.

.

2. Industry Outlook

Massive demand: India faces water scarcity. Urban wastewater recycling and reuse is now a national priority.

Government support: Programs like AMRUT (urban rejuvenation), Namami Gange, ADB/JICA funded projects provide a steady pipeline of orders

.Market size: Around ₹15 lakh crore potential in municipal wastewater and water supply projects over the next 15–20 years.

Growth driver: Increasing emphasis on reuse of treated water (for agriculture, power plants, industries).

3. Financial Performance (Past 7 Years)

🔹 Takeaway: Sales have grown 25% CAGR over 5 years, profits by 21% CAGR. Margins remain stable around 18–20%.

4. Q1 FY26 Highlights

Revenue: ₹239 Cr (+16% YoY)

Profit: ₹38 Cr (+3% YoY)

EPS: ₹6.82 (vs. ₹6.68 last year)

EBITDA Margin: 22.6% (down from 24.3% YoY)

PAT Margin: 15.9% (vs. 18% YoY)

EMS_Results

Reason for lower margins:

Higher finance costs (+213%)

Increased expenses (+19%) due to project delays in underground sewer works caused by extended rains

.

5. Order Book & Pipeline

Current order book: ~₹2,500 Cr

New wins in FY26 so far: ~₹200 Cr

Bids in pipeline: ~₹4,000 Cr

Execution rate: Company can execute ~40% of its order book annually, giving revenue visibility of ₹1,200–1,300 Cr in FY26

.

6. Business Expansion

EMS Realtech acquisition: Land bank worth ₹200–250 Cr, real estate projects planned.

EMS Industries (Paper & Flex sheets): 60% stake; ~₹100 Cr annual revenue with 6–8% margins. Used mainly for collateral but adds extra earnings

.

7. Valuation History

PE Range (FY24–FY26): 8x – 31x

PBV Range: 1.7x – 5.7x

Current Price: ~₹568

Forward EPS FY26: ~₹40 → Forward PE ~14x

PEG ratio: 0.7 (attractive for growth investors).

8. Future Growth Estimates

🔹 Takeaway: Long-term revenue could 5x by FY35, with profits growing ~20% annually.

9. Risks to Watch

Execution delays during rainy seasons impact quarterly results.

Competition in EPC projects can pressure margins.

Working capital needs (payments tied to project milestones).

Diversification risk: Real estate and manufacturing subsidiaries are not core strengths.

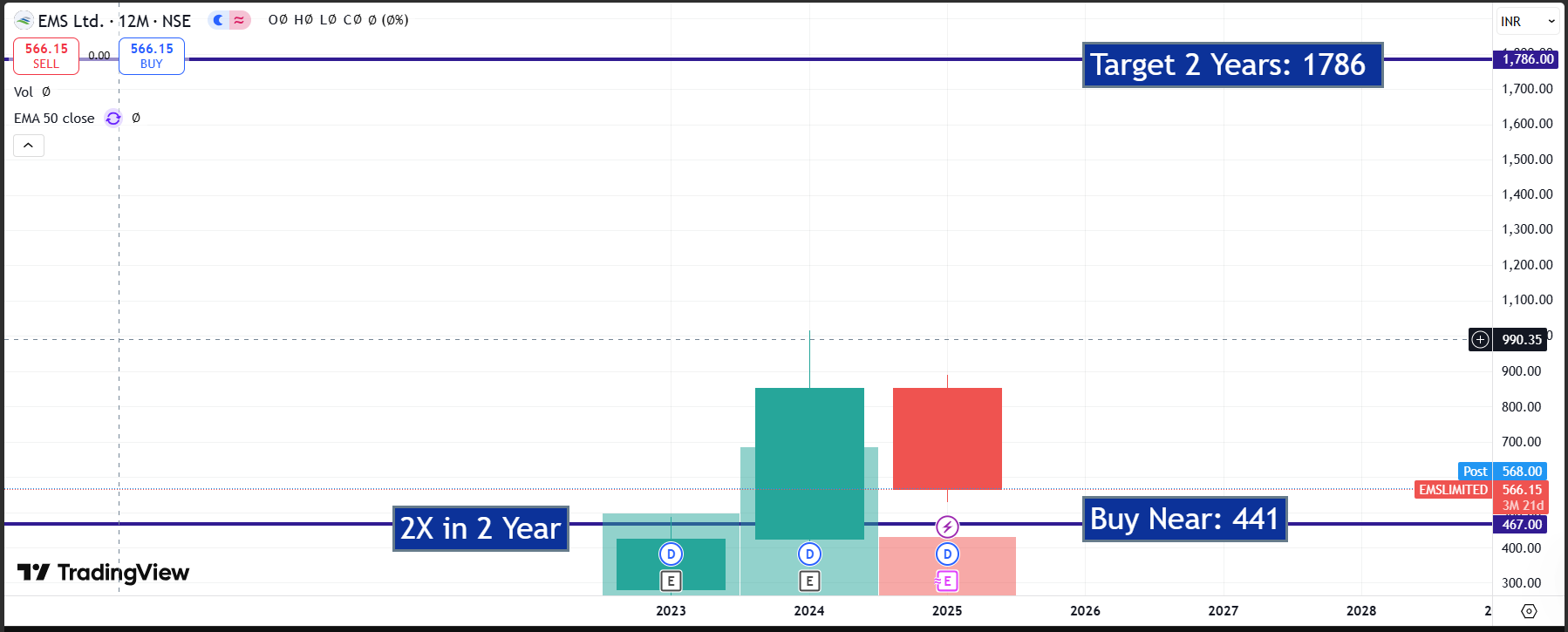

10. Technicals & Portfolio Weightage

Stock trades around ₹568.

Recommended portfolio weightage: ~1–1.5% (moderate exposure).

Technical view: Stable, with fair value range ₹360–₹1,120 for FY26.

11. Conclusion – Long-Term Risk & Reward

EMS is a steady compounder in India’s water infrastructure story.

Strengths: Strong order book, 20%+ profit margins, debt-free, government-backed projects.

Outlook: 20–25% annual growth in revenue and profit sustainable for a decade.

Risks: Seasonal disruptions and margin fluctuations.

Investor View: Suitable for long-term investors looking at India’s water & urban infrastructure theme. Expect 3–4x potential returns by FY35, with steady dividends and strong cash flows.

Disclaimer

This blog is for educational purposes only. It is not investment advice. Investors should conduct their own research before making financial decisions.